Will Savings Efforts Boost McCormick's (MKC) Q2 Earnings?

McCormick & Company, Incorporated MKC is slated to release second-quarter fiscal 2019 results on Jun 27. This provider of spices, flavors and more has a mixed bottom-line surprise record in the trailing four quarters. Let’s see what’s in store for the company in the upcoming quarterly results.

Factors Likely to Impact in Q2

McCormick gains from a rich brand portfolio and focus on boosting prospects through innovation and buyouts. Acquisitions that include the food division of RB Foods, Enrico Giotti SpA and Botanical Food Company have added iconic brands to the company’s portfolio. Additionally, the company’s new products are gaining strong retail acceptance. Health and wellness continue to drive the innovation agenda. Such upsides are likely to drive the company’s performance in the upcoming quarterly release.

Moreover, the company is undertaking robust measures to boost savings and productivity. In this respect, the Comprehensive Continuous Improvement (CCI) program is yielding results. Apart from supporting bottom-line growth, CCI savings are being utilized to increase investments, which are generating higher sales. Management expects savings of almost $110 million in fiscal 2019, which boosts expectations for the forthcoming quarter.

Although the aforementioned aspects are encouraging, there are certain headwinds that are likely to exert pressure on second-quarter results. In this respect, currency headwinds are a concern. Management expects currency movements to have an adverse impact on performance in fiscal 2019, which raises concerns for the quarter to be reported. In fact, the impact of unfavorable currency is expected to be higher in the first half of the fiscal. Apart from this, higher marketing expenses and other input costs might dent performance.

How are Estimates Faring?

The Zacks Consensus Estimate for second-quarter earnings is pegged at $1.09, which suggests growth of 6.8% from the earnings delivered in the year-ago quarter. The current estimate has been stable in the past 30 days.

Further, the consensus mark for revenues is pegged at $1,311 million, calling for a decline of approximately 1.2% from the year-ago quarter’s figure.

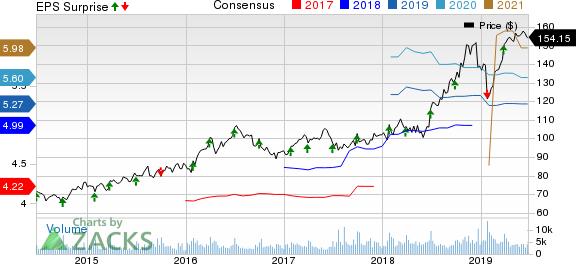

McCormick & Company, Incorporated Price, Consensus and EPS Surprise

McCormick & Company, Incorporated price-consensus-eps-surprise-chart | McCormick & Company, Incorporated Quote

What Does the Zacks Model Unveil?

Our proven model doesn’t show that McCormick is likely to beat bottom-line estimates in the to-be-reported quarter. For this to happen, a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although McCormick has a Zacks Rank #3, its Earnings ESP of 0.00% makes us apprehensive about an earnings beat.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks Poised to Beat Earnings Estimates

Here are some other companies you may want to consider, as our model shows that these have the right combination of elements to beat estimates.

The Estee Lauder Companies EL, flaunting a Zacks Rank 1, has an Earnings ESP of +6.58% and a Zacks Rank of 2.

General Mills GIS, a Zacks #2 Ranked company, has an Earnings ESP of +1.18%.

Kimberly-Clark Corporation KMB has an Earnings ESP of +0.10% and a Zacks Rank of 2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

To read this article on Zacks.com click here.