Sarah Ketterer Drills Deeper Into Oil Company Ovintiv

Causeway Capital Management leader Sarah Ketterer (Trades, Portfolio) disclosed this week she upped her firm's stake in Ovintiv Inc. (NYSE:OVV) by 28.36%.

With the goal of achieving superior risk-adjusted returns, Ketterer's Los Angeles-based firm, which she founded with Harry Hartford in 2001, invests in mispriced equities in both developed and emerging markets. The investment team looks for potential opportunities among mid- and large-cap companies using quantitative and value-oriented methods. Each stock also receives a risk score based on the amount of volatility it adds to the portfolio. The team then enters positions in the stocks with the highest expected risk-adjusted returns that also have a lower price-earnings ratio and higher dividend yield than the market.

According to GuruFocus Real-Time Picks, a Premium feature, Ketterer picked up 7.16 million shares of the Denver-based oil company on Jan. 31, bringing its total holding to 32.4 million shares. The stock traded for an average price of $15.63 per share.

Representing 5.97% of the equity portfolio, GuruFocus estimates Causeway has lost 47.3% on the investment since the third quarter of 2016.

Ovintiv, which recently announced it changed its name from Encana Corp. as part of a restructuring, also established a corporate domicile in the U.S. (having been headquartered in Canada previously) and completed a consolidation and share exchange. The stock exchange consisted on one common share of Ovintiv for every five shares of Encana. The company began trading under its new name and ticker on the New York and Toronto exchanges on Jan. 27.

The company will announce its fourth-quarter and full-year 2019 earnings results on Feb. 20.

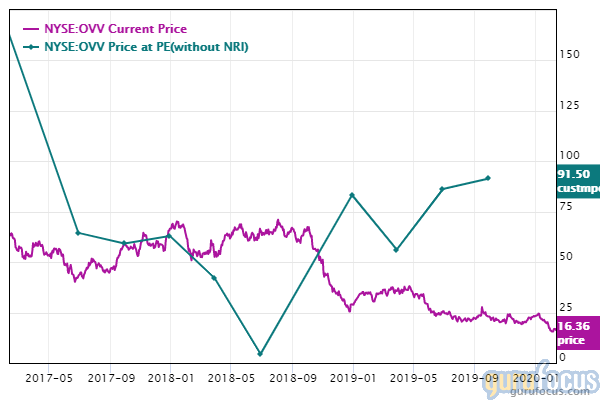

Ovintiv has a $4.33 billion market cap; its shares were trading around $16.50 on Tuesday with a price-earnings ratio of 2.69, a price-book ratio of 0.44 and a price-sales ratio of 0.52.

The Peter Lynch chart shows the stock is trading below its fair value, suggesting it is undervalued.

The company also has a GuruFocus valuation rank of 10 out of 10, indicating high undervaluation as its price ratios are all near 10-year lows.

Ovintiv's financial strength was rated 4 out of 10. Despite having adequate interest coverage, the Altman Z-Score of 0.89 warns the company could be in danger of going bankrupt as its revenue per share has declined over the past five years.

The company's profitability scored a 6 out of 10 rating, driven by strong margins and returns that outperform a majority of competitors and a high Piotroski F-Score of 7, which indicates its operating conditions are healthy. Ovintiv also has a business predictability rating of one of five stars. GuruFocus says companies with this rank typically see their stocks gain an average of 1.1% per annum over a 10-year period.

Of the gurus invested in Ovintiv, Ketterer has the largest position with 12.47% of its outstanding shares. Other top guru shareholders are Dodge & Cox, Chris Davis (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies, Steven Cohen (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Ron Baron (Trades, Portfolio) and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates.

Portfolio composition

Ketterer's $8.37 billion equity portfolio as of the end of third-quarter 2019 was composed of 86 stocks. The technology, financial services, energy and basic materials sectors have the largest representation.

Other energy companies the guru's firm has positions in as of the three months ended Sept. 30 include Halliburton Co. (NYSE:HAL), Royal Dutch Shell PLC (NYSE:RDS.B), Marathon Petroleum Corp. (NYSE:MPC), PetroChina Co. Ltd. (NYSE:PTR), China Petroleum & Chemical Corp. (NYSE:SNP), Total SA (NYSE:TOT), BP PLC (NYSE:BP) and RPC Inc. (NYSE:RES).

Disclosure: No positions.

Read more here:

Bill Ackman's Pershing Square Takes a Chip Off Chipotle Stake

T. Boone Pickens' BP Capital Adds 3 Energy Stocks to Portfolio

Royce International Premier Fund Adds 5 Stocks to Portfolio in 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.