Selling US$19m worth of stock earlier this year was a lucrative decision for ServiceNow, Inc. (NYSE:NOW) insiders

ServiceNow, Inc.'s (NYSE:NOW) stock rose 8.2% last week, but insiders who sold US$19m worth of stock over the last year are probably in a more advantageous position. Selling at an average price of US$517, which is higher than the current price might have been the right call as holding on to stock would have meant their investment would be worth less now than it was at the time of sale.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

See our latest analysis for ServiceNow

ServiceNow Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Chief Operating Officer, Chirantan Desai, for US$3.3m worth of shares, at about US$479 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. The good news is that this large sale was at well above current price of US$421. So it may not shed much light on insider confidence at current levels.

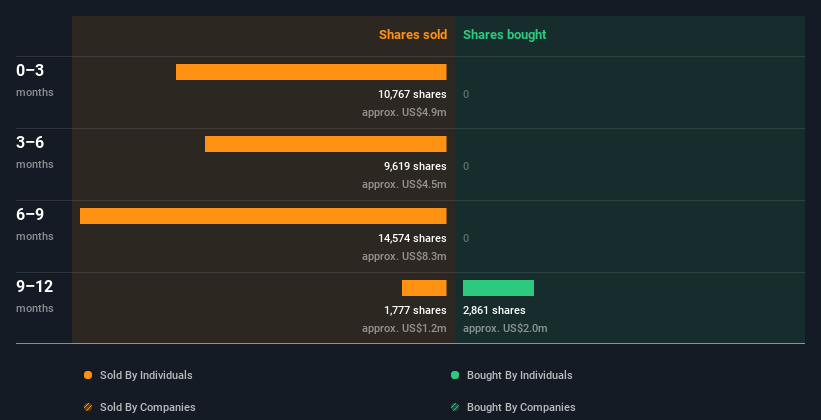

Over the last year we saw more insider selling of ServiceNow shares, than buying. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

I will like ServiceNow better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insiders At ServiceNow Have Sold Stock Recently

The last three months saw significant insider selling at ServiceNow. In total, insiders sold US$4.8m worth of shares in that time, and we didn't record any purchases whatsoever. In light of this it's hard to argue that all the insiders think that the shares are a bargain.

Insider Ownership Of ServiceNow

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. ServiceNow insiders own about US$205m worth of shares (which is 0.2% of the company). Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Does This Data Suggest About ServiceNow Insiders?

Insiders sold stock recently, but they haven't been buying. And our longer term analysis of insider transactions didn't bring confidence, either. But since ServiceNow is profitable and growing, we're not too worried by this. It is good to see high insider ownership, but the insider selling leaves us cautious. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. In terms of investment risks, we've identified 1 warning sign with ServiceNow and understanding it should be part of your investment process.

Of course ServiceNow may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here