Seattle Genetics' Cancer Study Boosts Prospects, Takeover Appeal

Seattle Genetics Inc. (NASDAQ:SGEN) CEO Clay Siegall called new data from the study of the company's breast cancer drug "stunning." Based on the fresh information, Needham analyst Chad Messer raised his target price on Seattle Genetics by $9 to $130, according to an article in The Fly.

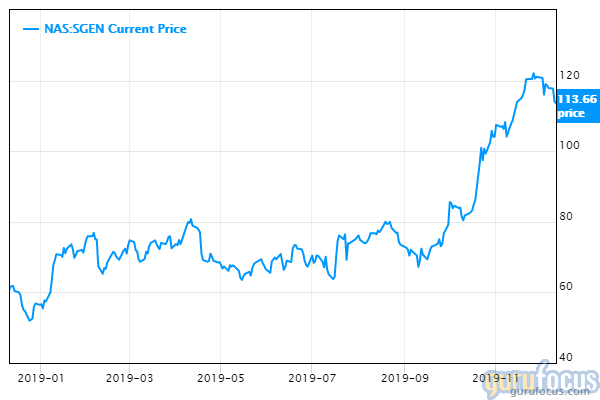

Messner's expectations are in line with the 16 analysts offering 12-month price forecasts for the biotech company. They have a median target of $120, with a high estimate of $140 and a low estimate of $87. Seattle Genetics, currently trading at just over $112, is rated a buy.

The release of full data from the phase 3 study of Seattle Genetics' drug tucatinib in advanced metastatic breast cancer reinforced optimism about the company's prospects. The pivotal trial indicated the drug reduced the risk of progression and death in patients with and without cancer that has spread to the brain. About 10% to 15% of women with stage-four breast cancer develop brain metastases, according to Breastcancer.org.

The risk of cancer spreading to the brain is usually highest for women with more aggressive subtypes of breast cancer, such as HER2-positive or triple-negative.

The women in the Seattle Genetics study had locally advanced or metastatic HER2-positive breast cancer and had, on average, received four types of prior therapy. About half the patients had brain metastases; they were no longer responding to any of Roche's (XSWX:ROG) three HER2 drugs.

Siegall said the results of the tucatinib study were unique because no other drugs have shown to be effective in treating breast cancer patients with pre-existing brain metastases, according to an article in FierceBiotech. Puma Biotechnology (NASDAQ:PBYI) has a drug that works in brain cancer, but patients have difficulty tolerating it, which doesn't seem to be the case with tucatinib.

Seattle Genetics plans to file for approval in the U.S. and Europe in the first quarter of 2020, though it is trying to pull that date forward and permit patients to access the drug while it is awaiting a regulatory decision. Geek Wire reported that SVB Leerink analyst Andy Berens thinks tucatinib could bring in $420 million in annual sales.

Given the study results and projected revenue, it looks as though Seattle Genetics' decision to buy Cascadian Therapeutics and its crown jewel tucatinib for $600 million last year was a good one. The deal allowed also allowed the company to expand its focus beyond antibody-drug conjugates.

Perhaps the success of the tucatinib and Seattle Genomics' cancer pipeline will make it an even more attractive takeover target. Earlier this year, Genetic Engineering & Biotechnology News reported that Jefferies' Michael Yee included Seattle Genetics on his short list of companies ripe for buyout. Shortly afterward, Dale Ratner Hershman, who is also known as "The Sick Economist," said Seattle Genetics' "robust cancer pipeline and rapidly growing revenue" would make it a nice fit for rumored suitor AbbVie (NYSE:ABBV).

Disclosure: The author holds no positions in any of the companies mentioned in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.