Sarepta (SRPT) Q4 Earnings Beat, DMD Drugs Sales Robust

Sarepta Therapeutics, Inc. SRPT reported a loss of $1.42 per share for the fourth quarter of 2021, narrower than the Zacks Consensus Estimate of a loss of $1.51 per share. The loss was also narrower than the year-ago loss of $2.40 per share.

The company reported adjusted earnings of 77 cents per share, down from $1.69 in the year-ago quarter. The adjusted figure excludes one-time items, depreciation & amortization expenses, interest expenses, income tax benefit, stock-based compensation expense and other items.

Sarepta recorded total revenues of $201.5 million, up 31.6% year over year. Revenues beat the Zacks Consensus Estimate of $189.2 million. The year-over-year increase in revenues was driven by additional sales following the launch of Amondys 45 in February 2021 and continued demand for Sarepta’s other two drugs — Exondys 51 and Vyondys 53.

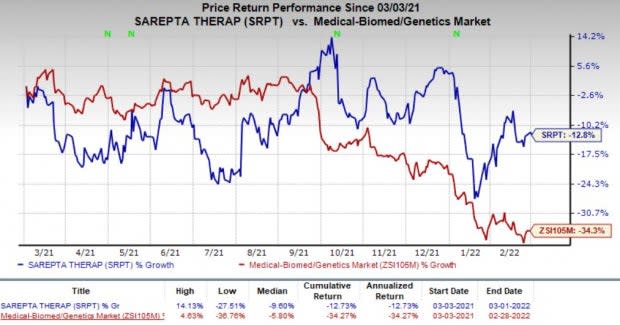

Despite beating market expectations with fourth-quarter results, shares of Sarepta were down almost 4% in after-hours trading on Mar 1. In fact, Sarepta’s shares have declined 12.8% in the past year compared with the industry’s decrease of 34.3%.

Image Source: Zacks Investment Research

Quarter in Details

Sarepta’s commercial portfolio includes three drugs approved for treating Duchenne muscular dystrophy (“DMD”) — Exondys 51, Vyondys 53 and Amondys 45.

The company derived product revenues of $178.7 million, up 45.8% year over year.

The company recorded $22.7 million in collaboration revenues, primarily from its licensing agreement with Roche RHHBY. Collaboration revenues were nearly flat year over year.

Sarepta and Roche entered into a licensing agreement to develop SRP-9001 in 2019. Per the agreement, Roche has exclusive rights to launch and commercialize SRP-9001 in the ex-U.S. markets.

Adjusted research and development (R&D) expenses totaled $175.5 million in the fourth quarter, down 8.3% year over year.

Adjusted selling, general & administrative (SG&A) expenses were $60.1 million, down 7.8% year over year.

Full-Year Results

Sarepta reported total revenues of $701.9 million in 2021, up 30% year over year. The company incurred a loss of $5.15 per share for the full year compared with a loss of $7.11 per share in the year-ago period. The adjusted loss in 2021 was $3.80 per share compared with an adjusted loss of $5.50 per share in 2020.

2022 Guidance

Sarepta issued guidance for revenues in 2022. The company expects total revenues in 2022 to be more than $880 million, indicating year-over-year growth of more than 25%. The company expects its net product revenues to be more than $800 million in 2022.

Pipeline Update

In October 2021, Sarepta initiated a pivotal study, EMBARK, which is evaluating the commercially representative material for its lead gene-therapy candidate, SRP-9001, in DMD patients. The study will enroll 120 patients aged four to seven from the United States and different countries in Europe and Asia. Enrollment in the study is expected in the first half of 2022.

In January 2022, Sarepta announced top-line data from a phase II part 2 of the mid-stage study — SRP-9001-102 (Study 102) — evaluating SRP-9001 in DMD patients. Data from the study showed that treatment with SRP-9001 led to a statistically significant improvement in patients.

During the fourth quarter, the company also initiated part B of the MOMENTUM study evaluating its next-generation PPMO-based DMD candidate, SRP-5051. Data from this part of the study may support the regulatory submission seeking accelerated approval of the candidate.

Sarepta Therapeutics, Inc. Price, Consensus and EPS Surprise

Sarepta Therapeutics, Inc. price-consensus-eps-surprise-chart | Sarepta Therapeutics, Inc. Quote

Zacks Rank and Stocks to Consider

Sarepta currently has a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the pharma/biotech sector include Celularity CELU and Assertio ASRT, all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Celularity’s loss per share estimates have improved from $1.19 to $1.23 for 2022 in the past 60 days. CELU has gained 20.4% so far this year.

Celularity delivered a negative earnings surprise of 237.93%, on average, in the last four quarters.

Assertio’s earnings per share estimates have moved north from 20 cents to 35 cents for 2022 in the past 60 days. ASRT has risen 9.7% so far this year.

Assertio delivered an earnings surprise of 33.33%, on average, in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

Assertio Holdings, Inc. (ASRT) : Free Stock Analysis Report

Celularity, Inc. (CELU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research