Some Seamless Green China (Holdings) (HKG:8150) Shareholders Have Taken A Painful 83% Share Price Drop

It is doubtless a positive to see that the Seamless Green China (Holdings) Limited (HKG:8150) share price has gained some 115% in the last three months. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Indeed, the share price is down a whopping 83% in that time. The recent bounce might mean the long decline is over, but we are not confident. The million dollar question is whether the company can justify a long term recovery.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Seamless Green China (Holdings)

Because Seamless Green China (Holdings) is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

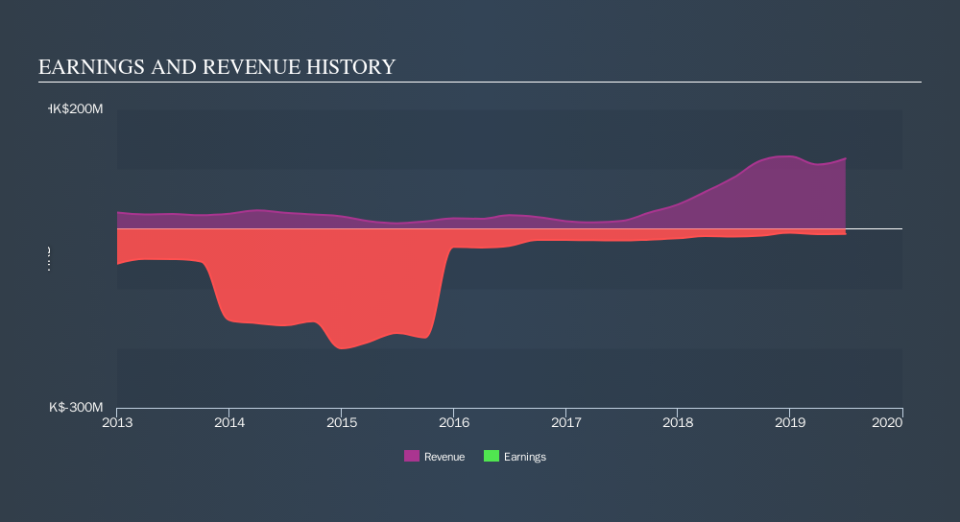

In the last half decade, Seamless Green China (Holdings) saw its revenue increase by 48% per year. That's better than most loss-making companies. So it's not at all clear to us why the share price sunk 30% throughout that time. You'd have to assume the market is worried that profits won't come soon enough. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We're pleased to report that Seamless Green China (Holdings) shareholders have received a total shareholder return of 12% over one year. Notably the five-year annualised TSR loss of 30% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course Seamless Green China (Holdings) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.