Russell 2000's Bull Run Continues: 5 Top Small-Cap Picks

Small-cap stocks continue to make hay as large-cap ones reel under the influence of severe market volatility. Several factors like inflationary concerns and impending interest rate hike, global trade war fear, geopolitical conflicts in the Middle East, political turmoil in Europe, oil price fluctuations and many more, have heightened market fluctuations.

However, small-cap stocks generally remain immune to external disturbances, making them lucrative investment options in a volatile market. Moreover, strong macro-economic fundamentals of the U.S. economy, massive tax-cut and business friendly policies adopted by the Trump administration have propelled these stocks. At this stage, investment in the top-ranked U.S. focused small-cap stocks will be a prudent move.

Russell 2000 Trending Upward

Russell 2000 (RUTX), the benchmark index of U.S. small-cap stocks, scaled an all-time high of 1620.64 on May 16. It has continued to rally following the achievement. On Jun 4, the index closed at a fresh all-time high, rising 5.39 points or 0.3%, to 1,653.37.

Over the last three months, the Russell 2000 has increased more than 7.8%. This is significantly higher than its large-cap counterparts, the Dow 30, S&P 500 and Nasdaq Composite, which gained -0.3%, 1.1% and 3.8%, respectively.

Immune to External Disturbances

Small-cap stocks are mostly immune to any external shocks. This has been aiding the small-cap segment of the broader market to outperform in 2018 defying extreme volatility.

Lingering trade conflict between the United States and China along with Canada, Mexico and the European Union have resulted systematic volatility affecting mainly the large-cap stocks. Geopolitical conflicts in the Middle East, North Korea and Eurozone along with potential U.S. sanctions on Iran have also shaken Wall Street.

Domestic Economy Focused

One typical characteristic of small-cap stocks is that the United States is the primary market for their products. The U.S. economy is currently on a strong footing. Both consumer and business confidence remains healthy.

Furthermore, the value of the U.S. dollar has been rising for the last four months making U.S. exports of large companies uncompetitive in the global market. Since small-cap corporates sold most of their products to indigenous customers, these stocks have remained unaffected by foreign exchange volatility.

Tax Overhaul: A Major Boost

The two pro-growth agendas of President Trump, namely, significant cut in corporate tax and deregulation are major catalysts to small-cap stocks. The corporate tax rate was recently lowered from 35% to 21%.

Small-cap corporates book most of their revenues in the homeland. Consequently, a significant reduction in corporate tax rate would be immediately accretive to cash flow of these companies.

Our Top Picks

Small-cap stocks have emerged as diamonds in the rough pushing aside the large-cap stocks in 2018. At this stage, investors with a higher risk appetite and return expectations can make the most by investing in small-cap stocks. However, picking winning stocks can be a difficult task.

This is where our VGM Score comes in handy. Here V stands for Value, G for Growth and M for Momentum and the score is a weighted combination of these three scores. Such a score allows you to eliminate the negative aspects of stocks and select the winners. However, it is important to keep in mind that each Style Score will carry a different weight while arriving at a VGM Score.

We narrowed down our search on five stocks with a market cap of below $1 billion. Each of these stock have a Zacks Rank #1 (Strong Buy) and a VGM Score A or B. You can see the complete list of today’s Zacks #1 Rank stocks here.

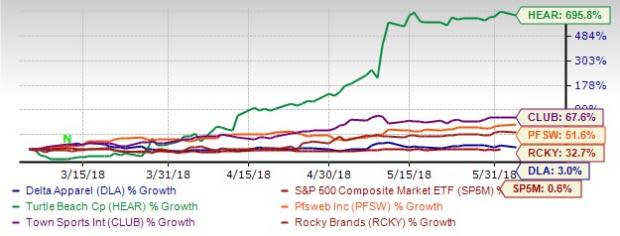

The chart below shows price performance of our five picks in the last three months.

PFSweb Inc. PFSW is an international provider of transaction management services for both traditional commerce and e-commerce, companies.

PFSweb carries a VGM Score A. The company has expected earnings growth of 13.2% for current year. The Zacks Consensus Estimate for the current year has improved by 4.9% over the last 60 days.

Town Sports International Holdings Inc. CLUB is the largest health club company in the northeastern part of the United States.

Town Sports carries a VGM Score A. The company has expected earnings growth of 211.7% for current year. The Zacks Consensus Estimate for the current year has improved by 575% over the last 60 days.

Delta Apparel Inc. DLA designs, produces and markets different types of branded active wear and lifestyle basic apparel as well as other accessory products.

Delta Apparel carries a VGM Score A. The company has expected earnings growth of 12.8% for current year. The Zacks Consensus Estimate for the current year has improved by 11.1% over the last 60 days.

Turtle Beach Corp. HEAR is a premium California-based audio technology company.

Turtle Beach carries a VGM Score A. The company has expected earnings growth of 504.2% for current year. The Zacks Consensus Estimate for the current year has improved by 891.7% over the last 60 days.

Rocky Brands Inc. RCKY) designs, manufactures and sells apparel and footwear in the market.

Rocky Brands carries a VGM Score B. The company has expected earnings growth of 29.3% for current year. The Zacks Consensus Estimate for the current year has improved by 7.1% over the last 60 days.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PFSweb, Inc. (PFSW) : Free Stock Analysis Report

Turtle Beach Corporation (HEAR) : Free Stock Analysis Report

Town Sports International Holdings, Inc. (CLUB) : Free Stock Analysis Report

Rocky Brands, Inc. (RCKY) : Free Stock Analysis Report

Delta Apparel, Inc. (DLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.