Royal Gold (RGLD) Provides Updates on Operations for Q3

Royal Gold, Inc. RGLD has provided an update on third-quarter fiscal 2019 (ended Mar 31, 2019) operations. During the quarter, RGLD Gold AG — the fully-owned subsidiary of Royal Gold — sold nearly 60,000 gold equivalent ounces consisting of around 48,000 gold ounces, 510,000 silver ounces and 1,200 tons of copper related to its streaming agreements. The company ended the reported quarter with 25,000 ounces of gold, 590,000 ounces of silver and 400 tons of copper.

Average realized prices of gold and silver were $1,303 per ounce, and $15.51 per ounce sold compared with the prior-quarter figure of $1,219 per ounce and $14.45 per ounce, respectively. Average realized copper prices were $6,051 per ton compared with $6,092 per ton recorded in the prior-year quarter.

In the fiscal third quarter, cost of sales was roughly $319 per gold equivalent ounce compared to the prior-quarter figure of $327 per gold equivalent ounce. The cost of sales is based on the quarterly average silver-gold ratio of roughly 84 to 1 and copper-gold ratio of around 0.21 ton per ounce.

Royal Gold's fiscal second-quarter 2019 sales performance was impacted by reduced sales at Mount Milligan. This was mainly caused by rail transportation issues experienced last July. The temporary shutdown of the mill processing facility in the beginning of calendar-year 2018 resulted due to lack of sufficient water sources. On Feb 27, 2019, Centerra — the operator of Mount Milligan mine — stated that it has received permit to access additional sources of groundwater and surface water. Centerra is upgrading water pumping structure to allow access to these water sources prior to the spring melt in April. Using the additional water captured during the spring melt will be enough to resume mill-processing operations at Mount Milligan to full capacity. Centerra expects following a ramp up of milling operations, mill throughput will average 55,000 tons per day through the remaining 2019.

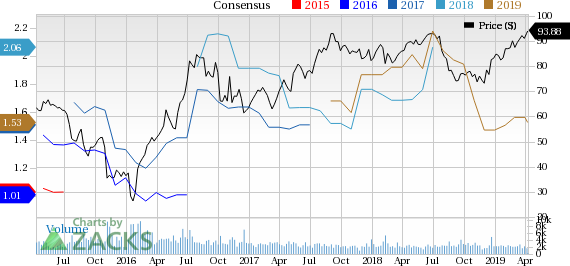

Coming to the price performance, Royal Gold’s shares have gained around 7.4% over the past year, outperforming the industry’s growth of 4.5%.

On Feb 25, Royal Gold and RGLD Gold AG entered into a silver mine life purchase agreement with Khoemacau Copper Mining Limited (“KCM’’) — subsidiary of Cupric Canyon Capital LP. The agreement highlights the purchase and sale of silver, produced from the Khoemacau Copper Project in Botswana. Royal Gold estimates silver deliveries of 1.5 million ounces per annum at 80% stream rate, with initial deliveries probably starting in the first half of calendar-year 2021. The transaction will be funded in cash and $1 billion available under a revolving credit facility.

For fiscal 2019, Royal Gold expects improved results backed by several positive catalysts, including the beginning of production at Cortez Crossroads, early deployment of the Peñasquito Pyrite Leach Project and higher production at Rainy River. It will also be aided by Preliminary Economic Assessment (“PEA”) on the Peak Gold Project. Moreover, the company is focused on allocating its strong cash flow toward dividend payouts, debt reduction and new businesses.

Royal Gold, Inc. Price and Consensus

Royal Gold, Inc. Price and Consensus | Royal Gold, Inc. Quote

Zacks Rank & Stocks to Consider

Royal Gold currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the Basic Materials sector are Ingevity Corporation NGVT , Innospec Inc. IOSP and Materion Corporation MTRN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingevity has an expected earnings growth rate of 17.9% for 2019. The company’s shares have rallied 51.6%, over the past year.

Innospec has a projected earnings growth rate of 3.5% for the current year. The stock has appreciated 21.7% in a year’s time.

Materion has an estimated earnings growth rate of 12.6% for 2019. The company’s shares have gained 9.9%, in the past year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Innospec Inc. (IOSP) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

Materion Corporation (MTRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research