ScanSource (SCSC) Q3 Earnings & Sales Beat Estimates, View Up

ScanSource, Inc. SCSC reported third-quarter fiscal 2022 (ended Mar 31, 2022) adjusted earnings of $1.04 per share, beating the Zacks Consensus Estimate of 69 cents. The bottom line increased 46.5% from the prior-year quarter’s earnings of 71 cents, courtesy of strong demand.

On a reported basis, the company delivered earnings of 91 cents per share compared with the prior-year quarter’s 54 cents per share.

The company reported net sales of $846 million in the reported quarter, up 16% from the year-ago quarter’s levels. The upside was driven by strong demand. The top line surpassed the Zacks Consensus Estimate of $759 million. Excluding foreign exchange impact, net sales were around $502 million in the quarter under review.

Net sales in the United States and Canada were up 15% to $765 million and international sales increased 27% to $81 million.

Specialty Technology Solutions’ revenues increased 15.3% to $503 million in third-quarter fiscal 2022, courtesy of broad-based growth across technologies.

Sales at Modern Communications & Cloud were $343 million in the reported quarter, up 17% year over year. Intelisys connectivity and cloud business net sales increased 18.2% year over year.

ScanSource, Inc. Price, Consensus and EPS Surprise

ScanSource, Inc. price-consensus-eps-surprise-chart | ScanSource, Inc. Quote

Operational Update

Cost of sales amounted to $739 million in the fiscal third quarter, up 15% from the year-ago quarter’ levels. The gross profit totaled $106.5 million, up 21% from the year-ago quarter’s $88.1 million. The gross margin came in at 12.6% during the reported quarter compared with the prior-year quarter’s 12.1%.

Selling, general and administrative expenses rose 11% year over year to $66.5 million. The adjusted operating profit was $37.4 million compared with the prior-year quarter’s $25.1 million. The adjusted operating margin was 4.4% compared with the prior-year quarter’s 3.5%. Adjusted EBITDA climbed 38% year over year to $44 million, owing to higher gross profits and operating leverage.

Financial Condition

The company reported cash and cash equivalents of $44 million as of Mar 31, 2022, compared with $63 million as of Jun 30, 2021. The company utilized $46 million of cash in operating activities in the first nine months period ended on Mar 31, 2022, compared with an inflow of $55 million in the prior-year comparable period. The company’s total debt was $138 million at the end of the third quarter of fiscal 2022, down from $143 million at the end of the fiscal 2021.

Outlook

Backed by strong demand from channel partners across its technologies, ScanSource raised its guidance for fiscal 2022. The company now expects net sales growth of at least 10%, up from its previous expectation of 7%. Adjusted EBITDA is projected to be at least $165 million, higher than the $148 million expected earlier.

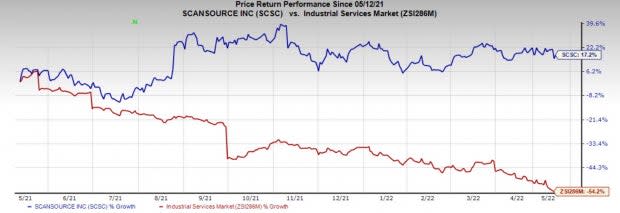

Share Price Performance

ScanSource's shares have gained 17.2% in the past year against the industry’s decline of 54.2%.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

ScanSource currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are Packaging Corporation of America PKG, Graphic Packaging Holding Company GPK and Alcoa AA. While PKG and GPK flaunt a Zacks Rank #1 (Strong Buy), AA carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Packaging Corporation has an expected earnings growth rate of 16.2% for 2022. The Zacks Consensus Estimate for the current year’s earnings has moved up 4.2% in the past 60 days.

PKG has a trailing four-quarter earnings surprise of 19.6%, on average. Packaging Corporation’s shares have gained 4% in the past year.

Graphic Packaging has an estimated earnings growth rate of 86.8% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 7.6%.

Graphic Packaging pulled off a trailing four-quarter earnings surprise of 7.2%, on average. The company’s shares have appreciated 14.8% in a year.

Alcoa has a projected earnings growth rate of 107% for the current year. The Zacks Consensus Estimate for 2022 earnings has moved north by 76% in the past 60 days.

Alcoa delivered a trailing four-quarter earnings surprise of 17.4%, on average. Alcoa’s shares have gained 32% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alcoa (AA) : Free Stock Analysis Report

Packaging Corporation of America (PKG) : Free Stock Analysis Report

ScanSource, Inc. (SCSC) : Free Stock Analysis Report

Graphic Packaging Holding Company (GPK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research