How Safe Is Leggett & Platt's Dividend?

Many of the best stocks in the markets are companies that few have actually heard of. Leggett & Platt (NYSE: LEG) is far from a household name among most people, but the company plays an important role in the economy. As a manufacturer of residential bedding and furniture, Leggett & Platt serves the consumer segment, but it also makes commercial products including office furniture, vehicle seat suspension systems, and even aerospace-related products.

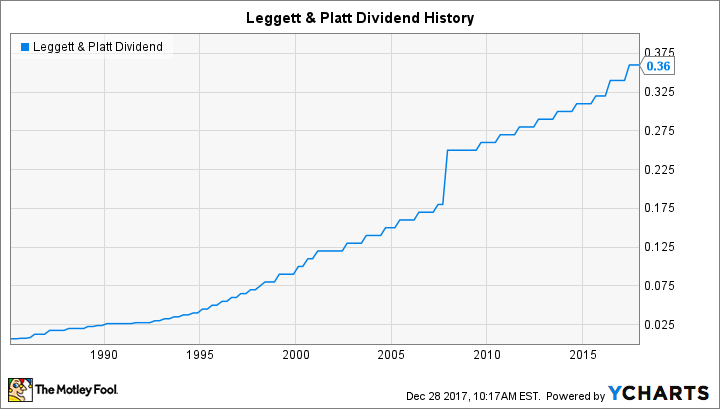

Over the years, Leggett & Platt has given its investors consistent share price gains. But even more impressive is its track record of dividend performance, which includes regular increases dating back for decades. Yet dividend investors always worry about potential roadblocks to future payouts. Below, we'll take a closer look at Leggett & Platt to see if there's anything to be worried about with the furniture maker.

Dividend stats on Leggett & Platt

Current Quarterly Dividend Per Share | $0.36 |

Current Yield | 3% |

Number of Consecutive Years With Dividend Increases | 46 years |

Payout Ratio | 57% |

Last Increase | June 2017 |

Data source: Yahoo! Finance. Last increase refers to ex-dividend date.

A healthy dividend yield for Leggett & Platt investors

The right balance between a high yield and a sustainable yield is important for a dividend stock. Leggett & Platt does a good job of threading the needle, with its 3% yield coming in at about one and a half times the market average but still keeping within a reasonable range.

Interestingly, Leggett's current yield is a lot lower than shareholders have seen in recent years. In the early 2010s, the company regularly sported yields in the 4% to 6% range, but a soaring share price sent the yield down as low as 2.5% before a recent bounce. Leggett has been able to keep its quarterly payout on the rise to help support above-average yields despite strong stock performance.

Image source: Leggett & Platt.

Payout ratio

Leggett & Platt pays out between 55% and 60% of its earnings in the form of dividends. That's a fairly typical level for a mature company in a stable business without huge amounts of growth, because Leggett doesn't need to take massive amounts of capital and reinvest it into its business to find growth opportunities.

Leggett's current payout ratio is largely in line with where it has been in recent years, with an earnings dip in 2014 and 2015 sending the ratio skyrocketing temporarily. The ups and downs of the business will create these spikes from time to time, but generally, Leggett has been prudent about paying out healthy dividends without jeopardizing the sustainability of the payout over the long run.

Dividend growth

Leggett & Platt has delivered rising dividends to shareholders for 46 straight years. That makes the company a Dividend Aristocrat, and because membership in that prestigious list of high-quality dividend stocks requires a continued commitment to future dividend increases, investors can be even more confident than usual about the prospects for long-term payout growth.

LEG Dividend data by YCharts.

If anything, Leggett has gotten more generous with its dividends recently. The company delivered a 6% increase earlier in 2017, reflecting an acceleration from the more modest low single-digit percentage boosts that it routinely gave during the early 2010s.

What's ahead for Leggett & Platt?

Leggett & Platt has done well over time, but that doesn't mean that it hasn't faced challenges along the way. For instance, during the summer of 2017, the company faced rising steel costs along with weaker demand from retail consumers for bedding and furniture products, and Leggett cut its guidance for the full year as a result.

Yet Leggett has done a good job of keeping its long-term vision in mind even through tough spells. In general, Leggett has worked to focus on its best opportunities for profit and growth, divesting weaker-performing businesses that lack the potential of its core operations. Continually refining its business has helped Leggett & Platt keep up with changing times for decades, and it still works well today even in a tough environment for high-priced consumer durable goods.

Leggett & Platt: Safe for dividend investors

At this point, Leggett & Platt is doing all the right things and has a sustainable dividend. Investors should expect another dividend increase in mid-2018, and as long as it can keep tapping into demand throughout the consumer and industrial sectors, Leggett & Platt has the capacity to remain a Dividend Aristocrat well into the future.

More From The Motley Fool

Dan Caplinger has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.