Ryder Rewards Shareholders With 13% Dividend Hike, Stock Up

Ryder System, Inc. R has approved a quarterly dividend hike of 13%. Following this announcement, shares of the company were up 2.3% to $82.49 at the close of business on Feb 12.

The move indicates the company’s commitment to add value to shareholders, reflecting its confidence in business growth.

The company’s board has announced a quarterly cash dividend of 52 cents per share, up from the earlier payout of 46 cents. The dividend is payable on Mar 16, 2018 to shareholders of record as of Feb 20. The raise in dividend is driven by the earnings benefit drawn from the new tax law (Tax Cuts and Jobs Act). The provision of the law allows capital expenses to be deducted in the year that incurred the same, thereby reducing tax bills significantly.

Notably, Ryder has an impressive dividend payment history of more than 41 years. The latest is the 166th consecutive quarterly cash dividend. In 2017, the company increased its payout by a couple of cents to 46 cents per share.

Investors always prefer an income-generating stock and a high dividend-yielding one is always much desired. It goes without saying that they are always on the lookout for companies with a track record of consistent and incremental dividend payments to put their money on.

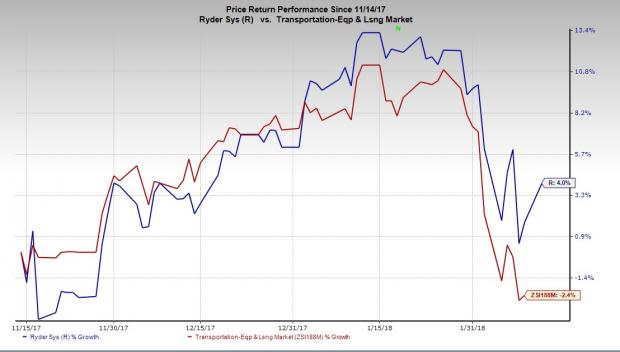

Shares of Ryder have gained 4% in the last three months, outperforming the industry’s decline of 2.4%.

The dividend rise is likely to further boost the stock.

Zacks Rank & Other Key Picks

Ryder carries a Zacks Rank #2 (Buy). Other top-ranked stocks in the broader Transportation sector include Deutsche Lufthansa AG DLAKY, Air France-KLM SA AFLYY and Allegiant Travel Company ALGT. While Air France-KLM and Allegiant have the same bullish Zacks Rank of 2 as Ryder, Deutsche Lufthansa sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Deutsche Lufthansa and Air France-KLM have skyrocketed more than 100% in a year. While the Allegiant Travel stock has surged 31.7% in the last six months.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report

Deutsche Lufthansa AG (DLAKY) : Free Stock Analysis Report

Air France-KLM SA (AFLYY) : Free Stock Analysis Report

Ryder System, Inc. (R) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research