Schnitzer Steel (SCHN) Earnings and Revenues Down Y/Y in Q2

Schnitzer Steel Industries, Inc. SCHN logged earnings from continuing operations of 14 cents per share in the second quarter of fiscal 2023 (ended Feb 28, 2023), declining from $1.27 per share in the year-ago quarter.

Adjusted earnings for the quarter were 14 cents per share. It was down from $1.38 per share in the year-ago quarter.

The company recorded revenues of $756 million, down around 3% year over year.

Schnitzer Steel saw a significant improvement in performance in the fiscal second quarter on a sequential comparison basis on higher demand for recycled metals and increased ferrous and nonferrous average net selling prices.

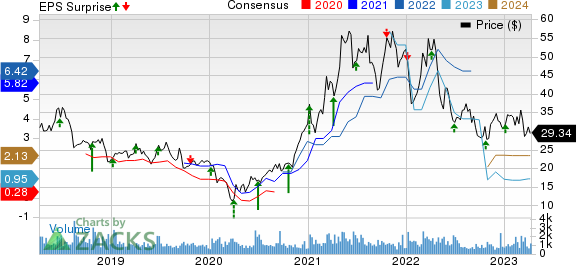

Schnitzer Steel Industries, Inc. Price, Consensus and EPS Surprise

Schnitzer Steel Industries, Inc. price-consensus-eps-surprise-chart | Schnitzer Steel Industries, Inc. Quote

Volumes and Pricing

Ferrous sales volumes increased 18% year over year in the reported quarter to 1,263,000 long tons. Volumes also rose 48% on a sequential comparison basis, supported by a drawdown of inventories and the resumption of full operations at the Everett and Oakland facilities in mid-November.

Average net ferrous sales prices in the second quarter went down around 17% year over year to $367 per long ton. It, however, rose 8% sequentially.

Finished steel sales volumes were 109,000 short tons in the quarter, up around 3% year over year. Volumes, however, fell around 7% sequentially due to seasonality and weaker demand for wire rod products.

Finished steel average net sales price was $943 per long ton, down around 10% year over year. It also fell around 7% sequentially.

Financials

The company ended the quarter with cash and cash equivalents of roughly $11.5 million, down around 74% year over year. Long-term debt was around $303.6 million, up around 25% year over year.

The company generated operating cash flow of $88 million in the quarter.

Outlook

Schnitzer Steel said that it sees results to improve further in the fiscal third quarter driven by an expansion of metal margins as it realizes the benefit of shipments contracted at increased prices and as supply flows improve seasonally. SCHN also believes that the structural demand for recycled metals remains favorable, aided by the transition to low carbon technologies, increased focus on decarbonization and the expected funding associated with the Infrastructure Investment and Jobs Act and the Inflation Reduction Act.

Price Performance

SCHN’s shares are down 42.6% over a year compared with a 4.2% decline recorded by the industry.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Schnitzer Steel currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, Olympic Steel, Inc. ZEUS and Linde plc LIN.

Steel Dynamics currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for STLD's current-year earnings has been revised 32.8% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 11.3%, on average. STLD has gained around 24% in a year.

Olympic Steel currently sports a Zacks Rank #1. The Zacks Consensus Estimate for ZEUS's current-year earnings has been revised 33.1% upward in the past 60 days.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 26.2%, on average. ZEUS has rallied around 30% in a year.

Linde currently carries a Zacks Rank #2. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 2.5% upward in the past 60 days.

Linde beat Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 5.9% on average. LIN’s shares have gained roughly 12% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Schnitzer Steel Industries, Inc. (SCHN) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report