Schneider (SNDR) Q4 Earnings & Revenues Beat Estimates, Rise Y/Y

Schneider National Inc.’s SNDR fourth-quarter 2020 earnings (excluding a penny from non-recurring items) of 44 cents per share beat the Zacks Consensus Estimate of 39 cents. The bottom line also increased 18.9% year over year due to higher revenues.

Operating revenues of $1,265.2 million surpassed the Zacks Consensus Estimate of $1,193.8 million and also climbed 9.4% year over year. Moreover, revenues (excluding fuel surcharge) jumped 15% to $1,191.6 million. Results benefited from higher intermodal and logistics revenues.

Income from operations (adjusted) ascended 16% from the prior-year quarter’s level to $106.3 million. Also, adjusted operating ratio (operating expenses as a percentage of revenues) improved 10 basis points to 91.1%. Notably, lower the value of the ratio, the better.

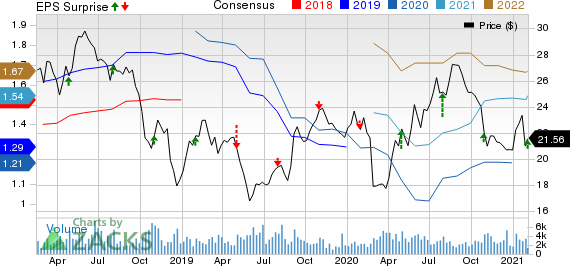

Schneider National, Inc. Price, Consensus and EPS Surprise

Schneider National, Inc. price-consensus-eps-surprise-chart | Schneider National, Inc. Quote

Segmental Highlights

Truckload revenues (excluding fuel surcharge) slipped 5% to $470.3 million due to low network capacity. Average trucks (company trucks and owner-operated trucks) in the segment also fell 5.7% to 9,764. Revenue per truck per week in the segment increased marginally. Truckload income from operations was $65.1 million in the reported quarter, indicating a rise of 61% from the year-ago period. Moreover, operating ratio improved to 86.2% from 91.8% in the year-ago quarter.

Intermodal revenues (excluding fuel surcharge) were $269.3 million, up 3% year over year. Revenue per order dipped marginally due to shorter length of haul Eastern freight. Segmental income from operations plunged 23% to $24.7 million primarily due to rail operating issues. Additionally, intermodal operating ratio deteriorated to 90.8% in the fourth quarter from 87.7% in the year-ago quarter.

Logistics revenues (excluding fuel surcharge) surged 64% to $374.4 million primarily due to expanded brokerage volumes and increase in revenue per order. Logistics income from operations soared more than 100% on a year-on-year basis. Further, operating ratio in the segment improved to 94.2% from 96.5% in the fourth quarter of 2019.

Liquidity

Schneider, carrying a Zacks Rank #3 (Hold), exited the fourth quarter with cash and cash equivalents of $395.5 million compared with $551.6 million at the end of 2019.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Outlook

For 2021, Schneider anticipates adjusted earnings per share to be between $1.45 and $1.60. The mid-point of the guided range is in line with the Zacks Consensus Estimate of $1.53. Additionally, the company estimates net capital expenditures of approximately $425 million for the year.

Sectorial Snapshot

Let’s take a look at some of the other recently released earnings reports from companies within the Zacks Transportation sector.

United Airlines UAL, carrying a Zacks Rank #3, incurred a loss (excluding 6 cents from non-recurring items) of $7 per share in the fourth quarter of 2020, wider than the Zacks Consensus Estimate of a loss of $6.56. Meanwhile, operating revenues of $3,412 million lagged the Zacks Consensus Estimate of $3,420.4 million.

J.B. Hunt Transport Services JBHT, carrying a Zacks Rank #3, reported earnings of $1.44 per share, beating the Zacks Consensus Estimate of $1.27. Total operating revenues of $2,737.7 million also surpassed the Zacks Consensus Estimate of $2,514.3 million.

Delta Air Lines DAL, carrying a Zacks Rank #3, incurred a loss (excluding $1.34 from non-recurring items) of $2.53 per share in the fourth quarter of 2020, wider than the Zacks Consensus Estimate of a loss of $2.43. Total revenues of $3,973 million topped the Zacks Consensus Estimate of $3,754.5 million.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research