Salesforce (CRM) Stake Reportedly Bought by Elliot Investment

Hedge fund Elliott Investment Management has bought a multi-billion-dollar stake in the enterprise software company, Salesforce CRM, The Wall Street Journal reported citing people familiar with the matter.

Elliot’s latest stake buyout is expected to raise pressure on Salesforce management to make operational improvements and increase profit margins. The activist investor Starboard Value disclosed taking a significant stake in the business software maker in October 2022 to increase profitability. Starboard believes that CRM has not taken advantage of its position as a market leader and lags in profitability compared with its peers.

To cut costs and improve profitability, Salesforce announced a broader restructuring plan in early January 2022. Under the plan, it intends to lay off approximately 10% of its total global workforce, exit real estate and shut down office spaces in certain markets.

Salesforce’s current restructuring plan will include $1.0-$1.4 billion in charges for employee transition, severance payments, employee benefits and share-based compensation. Further, the plan will encompass $450-$650 million in exit charges related to office space reductions.

The San Francisco, CA-based company expects to incur $1.4-$2.1 billion in charges over its restructuring plan. Out of this, $800 million to $1.0 billion is expected to be completed by the end of the fourth quarter of fiscal 2023.

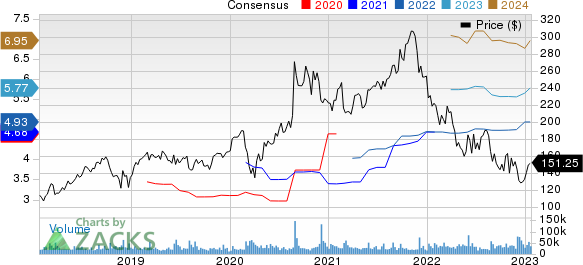

Salesforce Inc. price-consensus-chart | Salesforce Inc. Quote

Why Are Investors Interested in CRM Stock?

We believe that Salesforce’s impressive growth profile, combined with attractive valuations, is attracting long-term investors. CRM has been benefiting from the strong adoption of its cloud-based products and solutions as customers are undergoing a major digital transformation amid the ongoing hybrid work environment. Its ability to provide an integrated solution for customers’ business problems is the key driver.

Per a Grand View Research report, the global CRM software market is projected to witness a CAGR of 13.9% during the 2023-2030 period. With its SaaS-based CRM and social enterprise applications, we believe Salesforce is well-positioned to lead the market.

Additionally, the cloud-based customer relationship management software provider’s sustained focus on acquisitions and partnerships is helping it enhance its product offerings and expand across newer markets. The buyouts of Slack, Tableau, ClickSoftware, Mulesoft, Datorama and CloudCraze over the last couple of years have been beneficial for the company.

Salesforce's partnership agreements with the likes of Amazon and Google’s parent Alphabet for the firms’ cloud services have been helping it expand its international operations. The company also entered into an alliance with Apple through which it is offering new apps for iPhones and iPads.

Accelerated digital transformation and a sustained focus on acquisitions and partnerships are driving its revenues. Salesforce’s revenues almost doubled from $13.3 billion in fiscal 2019 to $26.5 billion in fiscal 2022.

The company’s third-quarter fiscal revenues increased 14% year over year to $7.84 billion. Moreover, it targets to achieve annual revenues of $50 billion in fiscal 2026.

Attractive Valuation Profile

In our opinion, shares of Salesforce are currently available at a huge valuation discount, which makes it a lucrative investment option for investors like Elliot and Starboard Value. CRM stock has plunged 32.2% in the trailing 12 months and currently trades at approximately 35.5% lower than the 52-week high of $234.49 attained on Feb 2, 2022.

Moreover, the stock currently trades at a forward 12-month price-to-sales multiple of 4.44, significantly lower than the three-year high of 11.27 and the three-year average of 7.65.

Technology has been among the most-battered sectors amid a broader market sell-off in 2022. However, this sell-off in the broader equity market has led to a massive correction in several technology companies’ stock prices. These companies were considered to be grossly overvalued at the sector’s peak in 2021. With this correction, several tech stocks are currently trading lower than their 52-week high and at an attractive valuation despite strong fundamentals.

This has led several private equity and hedge fund investors to buy stakes in fundamentally strong companies, which are available at a huge valuation discount. Apart from Salesforce, Elliot bought a stake in Pinterest PINS, while Starboard Value has a buildup stake in Splunk SPLK and Wix.com WIX.

Pinterest’s stock has plunged 32.2% in the trailing 12 months and currently trades at approximately 35.5% lower than the 52-week high of $234.49 attained on Feb 2, 2022. Moreover, the stock currently trades at a forward 12-month price-to-sales multiple of 5.47, significantly lower than the three-year high of 22.46 and the three-year average of 8.49.

Splunk has lost 25.3% of its value over the past year and currently trades at approximately 39.9% lower than its 52-week high of $150.79 attained on Apr 4, 2022. Moreover, the stock currently trades at a forward 12-month price-to-sales multiple of 3.72, significantly lower than the three-year high of 13.53 and the three-year average of 7.86.

Wix has lost 33.9% of its value in the last 12 months and currently trades at approximately 36.2% lower than its 52-week high of $134.24 attained on Jan 26, 2022. Additionally, the stock currently trades at a forward 12-month price-to-sales multiple of 3.23, significantly lower than the three-year high of 14.77 and the three-year average of 7.32.

Currently, CRM, PINS, SPLK and WIX each carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report