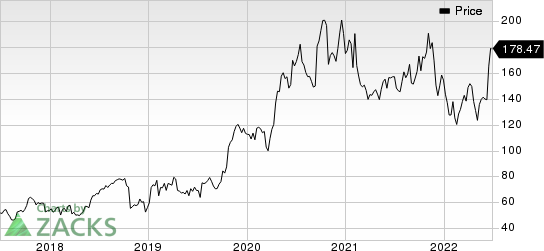

Seagen (SGEN) Up More Than 20% in Past 3 Months: Here's Why

Shares of Seagen Inc. SGEN have rallied 26.1% in the past three months against the industry’s decrease of 10.9%.

Image Source: Zacks Investment Research

The company has made steady progress with its portfolio of marketed drugs — Adcetris, Padcev, Tukysa and the newly approved Tivdak — targeting different types of cancer indications.

All these drugs have witnessed strong uptake so far, with Adcetris being the majority contributor to Seagen’s top line. The drug has been approved by the FDA for six cancer indications.

Several label expansion studies on Adcetris, Padcev, Tukysa and Tivdak are currently underway, wherein a potential approval is likely to drive sales further in 2022 and beyond.

Earlier this month, shares of Seagen rose after rumors of a potential acquisition by pharma giant Merck & Co., Inc. MRK did the rounds in the market.

Per a Wall Street Journal article, talks between the two companies have been underway for some time. However, a deal is not looking imminent at the moment due to the heightened risk of a regulatory challenge.

Both Seagen and Merck are yet to confirm the validity of the news through a formal statement.

Seagen has a collaboration deal with Merck, wherein the latter is co-funding the Tukysa global development plan. Padcev, in combination with Merck’s Keytruda, is being investigated in phase III studies for treating muscle-invasive bladder cancer.

In May 2022, Seagen’s current chief executive officer (“CEO”), president and member of its board of directors, Dr. Clay Siegall, resigned from all of his positions. Earlier, the company had announced that Dr.Siegall was on a leave of absence after he was allegedly arrested for an incident of domestic violence.

Roger Dansey, who currently serves as the chief medical officer, has been appointed as the interim CEO for Seagen, while Dr. Felix J. Baker has been appointed chair of the board of directors. Seagen is currently searching for a new and permanent CEO. Shares of the company were up on this news.

Although Seagen is riding high on the success of its portfolio of marketed drugs, it remains to be seen whether the company is able to continue its impressive growth trajectory and drive revenues further in future years. Stiff competition in the target market also remains a concern.

Seagen Inc. Price

Seagen Inc. price | Seagen Inc. Quote

Zacks Rank & Stocks to Consider

Seagen currently carries a Zacks Rank #2 (Buy). Other stocks worth considering in the biotech sector are Leap Therapeutics, Inc. LPTX and Precision BioSciences, Inc. DTIL, both carrying the same Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Precision BioSciences’ loss per share estimates narrowed 26.2% for 2022 and 42.6% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Seagen Inc. (SGEN) : Free Stock Analysis Report

Leap Therapeutics, Inc. (LPTX) : Free Stock Analysis Report

Precision BioSciences, Inc. (DTIL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research