Sarah Ketterer's Favorite Communication Services Stocks

Causeway Capital Management, the Los Angeles-based firm founded by Sarah Ketterer (Trades, Portfolio) and Harry Hartford in 2001, seeks to achieve superior risk-adjusted returns by investing in mispriced equities in both developed as well as emerging markets.

The guru and her team look for potential opportunities among mid- and large-cap companies using quantitative and value-oriented methods. Each stock also receives a risk score based on the additional volatility or risk it adds to the portfolio. The investment team then enters positions in the stocks with the highest expected risk-adjusted return that also have a lower price-earnings ratio and higher dividend yield than the market.

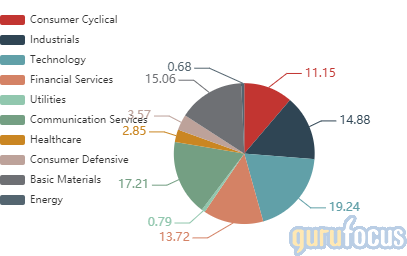

As of the first quarter, the communications services sector had the second-largest representation in Ketterer's $6.26 billion equity portfolio with a weight of 17.21%.

According to GuruFocus portfolio data, Ketterer's five largest communication services holdings as of the end of the three months ended March 31 were Baidu Inc. (NASDAQ:BIDU), ViacomCBS Inc. (NASDAQ:VIAC), China Mobile Ltd. (NYSE:CHL), SK Telecom Co. Ltd. (NYSE:SKM) and NetEase Inc. (NASDAQ:NTES).

Baidu

In the first quarter, Ketterer boosted her stake in Baidu by 1.28% to 6.7 million shares. The position accounts for 10.79% of the equity portfolio and is the second-largest holding overall. GuruFocus estimates she has lost 30.79% on the investment since establishing it in the second quarter of 2016.

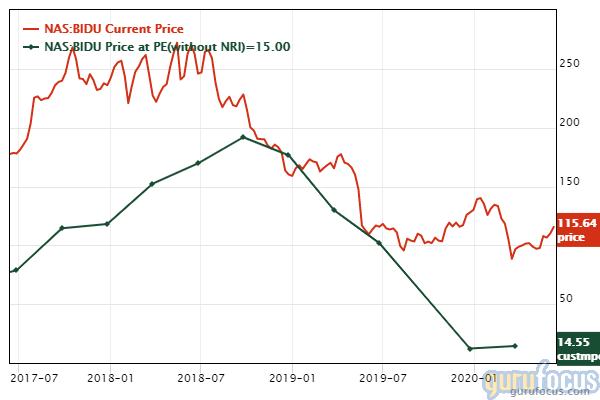

The Chinese company, which provides internet services and artificial intelligence products, has a $39.53 billion market cap; its shares were trading around $115.42 on Friday with a price-earnings ratio of 117.63, a price-book ratio of 1.71 and a price-sales ratio of 2.65.

The Peter Lynch chart shows the stock is trading above its fair value, suggesting it is overpriced.

GuruFocus rated Baidu's financial strength 6 out of 10 and its profitability 8 out of 10.

Of the gurus invested in the stock, PRIMECAP Management (Trades, Portfolio) has the largest stake with 2.13% of outstanding shares. Other top guru shareholders include Dodge & Cox, Jim Simons (Trades, Portfolio)' Renaissance Technologies, John Rogers (Trades, Portfolio), First Pacific Advisors (Trades, Portfolio), David Herro (Trades, Portfolio), Steven Romick (Trades, Portfolio), Tweedy Browne (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Mason Hawkins (Trades, Portfolio), Steven Cohen (Trades, Portfolio) and the Causeway International Value (Trades, Portfolio) Fund.

ViacomCBS

The guru increased her stake in ViacomCBS by 6.73% during the quarter to 4.8 million shares, which represents 1.08% of the equity portfolio. According to GuruFocus, Ketterer has lost an estimated 38.58% on the investment since the fourth quarter of 2019.

The New York-based mass media company has a market cap of $15.34 billion; its shares were trading around $23.52 on Friday with a price-earnings ratio of 5.29, a price-book ratio of 1.07 and a price-sales ratio of 0.42.

According to the Peter Lynch chart, the stock is undervalued. The GuruFocus valuation rank of 8 out of 10 aligns with this assessment.

While ViacomCBS's financial strength scored a 4 out of 10 rating, its profitability fared better with a rating of 8 out of 10.

With a 3.66% stake, Seth Klarman (Trades, Portfolio) is the company's largest guru shareholder. Other top investors include Larry Robbins (Trades, Portfolio), Rogers, John Paulson (Trades, Portfolio), Hotchkis & Wiley, Mario Gabelli (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio).

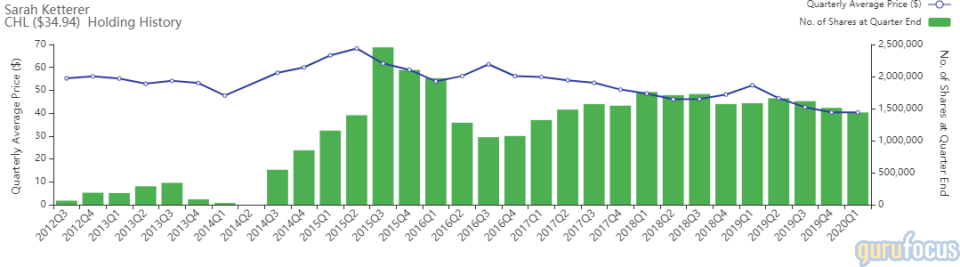

China Mobile

Ketterer trimmed her position in China Mobile by 4.72% during the quarter. She now holds 1.4 million shares, which account for 0.87% of the equity portfolio. GuruFocus data shows she has lost an estimated 21.13% on the investment since the third quarter of 2012.

The Chinese telecom company has a $142.51 billion market cap; its shares were trading around $34.77 on Friday with a price-earnings ratio of 9.4, a price-book ratio of 0.91 and a price-sales ratio of 1.34.

Based on the Peter Lynch chart and GuruFocus valuation rank of 10 out of 10, the stock appears to be undervalued.

GuruFocus rated China Mobile's financial strength 8 out of 10 and its profitability 7 out of 10.

Simons' firm has the largest stake in the company with 0.18% of outstanding shares. Other top guru shareholders are Rogers, Charles Brandes (Trades, Portfolio), Grantham and Richard Pzena (Trades, Portfolio).

SK Telecom

The investor curbed her stake in SK Telecom by 3.47%. Representing 0.82% of the equity portfolio, she now owns 3.16 million shares. GuruFocus says Ketterer has lost an estimated 13.31% on the investment since the third quarter of 2012.

The South Korean telecom company, which offers wireless services, has a market cap of $12.64 billion; its shares were trading around $19.26 on Friday with a price-earnings ratio of 21.87, a price-book ratio of 0.68 and a price-sales ratio of 0.75.

The Peter Lynch chart suggests the stock is overvalued. The GuruFocus valuation rank of 6 out of 10, however, leans more toward undervaluation.

SK Telecom's financial strength was rated 5 out of 10 by GuruFocus, while its profitability scored a 6 out of 10 rating.

Ketterer is the company's largest guru shareholder with 0.48% of outstanding shares. NWQ Managers (Trades, Portfolio) and Grantham also have positions in the stock.

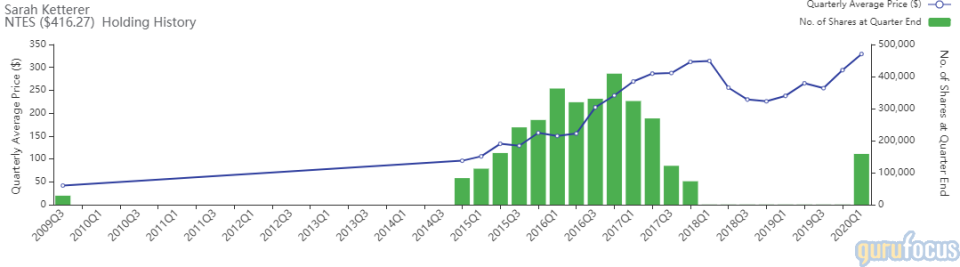

NetEase

Ketterer increased her holding of NetEase by 15,750% to 158,500 shares. The stock represents 0.81% of the equity portfolio. GuruFocus data shows she has gained an estimated 62.78% on the investment since the fourth quarter of 2014.

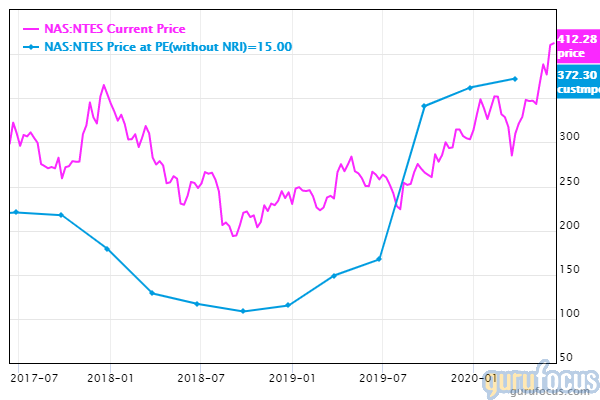

The Chinese internet technology company, which debuted on the Hong Kong exchange earlier this week, has a $54.08 billion market cap; its shares were trading around $410.46 on Friday with a price-earnings ratio of 16.94, a price-book ratio of 6.05 and a price-sales ratio of 6.09.

According to the Peter Lynch chart, the stock is slightly overvalued, an assessment which the GuruFocus valuation rank of 4 out of 10 agrees with.

NetEase's financial strength was rated 6 out of 10 by GuruFocus, while its profitability scored a 10 out of 10 rating.

With 0.73% of outstanding shares, Simons' firm is the company's largest guru shareholder. Other top guru investors are Fisher, Pioneer Investments (Trades, Portfolio), Grantham, Ken Heebner (Trades, Portfolio), Ray Dalio (Trades, Portfolio), Prem Watsa (Trades, Portfolio), Lee Ainslie (Trades, Portfolio), Caxton Associates (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio).

Additional holdings in the communication services space

Other communication-related stocks Ketterer owns as of the end of the first quarter include The Walt Disney Co. (NYSE:DIS), which is a new addition to the portfolio, as well as Mobile TeleSystems PJSC (NYSE:MBT), Telefonica Brasil SA (NYSE:VIV), Momo Inc. (NASDAQ:MOMO) and Vodafone Group PLC (NASDAQ:VOD).

View her entire portfolio here.

Disclosure: No positions.

Read more here:

3 Solar Companies to Consider as Coronavirus Begins to Weigh on the Industry

3 Stocks These Tech Investors Agree On

Ron Baron Is Positive on Tesla, SpaceX

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.