SenSen Networks (ASX:SNS) Has Debt But No Earnings; Should You Worry?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, SenSen Networks Limited (ASX:SNS) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for SenSen Networks

How Much Debt Does SenSen Networks Carry?

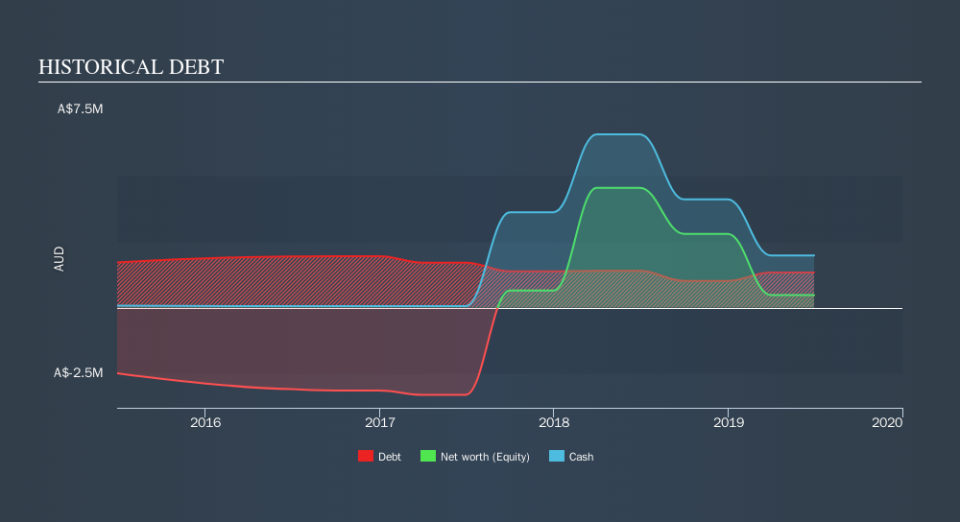

As you can see below, SenSen Networks had AU$1.32m of debt at June 2019, down from AU$1.39m a year prior. But it also has AU$1.97m in cash to offset that, meaning it has AU$647.5k net cash.

A Look At SenSen Networks's Liabilities

According to the balance sheet data, SenSen Networks had liabilities of AU$3.11m due within 12 months, but no longer term liabilities. Offsetting this, it had AU$1.97m in cash and AU$970.7k in receivables that were due within 12 months. So its liabilities total AU$171.5k more than the combination of its cash and short-term receivables.

This state of affairs indicates that SenSen Networks's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the AU$42.2m company is short on cash, but still worth keeping an eye on the balance sheet. While it does have liabilities worth noting, SenSen Networks also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is SenSen Networks's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year SenSen Networks had negative earnings before interest and tax, and actually shrunk its revenue by 8.0%, to AU$3.7m. That's not what we would hope to see.

So How Risky Is SenSen Networks?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year SenSen Networks had negative earnings before interest and tax (EBIT), truth be told. And over the same period it saw negative free cash outflow of AU$4.9m and booked a AU$5.3m accounting loss. With only AU$647.5k on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. For riskier companies like SenSen Networks I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.