Sabre (SABR) Strengthens Partnership With Etihad Airways

Sabre Corporation SABR recently announced that it has extended its decade-old partnership with Etihad Airways, the national carrier of the UAE, with a new multi-year deal. Per the deal, Etihad will leverage Sabre’s network planning and revenue management solutions to support its operations.

Sabre has been very proactive lately regarding upgrading its technology to address changing demands of the travel market and support the recovery of the travel industry from the pandemic-induced blues. This is driving the company’s customer loyalty and expanding its customer base.

This move is likely to help Etihad boost its post-pandemic growth ahead of the countries’ reopening borders. Per the renewed deal, Etihad will be utilizing Sabre’s “Fares Optimizer” that will provide the airline with dynamic price recommendations. Besides, Etihad will continue to use Sabre’s Inflight solutions and network planning services to improve its operational efficiency.

Meanwhile, the deal will provide Sabre increased access to Etihad’s broad customer portfolio. The airline currently serves 67 passenger and cargo destinations in 45 nations. Serving in North America, Europe and the Middle East, it carries over one million passengers at present. It has recently added Santorini, Vienna, Mykonos, Phuket and Malaga to its network.

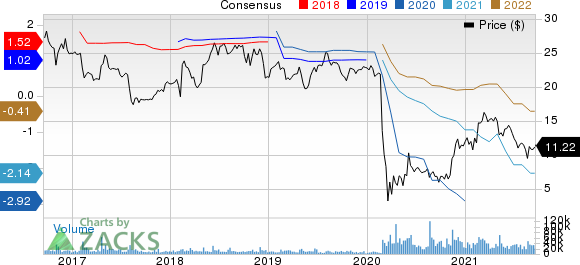

Sabre Corporation Price and Consensus

Sabre Corporation price-consensus-chart | Sabre Corporation Quote

Latest Deal Wins

The recent partnership extension with Etihad adds to a slew of partnership announcements by Sabre in the past few months.

Recently, the company signed a strategic partnership with Biman Bangladesh, to provide its Global Distribution System (“GDS”) and SabreSonic Passenger Service System (PSS) solutions. In a separate deal, it signed an agreement with GOL Linhas Aéreas, Brazil’s leading domestic airline, to provide full SabreSonic PSS offering.

In August, it strengthened its long-term relationship with Qatar Airways by agreeing to provide New Distribution Capability-enabled solutions. Before that, in July, it started a long-term contract with Cleartrip for providing its GDS platform and Bargain Finder Max API technology solutions.

In the same month, it signed an agreement with U.K.-based Polani Travel Group under which it agreed to provide its Red 360 Platform, Automation Hub and Virtual Payments solutions to the travel distributor. Notably, the deal fortifies its long-term relationship with Polani Travel Group.

We believe that the growing traction of Sabre’s technological solutions among airlines and travel companies is likely to remain a key growth driver in the upcoming period. However, uncertainty related to the pandemic and lockdowns in some countries remain concerns.

Zacks Rank & Key Picks

Sabre currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are MaxLinear MXL, Paycom Software PAYC and Semtech Corporation SMTC, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate of MaxLinear, Paycom and Semtech are pegged at 20%, 25% and 12.5%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Semtech Corporation (SMTC) : Free Stock Analysis Report

MaxLinear, Inc (MXL) : Free Stock Analysis Report

Sabre Corporation (SABR) : Free Stock Analysis Report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research