Royce Funds: Why Do Small-Cap Cyclicals with Global Exposure Look Poised to Lead?

- By Holly LaFon

With small-caps up more than 20% over the past year, what is your take on current valuations?

Chuck Royce (Trades, Portfolio) Small-cap valuations are definitely elevated. It's been more than 18 months since the Russell 2000 declined more than 7%. That kind of run will definitely help create higher-than-usual valuations. However, I think investors need to keep current small-cap valuations in context. My own view is that valuations are fair; not great, but not extremely high either.

Warning! GuruFocus has detected 5 Warning Sign with WMT. Click here to check it out.

The intrinsic value of SPY

So while we'd ideally like to see lower absolute valuations for small-caps as a whole, we're satisfied with the relative valuation picture, at least for the kind of small-cap cyclicals that we like versus both defensive stocks and bonds.

Francis Gannon It's also important to remember that averages are aggregates; they can't show the number or nature of those companies that are trading at prices that don't reflect their enterprise value. A good example is that 712 of the companies in the Russell 2000 were down year-to-date through the end of September and the bottom 30% were down significantly on average. Now, most of these companies are not going to appeal to us--but some undoubtedly will, and we've been looking carefully.

Due to these strong returns many market observers expect an imminent correction--what do you make of all that talk?

CR People typically expect corrections when bull markets extend themselves in return and/or duration. We've seen both of those in the current market. Of course, the current small-cap cycle goes back to the June 2015 peak and is therefore a lot younger than the large-cap cycle, which essentially began with the Financial Crisis. In any event, we always regard corrections as normal and inevitable. More important, they give us opportunities to find what we think are great companies selling for attractively low prices.

But we aren't timers. We haven't been keeping cash on the sidelines, for example, waiting for valuations to fall back to more enticing absolute levels. As Frank mentioned, we're looking for--and finding--things to buy pretty much every day. That's what investors are trusting us to do, and that's what we enjoy doing.

In fact, I suspect that just as much, if not more, money has been forfeited over the years by investors waiting for "imminent" or "inevitable" corrections--and missing the chance to put money to work in the market--than has been lost in the actual downturns themselves.

You mentioned that small- and large-cap have had different cycles. As a small-cap specialist, where do you see the current small-cap cycle?

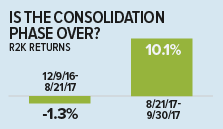

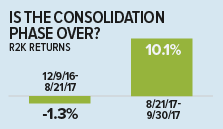

FG It's looking more and more to us like we're seeing a correction in time within a longer cycle for value and cyclicals. Prior to the shift we saw late in the quarter, small-caps as a group were pretty mediocre in August. From the post-election peak on 12/9/16 through 8/21/17, the Russell 2000 was down 1.3%.

What we've been focusing on lately is relating what's happening in the market to the health of the economic cycle. We've seen this reflected in steady or improved earnings for many small-caps, especially among our own cyclical holdings. We've also been watching wage growth pretty carefully because a lot of management teams have been talking to us about it. And a more meaningful uptick in wages would be another sign that the economy is heating up. Our thought is that faster growth would spur higher rates and the possibility of a late-cycle acceleration for small-caps.

What is your take on the fact that growth stocks continued to lead the U.S. market in 3Q17?

CR It initially looked surprising to us, especially in light of how powerfully value stocks rebounded in 2016, but I think it begins to make sense when we look further. The markets and economy are still winding their way back to normal after the seismic events of the Financial Crisis, which were almost a decade ago.

Over this period, the economic recovery has been long and very slow, some would say painfully slow, with growth in the U.S. still not proceeding at a fast enough pace to reassure most investors. During six of the eight calendar years following the Financial Crisis, small-cap growth beat small-cap value. Investors tend to stay loyal to what's worked for them and are slow to change. That's understandable, but we think small-cap investors' confidence in growth stocks is misplaced, particularly from a valuation standpoint.

Some have drawn parallels between this year and 2015, when growth, led by Health Care, also did well. Do you agree?

FG We don't actually. The resemblance doesn't go much further than this year's strong results so far for biotechnology and other areas of Health Care, as well as for certain tech stocks. We think that's a pretty superficial resemblance. The state of the economy and equity markets could not be more different this year than they were two years ago. The global economy is expanding, and we're also seeing signs of improved U.S. economic growth. The reach of this expansion is equally important--each of the 35 countries in the OECD has positive GDP, and 65% of them are expanding.

CR On the more granular level, we're seeing strong results for stocks with high multiples and/or high ROIC (returns on invested capital), which wasn't the case in 2015. So while it's been a relatively challenging year for small-cap value as a group, I would say it's been a very good year for stock pickers--and that was definitely not the case in 2015 when there was little that did well outside the narrow confines of bio-pharma and software.

Given investors' current preferences, what do you think needs to happen for small-cap value to regain leadership?

CR I think the style leadership in the market is driven by interest rates as much as anything else. And when we talk about the road back to normalization, a large part of what we mean is the normalization of interest rates. Ultimately, small-cap value will need to outperform for several years to win investors back, but we think that style leadership may have turned a corner in early September.

We began to see reversals at the level of small-cap style and sector that lasted through the end of the month. Small-cap value decisively beat small-cap growth, and cyclicals outpaced defensive sectors while small-caps also outperformed large-caps in September. Lending support to the idea that style leadership is influenced by interest rates, the 10-year Treasury reached its YTD low around this same time, hitting 2.05% on 9/7/17 and rising through the end of the month.

1Russell 2000 Value vs. Russell 2000 Growth shifted median relative last twelve months enterprise value/earnings before interest and taxes from 12/31/01 to 9/30/17. Source: Factset

Do you see this as a long-term shift?

FG We don't know if the "September Shift" will last--it's only a few weeks, but we certainly hope it will. From our perspective, it would indicate that investors are beginning to see a fuller, more global economic picture.

The breadth of this shift is encouraging--we saw reversals in bond yields and stock leadership by capitalization, style, and sector. So we see good reasons for thinking that the shift could last.

Do you see the recent results for micro-cap stocks as part of this shift?

CR We do, yes. The relative improvement for micro-caps as a group started in August, which was a down month for micro-, small-, and mid-cap stocks. The Russell Microcap Index lost less than the Russell 2000 and then went on to do noticeably better in the September rebound as well.

Their 3Q17 advantage was therefore a function of better relative results in a slightly down period and then in an upswing. We think that's a healthy sign going forward.

FG Micro-caps are a very important asset class for us--we've been investing in them for more than 25 years, well before they were a recognized subset of small-cap. We've been waiting for a year or two for a strong move for micro-caps, which would not only be good for investors in the asset class but would also offer a sign that investors were gaining confidence in the pace of economic growth. Arguably, that's what we saw in September.

With the global economy growing, why do you think cyclical stocks have underperformed so far in 2017?

FG To be sure, we see a lot of U.S. stock performance as disconnected from what's happening in the economy. For example, stock and bond investors alike appear to be pessimistic. The yield on the 10-year Treasury was tumbling into early September, which typically (though not always) is a sign of concern about economic growth, just as equity investors' preferences for higher yield and other non-cyclical investments is evidence of caution.

We're more optimistic. So while we recognize the uncertainty, we also see more than enough reasons to be cheerful about economic prospects--especially on the global level. Historically, economic accelerations have been good relative periods for value, and, not surprisingly, cyclical stocks.

Why do you think the markets have seen such low levels of volatility over the last 12-18 months and do you anticipate that changing?

FG Sooner or later it will, of course. It always does. But it's important to remember that volatility doesn't revert to the mean, with the exception being periods of high volatility, in which it dwindles back to lower levels. The misperception that volatility is cyclical may be rooted in the mistake of equating it with down markets. In any case, the current period of very low volatility doesn't mean that we're "due" for higher levels, and we don't see the market's placidity as an ominous sign.

Are you still finding interesting opportunities in healthcare outside the biopharma complex?

CR Certain portfolios that I manage have seen a gradual increase in the number of healthcare names over the last year or two. When it comes to healthcare and tech, I usually invest with the same approach--I look for suppliers and service businesses that provide 'picks and shovels' for more speculative, higher-growth players. In those areas I'm much more likely to find that sweet spot of quality and value, those more conservatively capitalized businesses with strong records of earnings and a history of free cash flow generation. That way, I can potentially avoid some of the higher risk while receiving what I think is a good return.

What are your thoughts on the performance of financial stocks so far in 2017?

CR There've been some disappointments in banks, so we've added names or built existing ones in a couple of portfolios. The state of rates is obviously a key factor in the industry. Since I'm confident that rates will rise, I like the long-term prospects for a number of smaller banks, particularly those with strong loan growth.

I also still like a select group of alternative asset managers and am pleased that some of them have been attracting other investors, who seem to recognize the attributes that drew us to these companies in the first place. In general, asset management remains an important area of focus for my portfolios.

What other areas look attractive to you?

CR We've seen some interesting opportunities in food- and agriculture-related stocks as well as in shipping companies so far this year. In each case, industry slowdowns have hit stock prices hard, which is giving us a chance to buy leading businesses with strong fundamentals--balance sheets, returns on capital, free cash flow--at prices that look attractive to us. Even in up markets, there are almost always pockets of opportunity.

Why do certain small-cap cyclicals with more global exposure look so well-positioned to you?

FG I think it's the fact that small-cap cyclicals with global end markets look very well-positioned to benefit from improving economic growth. In contrast to the conventional notion that all small-caps derive the bulk of their revenue from domestic sources, many small-cap companies have a healthy percentage that comes from outside the U.S. More than 400 companies in the Russell 2000 currently derive a third or more of their revenue from foreign sources.

And that total doesn't capture those small- and micro-cap companies that deal mostly or exclusively with U.S. firms which have global exposure. Factor in the weaker dollar, and we see solid-to-strong economic prospects combined with relatively more attractive valuations potentially adding up to positive outcomes for a certain kind of small-cap company. From our perspective, small-caps in cyclical industries with modest valuations and global exposure look poised to lead--and we are happy to be holding many.

Important Disclosure Information

Mr. Royce's and Mr. Gannon's thoughts and opinions concerning the stock market are solely their own and, of course, there can be no assurance with regard to future market movements. No assurance can be given that the past performance trends as outlined above will continue in the future. This material is not authorized for distribution unless preceded or accompanied by a current prospectus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Sign with WMT. Click here to check it out.

The intrinsic value of SPY