Sarah Ketterer's Top 4 Buys for the 4th Quarter

Sarah Ketterer (Trades, Portfolio), the CEO and fundamental portfolio manager of Causeway Capital Management, recently released the firm's portfolio updates for the fourth quarter of 2019.

Causeway Capital Management was founded in 2001 by Ketterer and Harry Hartford. The Los Angeles-based company chooses stocks from among large and mid-cap companies in developed markets around the world. Their screens use quantitative, value-oriented metrics and a "risk score" to find potential investment opportunities. After screening, the investment team chooses the stocks that have the most favorable risk-adjusted returns, price-earnings ratios and dividend yields.

Based on the above criteria, the firm's top new buys for the quarter were ViacomCBS Inc . (NASDAQ:VIAC), General Electric Co. (NYSE:GE), FedEx Corp. (NYSE:FDX) and Ashland Global Holdings Inc. (NYSE:ASH).

ViacomCBS

Causeway acquired 4,540,401 shares of ViacomCBS during the quarter as a result of the merger of CBS and Viacom (before the merger, the firm owned a 5,601,770-share stake in Viacom). The trade impacted the equity portfolio by 2.04%. Shares traded around $38.79 apiece during the quarter.

Viacom was originally a 2006 spinoff from CBS, so the merger is not expected to have much effect on operations. The New York City-based multinational mass media conglomerate owns mainly film and TV assets, including live sports, news, classic shows such as "Star Trek" and TV networks such as Nickelodeon.

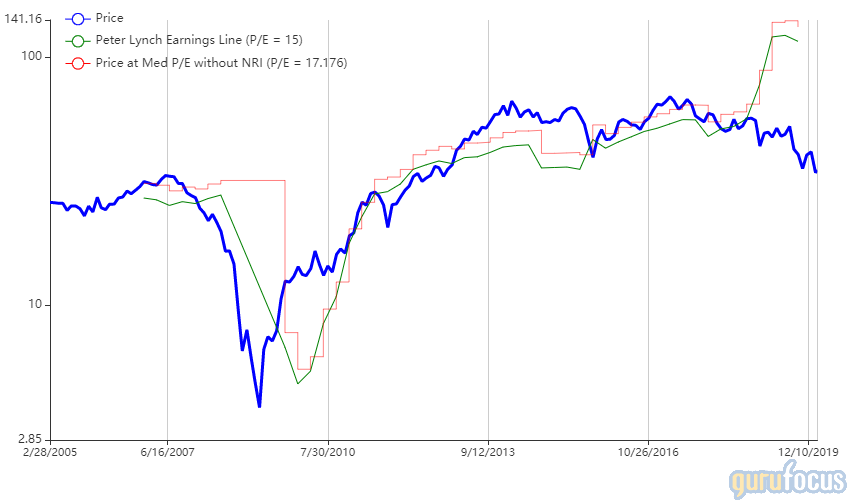

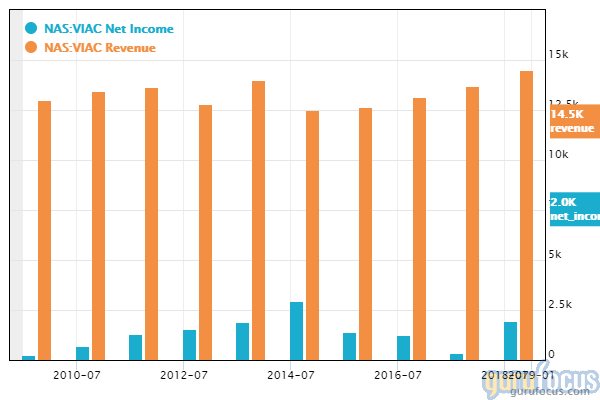

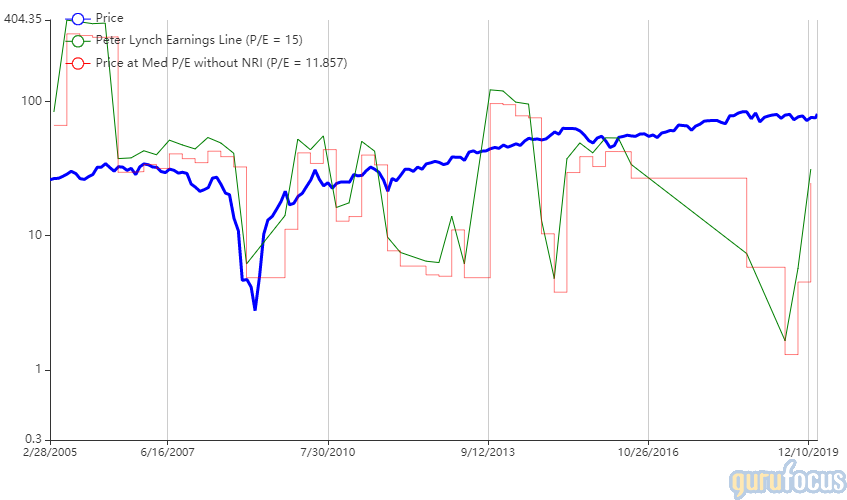

On Feb. 14, shares of ViacomCBS traded around $34.78 for a market cap of $21.5 billion, a price-earnings ratio of 4.49 and a dividend yield of 2.21%. According to the Peter Lynch chart, shares are undervalued by a large margin.

GuruFocus has given ViacomCBS a financial strength rating of 4 out of 10 and a profitability rating of 8 out of 10. The interest coverage of 6.09% and Altman-Z score of 0.97 are on the low end of the spectrum, though the current ratio of 1.52 indicates that the company is able to meet its short-term debt obligations. The three-year revenue growth rate of 13.7% is outperforming 80.38% of competitors.

The CBS-Viacom merger provides two things that have the potential to boost the company's growth: a doubled market share of TV viewers and a content list that will appeal to a wide range of audiences. The combined company will reach 4.3 billion subscribers globally, with brands spanning many content categories and demographics in 183 countries and 45 languages.

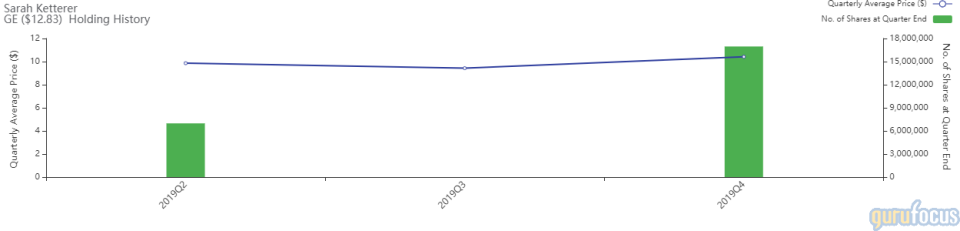

General Electric

After selling out of a previous holding in General Electric during the third quarter of 2019, the firm invested in 16,965,702 shares of the company, impacting the equity portfolio by 2.03%. During the quarter, shares traded at an average price of $10.42 each.

Headquartered in Boston, Massachusetts, General Electric is a large-scale multinational conglomerate that is known for its kitchen and other home appliances. It also owns businesses in a wide range of sectors, including aviation, health care, financial services and energy.

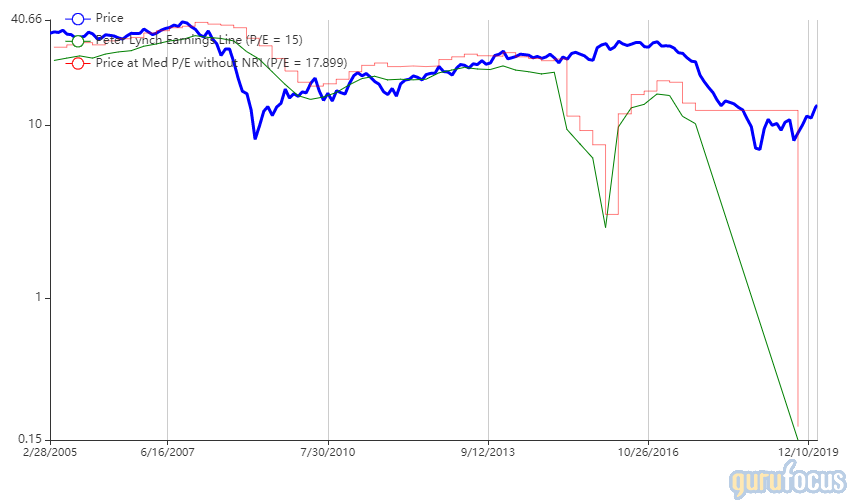

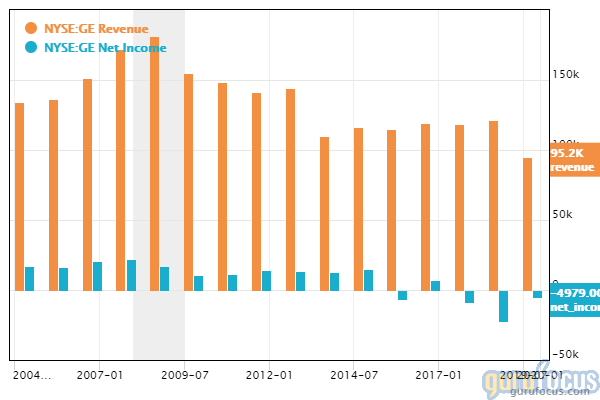

On Feb. 14, shares of General Electric traded around $12.82 apiece for a market cap of $111.7 billion and a dividend yield of 0.31%. According to the Peter Lynch chart, the stock may be overvalued.

General Electric has a GuruFocus financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. The interest coverage of 1.93 and Altman Z-score of 1.58 are underperforming 87.87% of competitors. The three-year revenue growth rate of 6.8% is average for the industry, but the negative return on assets is a big drawdown.

In mid-2018, Larry Culp took over as the company's CEO following years of losses, which a whistleblower alleged were largely covered up by accounting fraud. The massive conglomerate has seen an increasing amount of its profits coming from its energy businesses, so it may be worth it to keep an eye on changes in the energy sector to see if the company can recover.

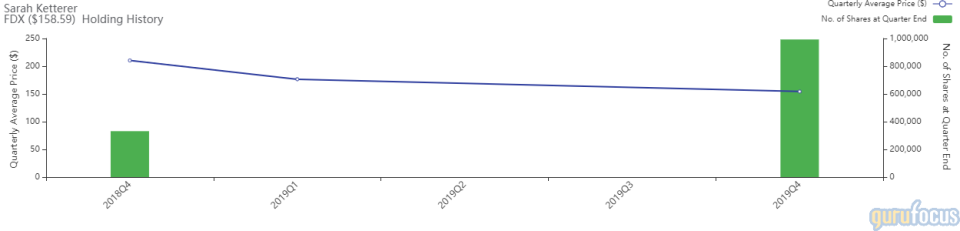

FedEx

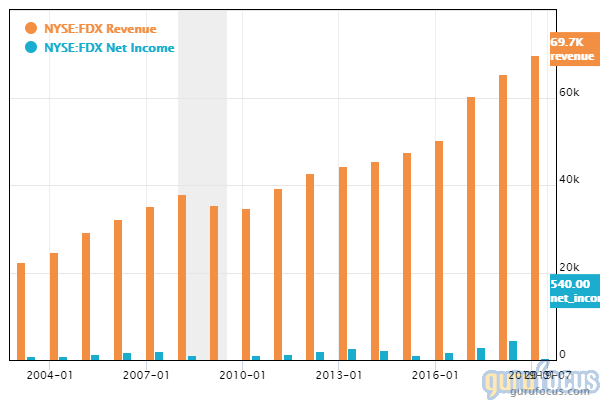

Causeway sold out of its previous FedEx holding in the first quarter of 2019, but this quarter, it established a new position in the company of 993,057 shares. The trade impacted the equity portfolio by 1.61%. Shares traded at an average price of $154.38 each during the quarter.

FedEx is a multinational delivery service based in Memphis, Tennessee. In the U.S., it is the go-to company when it comes to fast shipping for individuals and small online businesses. Its stores also have printing services, where customers can print posters, flyers and presentations in high quality.

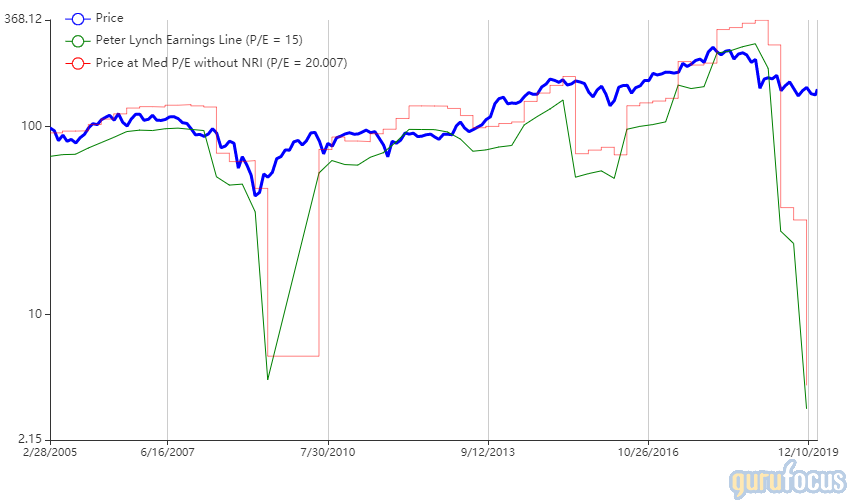

On Feb. 14, FedEx shares traded around $158.57 for a market cap of $41.33 billion, a price-earnings ratio of 755.66 and a dividend yield of 1.63%. According to the Peter Lynch chart, sales may be overvalued.

FedEx has a GuruFocus financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. The interest coverage of 6.71% and Altman Z-score of 2.06 are low but still within a safe range. The three-year revenue growth rate of 13.4% is tempered by a decline in net income for 2019.

Chairman and CEO Frederick W. Smith commented the following on FedEx's earnings report for the second quarter of fiscal 2020:

"Fiscal 2020 is a year of continued significant challenges and changes for FedEx, particularly in the quarter just ended due to the compressed shipping season. We have significantly enhanced our e-commerce capabilities with strategic initiatives including year-round seven-day FedEx Ground delivery, enhanced large package capabilities and the insourcing of FedEx SmartPost packages. These changes have been well-received by the marketplace as reflected in our record volumes this peak season. While we have experienced some higher-than-expected expenses this quarter, we forecast FedEx Ground operating margins to rebound to the teens in our fiscal fourth quarter as the bow wave of costs for these changes is absorbed."

Ashland Global Holdings

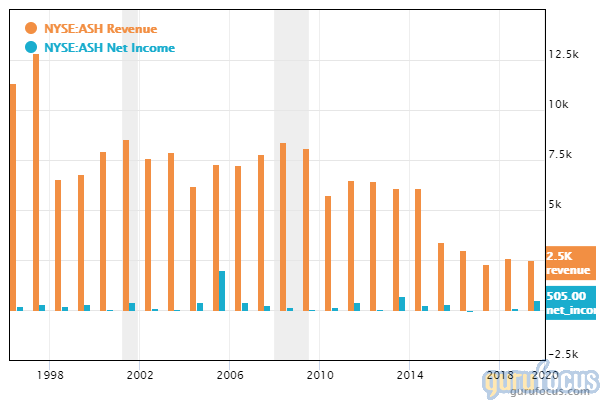

The firm also established a new stake of 1,448,021 shares in Ashland Global Holdings, impacting the equity portfolio by 1.19%. Shares traded around $75.86 in the observed period.

Ashland is a leading provider of specialty chemicals and chemical technologies. The company has reorganized in recent years, divesting unprofitable businesses and making more acquisitions in the specialty chemicals field.

On Feb. 14, shares of Ashland traded around $80.87 for a market cap of $4.11 billion, a price-earnings ratio of 8.52 and a dividend yield of 1.33%. Shares may currently be overvalued, according to the Peter Lynch chart.

GuruFocus has assigned Ashland a financial strength rating of 4 out of 10 and a profitability ranking of 5 out of 10. The interest coverage of 1.74% and Altman Z-score of 1.34 are low, though the current ratio of 1.95 indicates that the company can meet its short-term debt obligations. Revenue has declined by an average of 6.2% per year over the past three years.

From the chart above, it's clear that the company has been downsizing since the '90s with positive results in terms of profitability. While overall revenue has been cut with each round of divestitures, net income has hovered around the same median level.

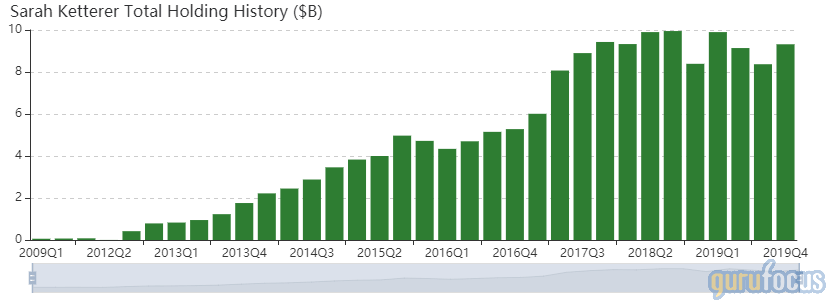

Portfolio overview

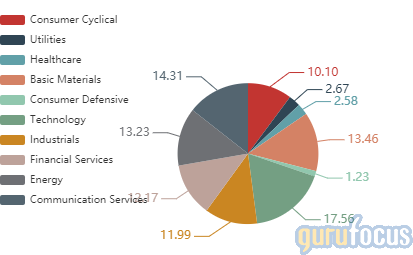

As of the quarter's end, the equity portfolio contained positions in 87 stocks and was valued at $9.32 billion. The turnover rate was 15%.

The firm's top holdings were Linde PLC (LIN) with 10.8% of the equity portfolio, Baidu Inc. (BIDU) with 8.95%, Ovintiv Inc. (OVV) with 6.86%, Ryanair Holdings PLC (RYAAY) with 6.06% and Alibaba Group Holding Ltd (BABA) with 4.84%. In terms of portfolio weight, the firm was most invested in technology, communication services and basic materials.

Read more here:

Seth Klarman's Top 4th-Quarter Trades

Daniel Loeb's Top Trades of the 4th Quarter

Ken Fisher's Top 4th-Quarter Buys

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.