SBA Communications (SBAC) Q2 FFO & Revenues Top, '22 View Up

SBA Communications Corporation’s SBAC second-quarter 2022 adjusted funds from operations (AFFO) per share of $3.07 outpaced the Zacks Consensus Estimate of $2.75. This reflects a rise of 16.3% from the prior-year quarter’s $2.64.

SBAC’s witnessed a robust operating performance in site-leasing and development businesses, both on the domestic and international front. It continues to benefit from the addition of sites to its portfolio. It also raised its 2022 outlook.

Quarterly total revenues increased 13.3% year over year to $652 million, outpacing the Zacks Consensus Estimate of $625.5 million.

Per Jeffrey Stoops, president and CEO of the company, “Wireless carrier activity was, and remains, robust across most of our markets. We achieved another record for US services revenue in the quarter.”

Subsequent to the quarter end, SBAC purchased or is under contract to buy around 200 communication sites for a total cash consideration of $85 million. It is also under contract to acquire roughly 2,600 sites from Grupo TorreSur in Brazil for $725 million. Both these purchases are expected to be completed in the fourth quarter of 2022.

Quarter in Detail

Site-leasing revenues were up 10.7% year over year to $580.2 million, beating our expectation of $576.2 million. This consisted of domestic site-leasing revenues of $442.1 million and international site-leasing revenues of $138.1 million. The domestic cash site-leasing revenues were $431.8 million, growing 5.8% year over year. International cash site leasing revenues were $138.6 million, rising 30.4%.

Site-development revenues increased 39.5% year over year to $71.8 million, surpassing our estimate of $55.8 million.

The site-leasing operating profit summed $468.7 million, marking a year-over-year increase of 9.3%. Our projection for the same was pegged at $462.1 million. Moreover, 96.4% of SBAC’s total operating profit in the quarter came from site leasing.

The overall operating income rose 15.6% from the prior-year quarter to $230.9 million.

The adjusted EBITDA totaled $437.8 million, up 9.4% year over year, while the adjusted EBITDA margin declined to 68.2% from 70.7%.

Portfolio Activity

In the June quarter, SBAC acquired 210 communication sites and one data center in Brazil for total cash consideration of $127.3 million. It also built 100 towers during this period. The company owned or operated 36,297 communication sites as of Jun 30, 2022, of which 17,395 were in the United States and its territories and 18,902 internationally.

SBA Communications also spent $9.9 million to purchase land and easements and extend lease terms. Total cash capital expenditure was $191.4 million in the reported quarter, of which $11.7 million was non-discretionary and $179.7 million represented discretionary.

Cash Flow & Liquidity

In the second quarter, SBA Communications generated $372.1 million of net cash from operating activities compared with the year-ago quarter’s $352.8 million.

As of Jun 30, 2022, it had $183.1 million in cash and cash equivalents, down from $263.6 million recorded at the end of the March quarter. SBAC ended the quarter with net debt-to-annualized adjusted EBITDA of 7.0X, down from 7.3X as of Mar 31, 2022.

As of Aug 1, 2022, the company had $480 million outstanding under the $1.5 billion revolving credit facility.

During the second quarter of 2022, SBAC did not repurchase any shares of its Class A common stock. As of Aug 1, 2022, it had $504.7 million of authorization remaining under its approved repurchase plan.

Raised 2022 Outlook

SBA Communications raised its guidance for 2022.

It expects AFFO per share of $11.87-$12.24, up from prior guidance of $11.72-$12.09. The Zacks Consensus Estimate for the same is pegged at $11.98.

Site-leasing revenues are projected at $2,297-$2,317 million, while site-development revenues are expected to lie between $260 million and $280 million. The adjusted EBITDA is estimated to be in the band of $1,731-$1,751 million.

Dividend Update

Concurrently, SBA Communications announced a quarterly cash dividend of 71 cents on its Class A common stock. The dividend will be paid out on Sep 20 to shareholders on record as of the close of business on Aug 25, 2022.

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

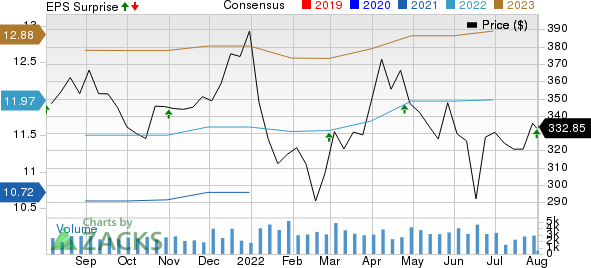

SBA Communications Corporation Price, Consensus and EPS Surprise

SBA Communications Corporation price-consensus-eps-surprise-chart | SBA Communications Corporation Quote

Performance of Other REITs

Kimco Realty Corp.’s KIM second-quarter 2022 FFO per diluted share came in at 40 cents, surpassing the Zacks Consensus Estimate of 38 cents. The figure grew 17.6% from the year-ago quarter’s 34 cents.

Results reflect year-over-year growth in the top line. The rise in occupancy levels and rental rate growth aided KIM’s performance. It raised 2022 FFO outlook.

Boston Properties Inc.’s BXP second-quarter 2022 FFO per share of $1.94 beat the Zacks Consensus Estimate of $1.85. The figure also compared favorably with the year-ago quarter’s $1.72.

BXP’s quarterly results reflect growth in the bottom line. Also, it experienced strong leasing activity during the quarter.

SITE Centers Corp. SITC reported second-quarter 2022 operating FFO per share of 31 cents, beating the Zacks Consensus Estimate of 28 cents. The figure was in line with the prior-year quarter’s FFO per share.

SITC’s results were aided by strong top-line growth and an improvement in annualized base rent.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Properties, Inc. (BXP) : Free Stock Analysis Report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

SITE CENTERS CORP. (SITC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research