Semiconductor Stock Could Bounce Towards Fresh Record

Chip name Micron Technology, Inc. (NASDAQ:MU) was last seen down 2.4% to trade at $87.84, after the company said Covid-19 shutdowns in China could lead to production delays, and noted that government restrictions "may be increasingly difficult to mitigate.” The equity is fresh off a Jan. 5, record high of $98.45, though, adding 29.3% in the last three months. Another reason why investors may not want to look away just yet is that MU is flashing a historically bullish signal, which could push it to fresh all-time highs.

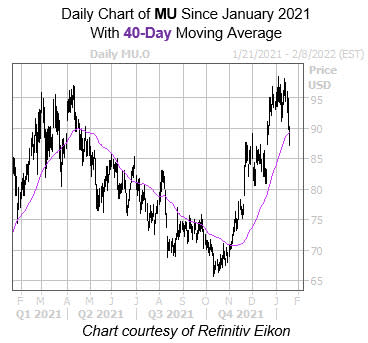

More specifically, Micron Technology stock's dip has put it within one standard deviation of its 40-day moving average, which has helped MU surge higher in the past. According to a study conducted by Schaeffer's Senior Quantitative Analyst Rocky White, the stock has seen seven similar signals in the last three years. One month after each signal, the security was higher 86% of the time, averaging a 13.3% return in that period. From its current perch, a move of the same magnitude would put MU at a fresh record of $100.61.

An unwinding of pessimism in the options pits could push MU even higher. This is per the stock's Schaeffer's put/call open interest ratio (SOIR) of 1.16, which sits in the 93rd percentile of its annual range. This indicates near-term put open interest outweighs call open interest by a wider-than-usual margin right now.