SBA Communications (SBAC) Beats on Q3 AFFO, Ups '21 Guidance

SBA Communications Corporation SBAC delivered solid third-quarter 2021 results, wherein the adjusted funds from operations (AFFO) and the top line increased year over year and surpassed the Zacks Consensus Estimate as well.

The AFFO per share of $2.71 for the third quarter topped the Zacks Consensus Estimate of $2.65. Further, the reported figure is 13.9% higher than the prior-year quarter’s $2.38.

Results highlight robust operating performance in both its site-leasing and development business. The company continues to benefit from the addition of sites to its portfolio. Moreover, cost-control measures and interest-rate savings encouraged the company to raise the full-year outlook.

Quarterly total revenues increased 12.7% year over year to $589.3 million and outpaced the consensus mark of $577.5 million.

In October, the company, through an existing trust, issued $1.79 billion of Tower Securities at an interest rate of 2.217%.

Quarter in Detail

The site-leasing revenues were up 10% year over year to $535.5 million. This consisted of domestic site-leasing revenues of $426.8 million and international site-leasing revenues of $108.7 million. The domestic cash site-leasing revenues came in at $415.4 million, while international cash site-leasing revenues were $109.8 million. The site-leasing operating profit summed $436.8 million, marking an increase of 10.9%, year over year.

The site-development revenues increased significantly to $53.8 million from the prior-year quarter’s $36.2 million.

The overall operating income improved to $211.8 million from the year-ago quarter’s $160.3 million.

The adjusted EBITDA totaled $407 million, up 9% year over year, while the adjusted EBITDA margin declined to 70.3% from the year-ago figure of 71.5%.

During the September-end quarter, the company acquired 144 communication sites for cash consideration of $57.1 million. It also built 87 towers during this period. The company owned or operated 34,072 communication sites as of Sep 30, 2021. Of these, 17,322 sites are located in the United States and its territories, and 16,750, internationally.

SBA Communications also spent $11.6 million to purchase land and easements, and extend lease terms. Total cash capital expenditure was $92.9 million in the reported quarter, of which $10 million was non-discretionary and $82.9 million represented discretionary.

Cash Flow & Liquidity

In the third quarter, SBA Communications generated $253 million of net cash from operations compared with the year-ago quarter’s $290.5 million.

As of Sep 30, 2021, it had $187.8 million in cash and cash equivalents, with $11.7 billion of net debt.

Further, it paid out a cash dividend of $63.6 million in third-quarter 2021.

Outlook

SBA Communications has hiked the guidance for 2021 and expects AFFO per share of $10.55-$10.76 for the year. The Zacks Consensus Estimate for the same is pegged at $10.61.

The site-leasing revenues are projected at $2,095-$2,105 million, and the site-development revenues are expected to lie between $195 million and $205 million. Moreover, the adjusted EBITDA is predicted to lie between $1,599 million and $1,609 million.

Dividend Update

On Nov 1, SBA Communications announced a quarterly cash dividend of 58 cents on its Class A common stock. The dividend will be paid out on Dec 16 to shareholders of record as of the close of business on Nov 18, 2021.

SBA Communications currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

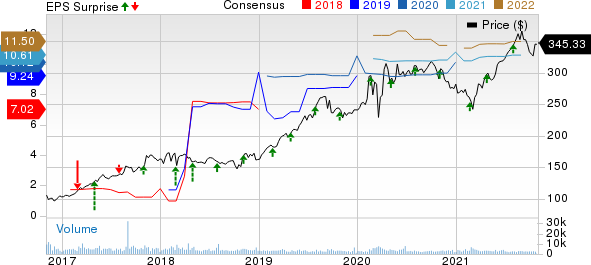

SBA Communications Corporation Price, Consensus and EPS Surprise

SBA Communications Corporation price-consensus-eps-surprise-chart | SBA Communications Corporation Quote

We now look forward to the earnings releases of other REITs like Apple Hospitality REIT, Inc. APLE, CubeSmart CUBE and Sunstone Hotel Investors, Inc. SHO scheduled for Nov 4.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

Sunstone Hotel Investors, Inc. (SHO) : Free Stock Analysis Report

CubeSmart (CUBE) : Free Stock Analysis Report

Apple Hospitality REIT, Inc. (APLE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research