Science Applications (SAIC) Beats on Q1 Earnings & Revenues

Science Applications SAIC reported first-quarter fiscal 2022 results, with earnings and revenues topping the Zacks Consensus Estimate. The company also recorded year-over-year growth in both metrics, mainly benefiting from higher demand for its technology solutions owing to the ongoing digital transformation wave across industries.

The company’s fiscal first-quarter adjusted earnings increased 41% year over year to $1.94 per share and surpassed the Zacks Consensus Estimate by 30.2%.

Quarterly revenues increased 7% from the year-ago quarter’s level to $1.72 billion, outpacing the consensus mark of $1.79 billion. Revenues realized from the acquisition of Unisys Federal drove the top line. Solid performance of the company’s contract portfolio was a tailwind. Adjusting for the impact of acquired revenues, the metric moved up 2.6%.

Science Applications also announced its intent to acquire health IT company, Halfaker and Associates, to expand its presence in public sector health.

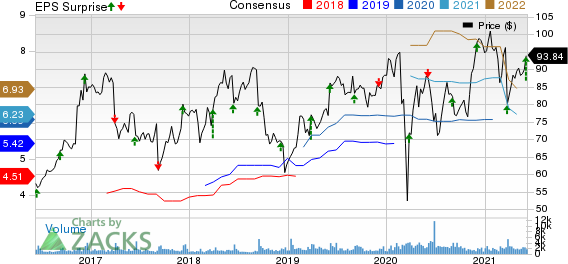

Science Applications International Corporation Price, Consensus and EPS Surprise

Science Applications International Corporation price-consensus-eps-surprise-chart | Science Applications International Corporation Quote

Quarter in Detail

Net bookings for fiscal first quarter were $4.2 billion, reflecting a book-to-bill ratio of 2.2. Science Applications’ estimated backlog of signed business deals was $24 billion, of which $3.3 billion was funded.

Non-GAAP operating income rallied 32% year over year to $140 million, primarily driven by Unisys Federals’ acquisition along with lower integration and indirect costs. Moreover, non-GAAP operating margin expanded 150 basis points (bps) to 7.5%.

Adjusted EBITDA increased 34% year over year to $184 million. Moreover, adjusted EBITDA margin expanded 200 bps to 9.8%.

Balance Sheet & Cash Flow

Science Applications ended the fiscal first quarter with cash and cash equivalents of $261 million, up from the prior quarter’s level of $171 million.

The quarterly cash flow from operating activities was $189 million, 49% lower year over year.

Excluding the MARPA facility, free cash flow was $164 million in the said quarter.

During the reported quarter, Science Applications deployed $71 million of capital, which includes $22 million for dividend payments, $23 million for mandatory debt repayment and $39 million for planned share repurchases.

Guidance

Science Applications updated its fiscal 2022 guidance. The company anticipates revenues between $7.15 billion and $7.30 billion, up from the previous guidance of $7.1-$7.3 billion. The top-line guidance indicates a negative impact of $150 million on the supply chain portfolio, stemming from the coronavirus pandemic.

It expects adjusted earnings in the $6.15-$6.40 per share range, up from the previous range of $6-$6.25 per share.

Free cash flow is expected between $430 million and $470 million for fiscal 2022.

Zacks Rank & Stocks to Consider

Science Applications currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector include Silicon Motion Technology Corporation SIMO, Lam Research Corporation LRCX and LG Display Co., Ltd. LPL, all sporting a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Silicon Motion Technology Corporation, Lam Research and LG Display is currently pegged at 8%, 32.8% and 32.56%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

LG Display Co., Ltd. (LPL) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

Science Applications International Corporation (SAIC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research