Schneider (SNDR) Gains Nearly 4% Since Q2 Earnings Release

Shares of Schneider National SNDR have gained 3.9% since its second-quarter 2021 earnings release on Jul 29, following its better-than-expected performance as well as raised 2021 earnings guidance.

The company’s earnings of 60 cents per share beat the Zacks Consensus Estimate of 42 cents. The bottom line surged more than 100% from the year-ago period (which bore the brunt of coronavirus-led woes).

Operating revenues of $1,360.8 million surpassed the Zacks Consensus Estimate of $1,213 million and also climbed nearly 32% year over year. Revenues (excluding fuel surcharge) increased 30% to $1,250.6 million. Results benefited from higher revenues across all segments.

Income from operations (adjusted) skyrocketed 98% from the prior-year quarter’s level to $125.8 million. Adjusted operating ratio (operating expenses as a percentage of revenues) improved 350 basis points to 89.9%. Notably, lower the value of the ratio, the better.

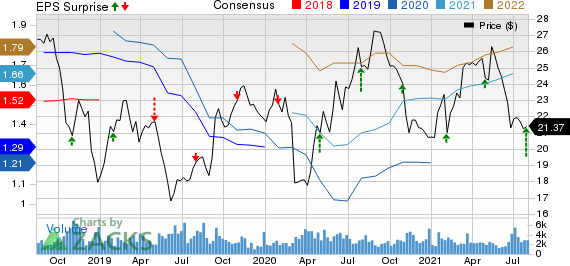

Schneider National, Inc. Price, Consensus and EPS Surprise

Schneider National, Inc. price-consensus-eps-surprise-chart | Schneider National, Inc. Quote

Segmental Highlights

Truckload revenues (excluding fuel surcharge) increased 5% year over year to $475.2 million, primarily due to effective yield management. Average trucks (company trucks and owner-operated trucks) in the segment fell 9.3% year over year to 9,287. Revenue per truck per week in the segment increased 16% to $3,985 million. Truckload income from operations was $73.6 million in the reported quarter, up 82% year over year. Operating ratio improved to 84.5% in the second quarter from 91% in the year-ago period.

Intermodal revenues (excluding fuel surcharge) were $274 million, up 25% year over year owing to yield management and increased volumes, mainly in the Eastern rail network. Revenue per order increased 12%. Segmental income from operations surged more than 200% to $34.9 million. Intermodal operating ratio improved to 87.3% in the quarter under review from 95% in the second quarter of 2020.

Logistics revenues (excluding fuel surcharge) surged 87% to $430.7 million, driven by favorable constructive market conditions, among other factors. Logistics income from operations soared more than 100% year over year to $17 million due to rise in net revenue per order and higher volumes. Operating ratio in the segment improved to 96.1% from 96.4% in second-quarter 2020.

Liquidity

Schneider, sporting a Zacks Rank #1 (Strong Buy), exited the second quarter with cash and cash equivalents of $490.5 million compared with $395.5 million at the end of 2020. You can see the complete list of today’s Zacks #1 Rank stocks here.

2021 Outlook

Schneider anticipates improved demand environment to sustain through the remainder of the year. Following strong second-quarter results and expectations of favorable market conditions, the company has raised its adjusted earnings per share guidance for 2021 to $1.85-$1.95 compared with $1.60-$1.70 expected previously. The Zacks Consensus Estimate for the same stands at $1.75. Due to expectations of supply chain delays and higher equipment sales proceeds, the company has revised its net capital expenditure guidance for 2021 to $325-$350 million, from $375-$425 million estimated previously.

Sectorial Snapshot

Let’s take a look at some of the other recently released earnings reports from companies within the Zacks Transportation sector:

Knight-Swift Transportation Holdings KNX, carrying a Zacks Rank #2 (Buy), reported second-quarter 2021 earnings (excluding 6 cents from non-recurring items) of 98 cents per share, surpassing the Zacks Consensus Estimate of 87 cents. Total revenues of $1,315.7 million also outperformed the Zacks Consensus Estimate of $1,300.8 million.

United Parcel Service UPS, carrying a Zacks Rank #3 (Hold), reported second-quarter 2021 earnings (excluding a penny from non-recurring items) of $3.06 per share, beating the Zacks Consensus Estimate of $2.75. Quarterly revenues of $23,424 million also outperformed the Zacks Consensus Estimate of $23,085.4 million.

Ryanair Holdings RYAAY, carrying a Zacks Rank #4 (Sell), incurred a loss of $1.46 per share in the first quarter of fiscal 2022 (ended Jun 30, 2021), narrower than the Zacks Consensus Estimate of a loss of $1.50. Quarterly revenues of $446.4 million fell short of the Zacks Consensus Estimate of $459 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

KnightSwift Transportation Holdings Inc. (KNX) : Free Stock Analysis Report

Schneider National, Inc. (SNDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research