Sarepta (SRPT) Q3 Loss Wider-Than-Expected, Sales Lag Estimates

Sarepta Therapeutics, Inc. SRPT reported a loss of $2.94 per share in the third quarter of 2022, wider than the Zacks Consensus Estimate of a loss of $1.21 per share. The loss was also wider than the year-ago quarter’s loss of 60 cents per share.

The company reported an adjusted loss of 80 cents per share against adjusted earnings of 3 cents in the year-ago quarter. The adjusted figure excludes one-time items, depreciation and amortization expenses, interest expenses, income tax benefit, stock-based compensation expenses and other items.

Sarepta recorded total revenues of $230.3 million, up 21.6% year over year. Revenues missed the Zacks Consensus Estimate of $235.8 million. The year-over-year increase in revenues was driven by the sales of Sarepta’s three currently approved RNA-based PMO therapies for DMD.

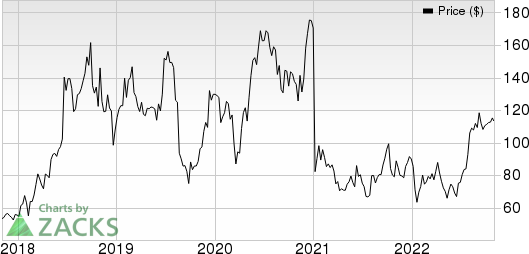

Shares of Sarepta were down 4.8% in after-hours trading on Nov 2, likely due to the wider loss reported during the quarter. Sarepta’s shares have moved up 26.0% this year against the industry’s 21.2% decline.

Image Source: Zacks Investment Research

Quarter in Detail

Sarepta’s commercial portfolio includes three drugs approved for treating Duchenne muscular dystrophy (“DMD”) — Exondys 51, Vyondys 53 and Amondys 45.

The company derived product revenues of $207.8 million, up 24.5% year over year. The upside was driven by an increase in demand for its DMD products.

The company recorded $22.3 million in collaboration revenues, primarily from its licensing agreement with Roche RHHBY. Collaboration revenues were flat compared with the year-ago quarter’s levels.

Sarepta and Roche entered into a licensing agreement to develop SRP-9001, its investigational gene-therapy candidate for DMD, in 2019. Per the agreement, Roche has exclusive rights to launch and commercialize SRP-9001 in ex-U.S. markets.

Adjusted research and development (R&D) expenses totaled $193.7 million in the third quarter, up 61.9% year over year. This surge is attributable to the increase in manufacturing expenses for ramping up production for SRP-9001.

Adjusted selling, general & administrative (SG&A) expenses were $66.8 million, up 53.2% year over year.

2022 Guidance

Sarepta reiterated its revenue guidance for 2022. Management expects total revenues in 2022 to be in the range of $905-$920. The company expects net product revenues for the full year to be in the range of $825-$840 million.

Pipeline Updates

In September, Sarepta along with partner announced that they have submitted a biologic license application (BLA) to the FDA seeking accelerated approval for SRP-9001 in DMD. The BLA filing is supported by data from multiple studies from the clinical development program evaluating SRP-9001 in DMD, which show that treatment with SRP-9001 led to functional improvements in individuals suffering from DMD compared with a propensity-weighted external control group at multiple times. The time points vary from one-, two- and four years post-treatment.

Management expects the SRP-9001 BLA to be eligible for priority review. If the BLA were to be granted a priority review designation, the company expects an FDA decision by May 2023-end.

During the quarter, Sarepta also announced that the FDA removed the clinical hold placed on its next-generation exon-skipping pipeline candidate, SRP-5051 (vesleteplirsen), being evaluated for treating DMD patients with skipping exon 51. The hold was set in June following a report of a severe adverse event of hypomagnesemia in the ongoing phase II MOMENTUM study. Sarepta will modify the global protocols for clinical studies evaluating SRP-5051 to include expanded monitoring of urine biomarkers as part of the condition for removing the clinical hold.

Sarepta Therapeutics, Inc. Price

Sarepta Therapeutics, Inc. price | Sarepta Therapeutics, Inc. Quote

Zacks Rank & Other Stocks to Consider

Sarepta currently has a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the overall healthcare sector include Angion Biomedica ANGN and Gilead Sciences GILD, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for Angion Biomedica’s 2022 loss per share have narrowed from $1.64 to $1.53 in the past 60 days. Angion’s loss estimates for 2023 have narrowed from $1.54 to $1.43 in the past 60 days. Shares of Angion Biomedica have plunged 66.6% in the year-to-date period.

Earnings of Angion Biomedica beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 62.85%. In the last reported quarter, ANGN delivered an earnings surprise of 34.78%.

Gilead’s stock has increased 7.3% this year so far. While Gilead’s earnings estimates for 2022 have risen from $6.61 to $6.94 per share in the past 60 days, estimates for 2023 have increased from $6.32 to $6.74 per share during the same period.

Gilead beat earnings estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 0.36%. In the last reported quarter, GILD delivered an earnings surprise of 31.94%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Angion Biomedica Corp. (ANGN) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research