Sea Ltd's (NYSE:SE) Valuation looks Reasonable Despite the Share Price rallying over 600% in the last 18 months

This article originally appeared on Simply Wall St News.

Sea Ltd's ( NYSE:SE ) share price is back at all time highs ahead of the company's second quarter results which are due next week. The stock price is up 650% since March 2020 and some 2,000% in the last 3 years. When a stock experiences such a big rally, there's always a risk that it has become overvalued. It’s even more important to look at the valuation when a company isn’t profitable, as is the case with Sea.

Sea Ltd is based in Singapore, and operates an online gaming platform, e-commerce sites, and a fintech platform. The company has experienced phenomenal growth in the last few years, with revenue growing nearly 20 fold since 2015.

See our latest analysis for Sea

What is Sea worth?

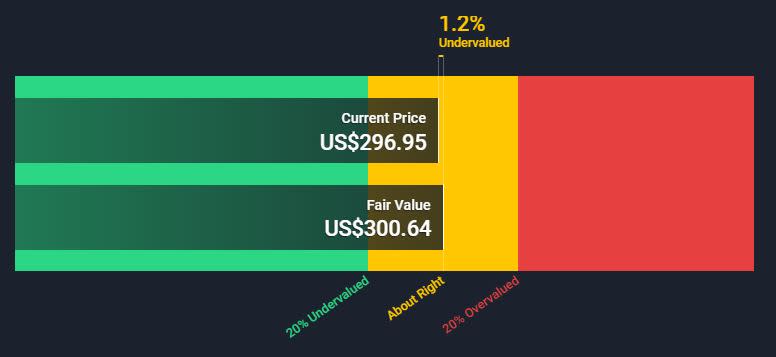

When we estimate Sea’s fair value using analyst estimates for revenue and earnings, we come to a value of $300.71 a share. The current price of $296.95 implies a 1.2% discount which suggests the stock is trading at a reasonable valuation. Ideally, investors would like to buy growth stocks like Sea at a wider discount which would offer a 'margin of safety' and more potential upside.

What does the future look like for Sea?

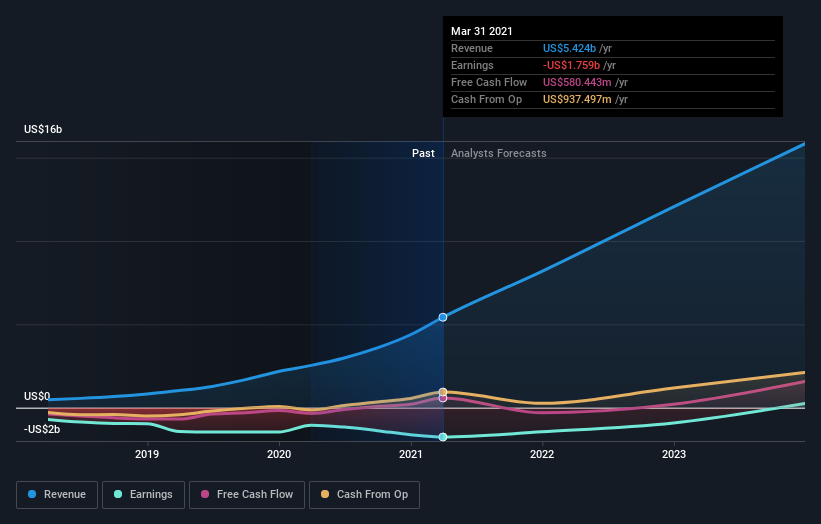

As you can see from the chart below, revenue growth has actually accelerated in the last few years. Over the last five years, revenue growth has averaged 73% a year, but over the last 24 months it has accelerated to 130%. Having said that, there has been some volatility from one quarter to the next, so we shouldn’t expect the trajectory to continue each and every quarter.

Looking to the future, analysts are expecting top line growth of 87% this year, 47% in 2022 and 31% in 2023. Those estimates appear quite conservative compared to historical rates of growth. In the 12 months to March, Sea’s net income loss was $1.7 billion on revenue of $5.4 billion - so the profit margin is currently minus 32%, although the company is already generating free cash flow. The profit margin is expected to improve steadily until the company breaks even in 2023, which should be achievable if expenses rise at a slower rate than revenue.

What this means for you:

Sea Ltd is growing rapidly, yet doesn't appear overvalued at the current price. However, this is a high beta stock which means we should expect periods of volatility, and these periods may offer an entry point with a wider discount to fair value.

Sea will be reporting second quarter results on 16 August and analysts are expecting a loss per share of 53 cents, compared to a loss a year ago of 68 cents. Revenue for the quarter is expected to be about $1.94 billion, up 50% from a year ago.

The company has historically beaten revenue estimates in most quarters and missed EPS estimates in most quarters, so it won’t be surprising to see this repeated. Nevertheless, another miss on the bottom line might create some volatility and a better entry point.

The results will also allow analsysts to update their forecasts which may affect the valuation. If our estimated intrinsic value changes it will be reflected here .

If you want to dive deeper into Sea, you'd also look into what risks it is currently facing. Every company has risks, and we've spotted 2 warning signs for Sea you should know about.

If you are no longer interested in Sea, you can use our free platform to see our list of over 50 other stocks with a high growth potential

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com