Ruane Cunniff's Top 5 Trades of the 3rd Quarter

- By Graham Griffin

Ruane Cunnif (Trades, Portfolio) has revealed its portfolio for the third quarter. The most impactful trades during the quarter included reductions in Amazon.com Inc. (NASDAQ:AMZN) and Wayfair Inc. (NYSE:W) alongside new buys in Intercontinental Exchange Inc. (NYSE:ICE) and Fidelity National Information Services Inc. (NYSE:FIS).

Ruane, Cunniff & Goldfarb are value investors focused on the intrinsic value of business. They are long-term investors that will buy a stock and hold it for a long time, even if sometimes the stocks seem to be overvalued. They look at common stocks as units of ownership in a business and purchase them when the price appears low in relation to the value of the total enterprise.

Portfolio overview

At the end of the quarter, the portfolio contained 35 stocks, with two new holdings. It was valued at $8.40 billion and has seen a turnover rate of 10%. Top holdings include Wayfair, Alphabet Inc. (NASDAQ:GOOG), CarMax Inc. (NYSE:KMX), Facebook Inc. (NASDAQ:FB) and UnitedHealth Group Inc. (NYSE:UNH).

By weight, the top three sectors represented are communication services (32.98%), financial services (25.37%) and consumer cyclical (15.34%).

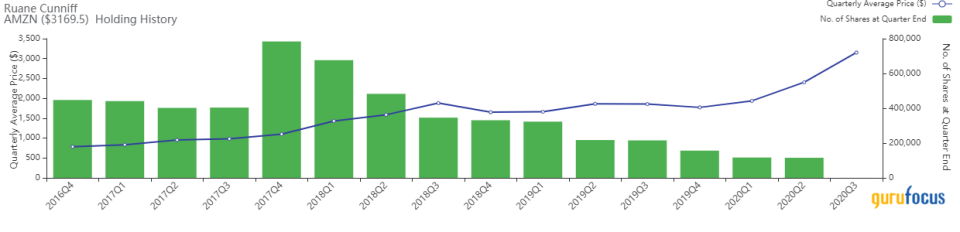

Amazon

A reduction in the firm's Amazon holding represented the largest impact on the portfolio during the quarter. The firm sold 114,651 shares to cut the holding by 99.40%. The shares traded at an average price of $3,151.21 during the quarter. Overall, the sale had an impact of -4.23% on the portfolio and GuruFocus estimates the total gain of the holding at 100.91%.

Amazon is among the world's highest-grossing online retailers, with $281 billion in net sales and approximately $365 billion in estimated physical and digital gross merchandise volume in 2019. Online product and digital media sales comprised 50% of net revenue in 2019, followed by commissions, related fulfillment and shipping fees and other third-party seller services.

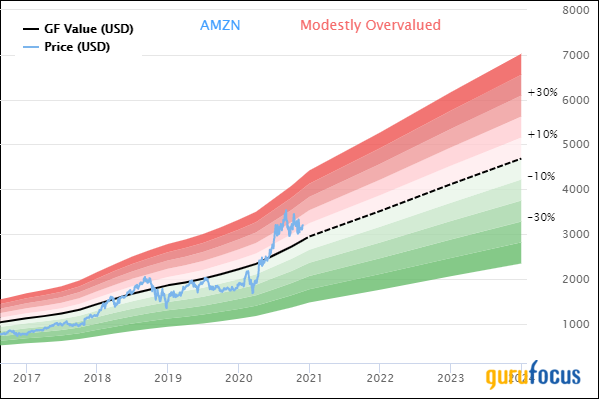

On Nov. 30, the stock was trading at $3,169.50 per share with a market cap of $1.59 trillion. The GF Value Line shows the stock trading at a modestly overvalued level.

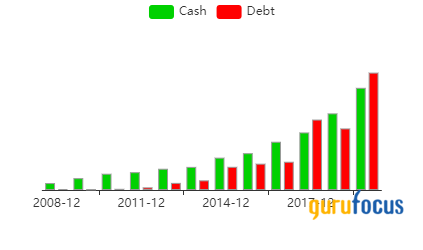

GuruFocus gives the company a financial strength rating of 7 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 1 out of 10. There is currently one severe warning sign issued for assets growing faster than revenue. Despite recent increases in debt, the company maintains a cash-to-debt ratio of 0.84 that outranks 61.43% of competitors.

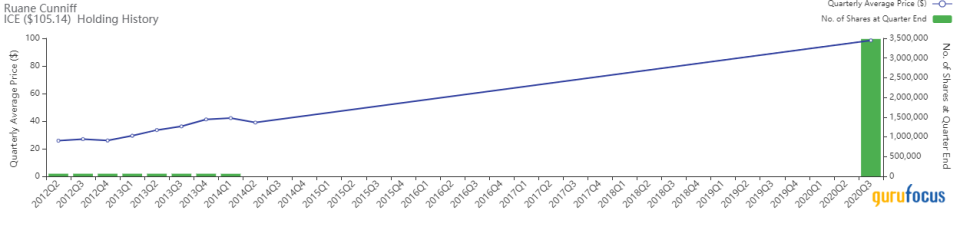

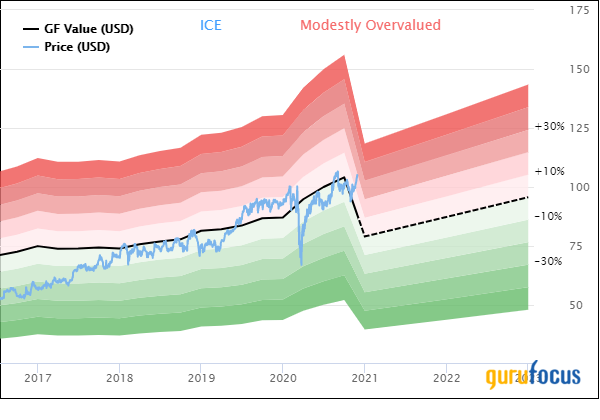

Intercontinental Exchange

A new holding was established in Intercontinental Exchange for the first time since 2014. The firm purchased 3.48 million shares, which traded at an average price of $98.51 during the quarter. The purchase had an overall impact of 4.15% on the portfolio and GuruFocus estimates the total gain on the holding at 6.95%.

Intercontinental Exchange is a vertically integrated operator of financial exchanges and provides ancillary data products. Though the company is probably best known for its ownership of the New York Stock Exchange, which it acquired in 2013, ICE is the operator of a large derivatives exchange as well. The company's largest commodity futures product is the ICE Brent crude futures contract. In addition to exchanges, ICE's data and listings segment offers critically important equity and fixed-income market and pricing data.

As of Nov. 30, the stock was trading at $105.18 with a market cap of $58.92 billion. According to the GF Value Line, the stock is trading at a modestly overvalued level.

GuruFocus gives the company a financial strength rating of 3 out of 10, a profitability rank of 7 out of 10 and a valuation rank of 3 out of 10. There are currently two severe warning signs issued for poor financial strength and an Altman Z-Score of 0.57, placing the company under distress. Cash flow has increased significantly over the last several years and easily supports dividend payouts.

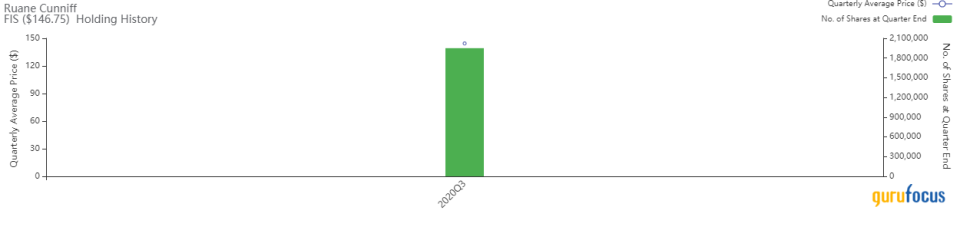

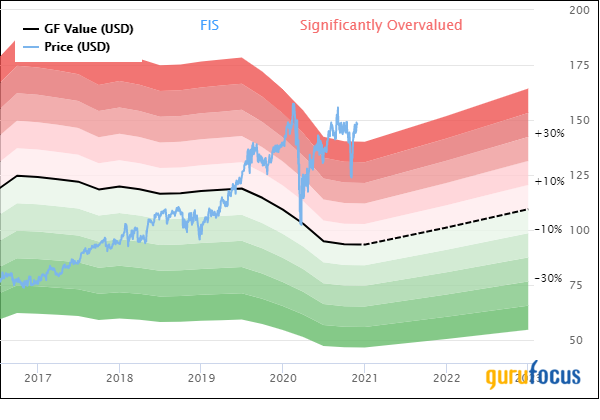

Fidelity National Information Services

Fidelity National Information Services was added to the portfolio for the first time during the third quarter. The firm established the holding with 1.95 million shares that traded at an average price of $144.47 during the quarter. Overall, the purchase had an impact of 3.42% on the portfolio and GuruFocus estimates the total gain at 1.58%.

Fidelity National Information Services' legacy operations provide core and payment processing services to banks, but its business has expanded over time. By acquiring Sungard in 2015, the company now provides record-keeping and other services to investment firms. With the acquisition of Worldpay in 2019, FIS now provides payment processing services for merchants and holds leading positions in the United States and United Kingdom. About a fourth of revenue was generated outside North America in 2019.

Nov. 30 saw the stock trading at $147.07 with a market cap of $91.46 billion. The GF Value Line shows the stock trading at a significantly overvalued level.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rank of 7 out of 10 and a valuation rank of 2 out of 10. There are four severe warning signs, including declining operating margin and revenue per share. Both the operating margin and net margin percentages fall below industry competitors despite the reasonably strong profitability rank.

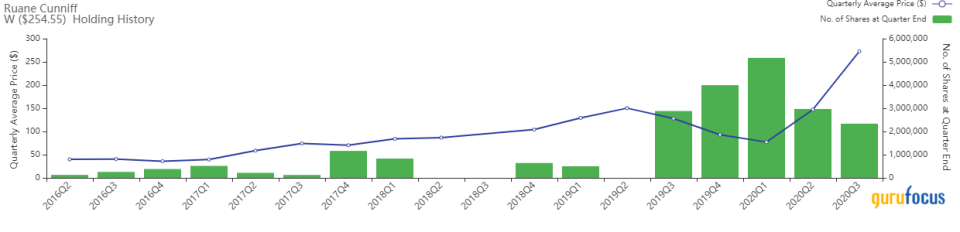

Wayfair

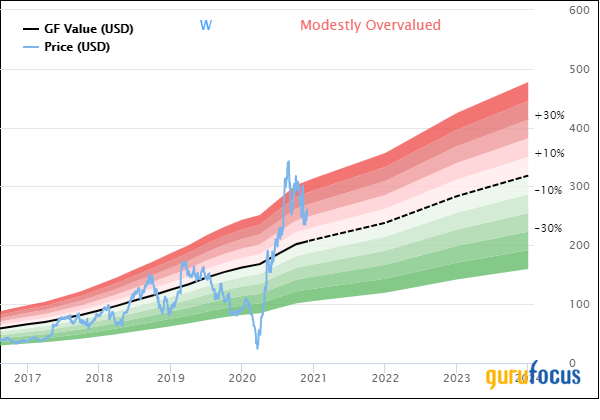

Alongside Amazon, Wayfair came in as the second-most impactful sale during the quarter. The firm reduced the holding by 21.34% with the sale of 633,438 shares. The shares traded at an average price of $272.54 during the quarter. GuruFocus estimates the total gain of the holding at 81.10% and the sale had an impact of -1.68% on the portfolio.

Wayfair engages in e-commerce in the United States and Europe. At the end of 2019, the firm offered approximately 18 million products from more than 12,000 suppliers for the home sector under the brands Wayfair, Joss & Main, AllModern, DwellStudio, Birch Lane and Perigold. This includes a selection of furniture, decor, decorative accent, housewares, seasonal decor and other home goods. Wayfair was founded in 2002 and is focused on helping people find the perfect product at the right price.

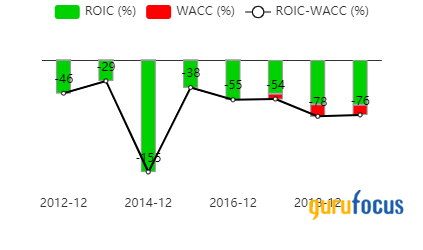

On Nov. 30, the stock was trading at $251.97 per share with a market cap of $25.10 billion. The GF Value Line gives the stock a modestly overvalued rating.

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rank of 3 out of 10. There are two severe warning signs issued for assets growing faster than revenue and a declining operating margin percentage. The company currently has a negative return on invested capital that does not match up to the weighted average cost of capital, which indicates it will destroy value.

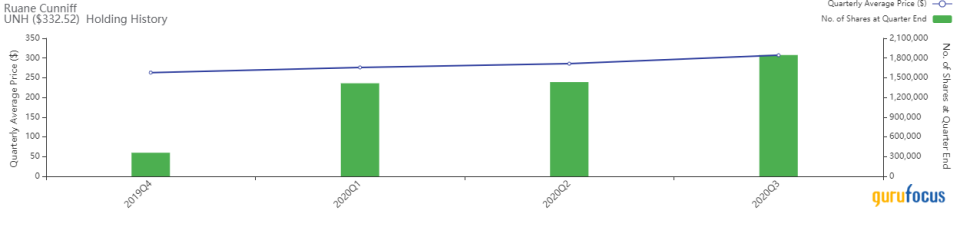

UnitedHealth

A top holding in the portfolio, the UnitedHealth position was further increased by 28.74%. During the quarter, the firm purchased 412,062 shares. The stock traded at an average price of $307.11. Overall, the purchase had an impact of 1.53% on the portfolio and GuruFocus estimates the total gain of the holding at 18.49%.

UnitedHealth Group is the largest private health insurance provider in the United States, offering medical benefits to nearly 50 million members. As a leader in employer-sponsored, self-directed and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth's continued investments in its Optum franchises have created a health care services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

As of Nov. 30, the stock was trading at $335.31 per share with a market cap of $316.33 billion. The GF Value Line gives the stock a modestly overvalued rating.

GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rank of 9 out of 10 and a valuation rank of 2 out of 10. There is one severe warning sign issued for assets growing faster than revenue. Net income and revenue have grown steadily over the years despite the rapid growth in assets.

Disclosure: Author owns no stocks mentioned.

Read more here:

Chuck Royce's Firm's Stop 5 Sells of the 3rd Quarter

Bill Gates' Foundation Buys Into Voya Asia Pacific High Dividend Income Fund

Tweedy Browne Burns Oil Holdings in the 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.