Schneider (SNDR) Stock Up 1.1% on Q2 Earnings Beat

Schneider National, Inc. SNDR stock has gained 1.1% since its second-quarter 2022 earnings release on Jul 28. The uptick can be attributed to better-than-expected earnings and revenue performance.

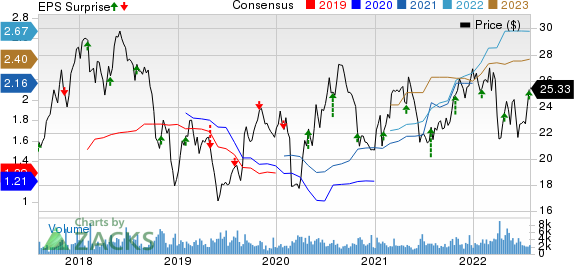

Quarterly earnings of 72 cents per share beat the Zacks Consensus Estimate of 68 cents. The bottom line surged 20% from the year-ago quarter’s levels.

Operating revenues of $1,746.9 million surpassed the Zacks Consensus Estimate of $1,668.8 million and rallied 28.4% year over year as economic activities gained pace. Revenues (excluding fuel surcharge) increased 20% to $1,497.9 million.

Income from operations (adjusted) surged 39% from the prior-year quarter’s level to $174.8 million. Adjusted operating ratio (operating expenses as a percentage of revenues) improved 160 basis points to 88.3%.

Schneider National, Inc. Price, Consensus and EPS Surprise

Schneider National, Inc. price-consensus-eps-surprise-chart | Schneider National, Inc. Quote

Segmental Highlights

Truckload revenues (excluding fuel surcharge) increased 20% year over year to $571.6 million, owing to Midwest Logistics Systems revenues, effective yield management, and dedicated new business growth. Average trucks (company trucks and owner-operated trucks) in the segment rose 12.6% year over year to 10,466. Revenues per truck per week in the segment increased 6% to $4,242 million. Truckload income from operations was $80.7 million in the reported quarter, up 10% year over year. The operating ratio improved to 85.9% in the second quarter from 84.5% in the year-ago period.

Intermodal revenues (excluding fuel surcharge) were $335.1 million, up 22% year over year, owing to revenue per order and volume growth. Segmental income from operations surged 21% to $42.3 million, primarily driven by favorable revenue management actions. The intermodal operating ratio improved to 87.4% in the quarter under review from 87.3% in second-quarter 2021.

Logistics revenues (excluding fuel surcharge) surged 21% to $521.3 million, driven by increased revenue per order, higher volumes within the company’s brokerage offering, including increased contribution from the Power Only service offering, and incremental port dray revenues. Logistics income from operations surged 178% year over year to $47.3 million. The operating ratio in the segment came in at 90.9% from 96.1% in second-quarter 2021.

Liquidity

Schneider exited the second quarter with cash and cash equivalents of $331 million compared with $272.6 million at the end of March 2022. Long-term debt was $209.8 million at the end of second quarter compared with $209.9 million at the end of March 2022

2022 Outlook

Schneider now anticipates 2022 adjusted earnings per share in the range of $2.60-$2.70 (previous view: $2.55-$2.70). The company continues to expect net capital expenditures to be approximately $500 million.

Currently, Schneider carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Transportation Companies

Delta AirLines’ DAL second-quarter 2022 earnings (excluding 29 cents from non-recurring items) of $1.44 per share fell short of the Zacks Consensus Estimate of $1.71. Escalated operating expenses induced the earnings miss. Multiple flight cancellations in May and June also hurt results. The earnings miss disappointed investors, resulting in the stock shedding value in early trading. In the year-ago quarter, Delta incurred a loss of $1.07 per share when air-travel demand was not as buoyant as in the current scenario.

DAL’s revenues came in at $13,824 million, which not only beat the Zacks Consensus Estimate of $13,608.9 million and soared 94% from the year-ago quarter’s figure as air-travel demand rebounded from the pandemic lows. The uptick in air-travel demand in the United States can be gauged from the fact that 75.9% of second-quarter 2022 passenger revenues came from the domestic markets.

J.B. Hunt Transport Services, Inc. JBHT reported better-than-expected second-quarter 2022 results, wherein both earnings and revenues outperformed the Zacks Consensus Estimate.

JBHT’squarterly earnings of $2.42 per share surpassed the Zacks Consensus Estimate of $1.61 and improved 50.3% year over year.

JBHT’stotal operating revenues of $3,837.53 million also outperformed the Zacks Consensus Estimate of $2,908.37 million. The top line jumped 32% year over year on the back of strength across all segments. JBHT’s total operating revenues, excluding fuel surcharges, rose 21.2% year over year.

CSX Corporation (CSX) reported better-than-expected second-quarter 2022 results, wherein both earnings and revenues outperformed the Zacks Consensus Estimate.

CSX’s quarterly earnings of 50 cents per share (excluding 4 cents from non-recurring items) beat the Zacks Consensus Estimate of 47 cents and improved 25% year over year.

CSX’s total revenues of $3,815 million outperformed the Zacks Consensus Estimate of $2,990 million. The top line increased 28% year over year on the back of higher revenues in almost all markets, driven by pricing gains, fuel surcharge, and contribution from the acquisition of Quality Carriers. CSX’s overall revenues per unit increased 27%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CSX Corporation (CSX) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Schneider National, Inc. (SNDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research