'Secular stagnation' is no longer the dominant investor outlook

Investors’ outlooks for the economy have taken a notably optimistic turn.

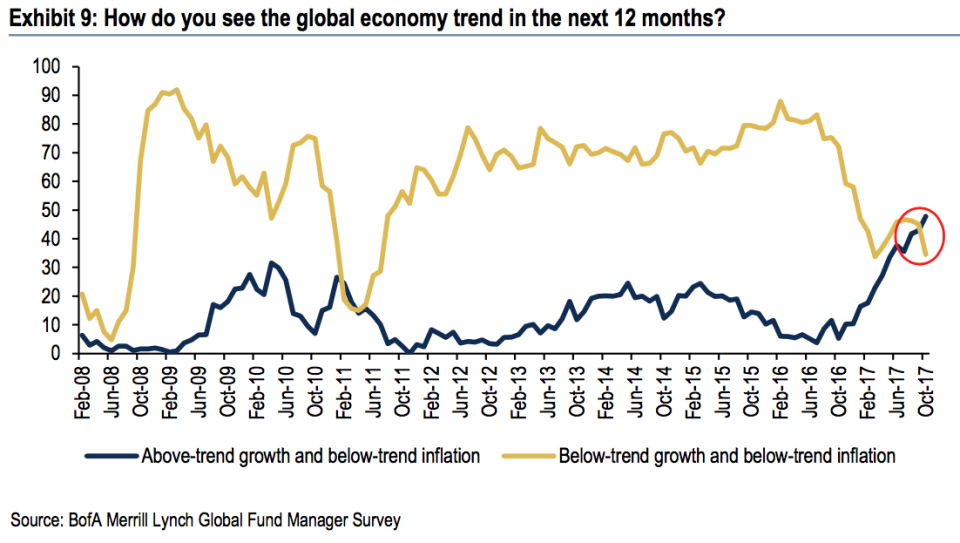

According to a new survey from Bank of America Merrill Lynch, 48% of fund managers expect the economy to exhibit Goldilocks-like characteristics: above-trend growth and below-trend inflation. Meanwhile, 34% of fund managers expect the economy to reflect secular stagnation: below-trend growth and below-trend inflation.

“‘Goldilocks’ beats ‘secular stagnation’ for the first time in six years,” said Bank of America Merrill Lynch analyst Michael Hartnett.

The severity of the global financial crisis and the damage left in its wake had economists thinking that the world economy had changed in a bad way. Specifically, trauma from the recession, an intense aversion to risk, and the desire to cut back debt in the face of tighter financial conditions meant that we could look forward to a long period of low growth and high unemployment.

Back in May of 2009, Mohamed El-Erian coined “new normal” to characterize what was happening. “Global growth will be subdued for a while and unemployment will remain high. A heavy hand of government will be evident in several sectors. The banking system will be a shadow of its former self,” El-Erian wrote while co-CIO at PIMCO. “The core of the global system will be less cohesive and, with the magnet of the Anglo-Saxon model in retreat, finance will no longer be accorded a preeminent role in post-industrial economies. Moreover, the balance of risk will tilt over time toward higher sovereign risk, growing inflationary expectations and stagflation.”

In November of 2013, Larry Summers warned of “secular stagnation,” emphasizing the limitations of monetary policy when interest rates are at or near zero. He said: “We may well need, in the years ahead, to think about how we manage an economy in which the zero nominal interest rate is a chronic and systemic inhibitor of economic activity holding our economies back below their potential.”

That professional investors now see a world with brighter prospects is yet more evidence that the financial crisis is indeed over.

The world is growing again

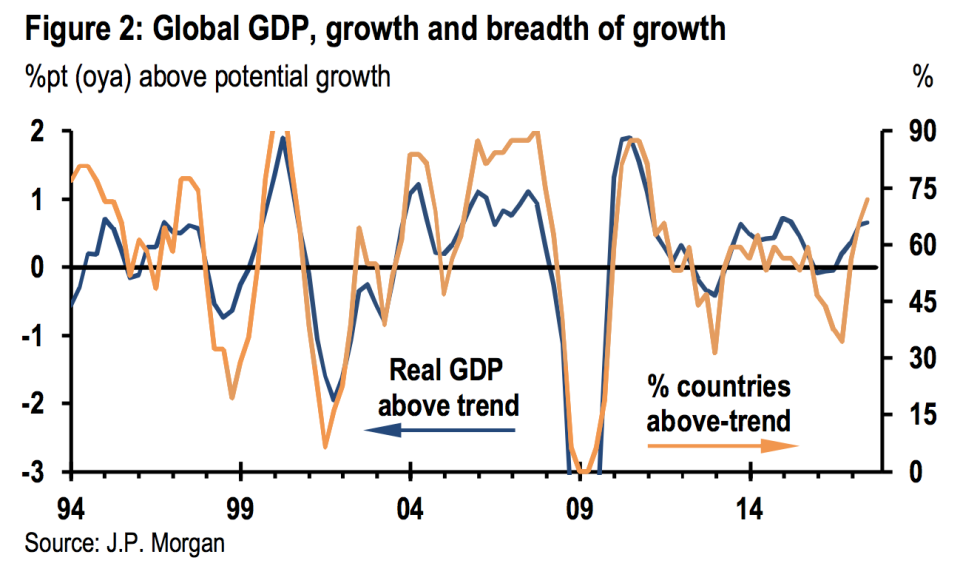

Notably, it’s not just the soft survey day that has turned. The hard economic data is confirming that the world economy is growing at a healthy clip.

“The rebound in aggregate growth is clear, with global GDP expanding over the year at a pace on par with the strongest in over six years,” JPMorgan economist Joseph Lupton observed. “Less clear but no less important, however, is the fact that the breadth of the rebound is every bit as impressive.”

According to Lupton, 75% of 24 countries tracked by JPMorgan have been experiencing “above trend growth” in 2017 so far. These include economies across both the developed as well as emerging markets.

Meanwhile, unemployment is low, stock prices are at record levels, home prices have recovered all of their losses, and central banks unwind crisis-era policy stimulus.

–

Sam Ro is managing editor at Yahoo Finance.

Read more: