Sabre (SABR) Q2 Earnings Top Estimates, Revenues Up Y/Y

Sabre Corporation SABR reported second-quarter 2019 adjusted earnings per share of 24 cents, which decreased 35% on a year-over-year basis. However, the figure surpassed the Zacks Consensus Estimate of 22 cents.

Revenues came in at $1 billion, up 1.6% from the year-ago quarter. The figure also beat the consensus estimate of $994 million. Growth across each of its business segments drove results.

However, increased technology expenses due to high cloud migration-related costs, decline in technology capitalized expenditures, modest growth in Travel Network incentive expense per booking, and acquisition-related costs weighed on margins.

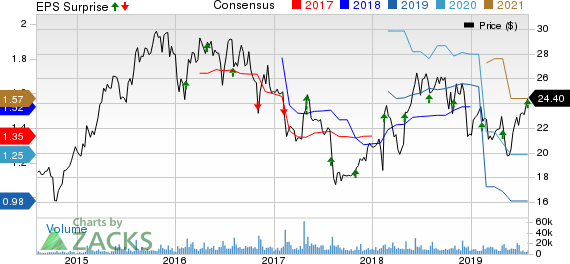

Sabre Corporation Price, Consensus and EPS Surprise

Sabre Corporation price-consensus-eps-surprise-chart | Sabre Corporation Quote

Revenue Details

Travel Network revenues increased 0.7% year over year to $724.6 million. The growth was backed by 0.3% increase in transaction revenues. Increase of 0.9% in bookings drove results for this segment. Incentive expense per booking also grew moderately.

Airline Solutions revenues came in at $211.8 million, marking an increase of 3.4% from the year-ago quarter. AirVision and AirCentre revenues increased 14.7%. SabreSonic revenues declined 3.0% due to the impact of insolvency of Jet Airways and volume reductions at a certain carrier due to a 737 MAX incident, and the demigration of Pakistan International Airlines. A 7.8% year-over-year decline in passengers boarded was also a headwind to SabreSonic revenues.

Hospitality Solutions revenues jumped 8.1% year over year to $73.9 million, driven by 28.1% growth in central reservation system transactions.

The second quarter marked the sixth consecutive quarter of strong gains in Sabre’s share in the Global Distribution System market. Bookings grew 8% in North America.

Moreover, Sabre’s SaaS airline solutions continue to gain momentum.

Margin Details

Adjusted gross profit came in at $350.4 million, down 6.2% from the year-ago quarter. Adjusted gross margin contracted 292 basis points (bps) to 35.04% due to increased technology costs and Travel Network incentives.

Adjusted operating income decreased 26.2% year over year to $127 million. Adjusted operating margin of 12.7% fell 480 bps.

Adjusted operating income for the Travel Network fell 18.5% due to increase in incentive-related expenses and technology costs.

Adjusted operating income for Airline Solutions decreased 0.7%.

Hospitality Solutions incurred an adjusted operating loss.

Balance Sheet and Cash Flow

Sabre ended the quarter with cash and cash equivalents of $396.85 million compared with $459.5 million in the previous quarter.

Cash provided by operating activities decreased to $152 million from $724.8 million sequentially.

Free cash flow was $105.7 million for the second quarter compared with $114.1 in the first quarter.

During the quarter, $45.5 million worth of shares were repurchased. Including dividends, Sabre returned $83.8 million to shareholders.

Guidance

Revenues for full-year 2019 are expected to be in the range of $3.97 billion to $4.05 billion. This indicates 3-5% growth. The Zacks Consensus Estimate stands at $3.99 billion.

Adjusted earnings per share are expected to be between 91 cents and $1.05.

Free cash flow is likely to be approximately $455 million.

Zacks Rank and Key Picks

Sabre currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A few better-ranked stocks in the broader technology sector are Rosetta Stone RST, Anixter International AXE and Alteryx AYX, each flaunting a Zacks Rank #1.

Long-term earnings growth rate for Rosetta Stone, Anixter and Alteryx is currently projected to be 12.5%, 8% and 13.7%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sabre Corporation (SABR) : Free Stock Analysis Report

Rosetta Stone (RST) : Free Stock Analysis Report

Anixter International Inc. (AXE) : Free Stock Analysis Report

Alteryx, Inc. (AYX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research