Sentiment is Down, but Here is Why Johnson & Johnson (NYSE:JNJ) Seems to be Undervalued

This article was originally published on Simply Wall St News

Johnson & Johnson (NYSE:JNJ) received a lot of attention from a substantial price movement on the NYSE over the last few months. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether Johnson & Johnson's current trading price of US$166 reflective of the actual value of the large-cap?

One factor that we keep track of are the recent earnings releases, and how they fit into the bigger fundamental picture.

For Johnson and Johnson the third quarter 2021 results were:

Revenue: US$23.3b (up 11% from 3Q 2020).

Net income: US$3.67b (up 3.2% from 3Q 2020).

Profit margin: 16% (down from 17% in 3Q 2020). The decrease in margin was driven by higher expenses.

There were no large surprises for the stock, and we can continue our analysis by turning to the value of the cash flows which the company produces.

View our latest analysis for Johnson & Johnson

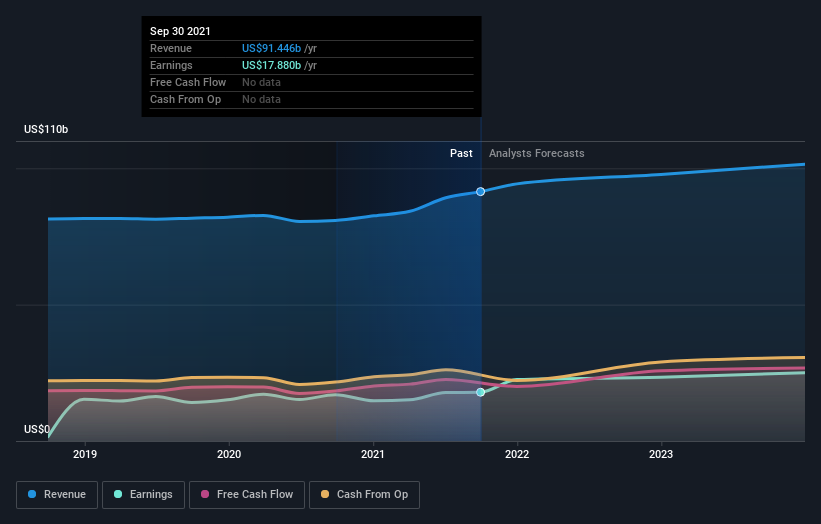

Over the last 3 years on average, earnings per share has increased by 17% per year, but the company’s share price has only increased by 6% per year, which means it is significantly lagging earnings growth.

In Q3, the largest segment changes were:

Over the Counter Medication, grew by 18%. Driven by pediatric fever incidences, as well as U.S. share gain across multiple brands. Outside the U.S. from Tylenol vaccine symptom relief usage (mostly in S. Korea)

Skin/Health Beauty declined by 3%

Oral Care declined by 4.5%

Baby Care declined by 1.2%

Women's Health growth 0.8%

Wound Care / Other, declined by 4.8%

Is Johnson & Johnson still cheap?

Johnson & Johnson is still trading at a fairly cheap price. The Simply Wall St valuation model shows that the intrinsic value for the stock is $251.94, which is above what the market is valuing the company at the moment.

What’s more interesting is that, Johnson & Johnson’s share price is theoretically quite stable, which could mean two things: firstly, it may take the share price a while to move to its intrinsic value, and secondly, there may be less chances to buy low in the future once it reaches that value. This is because the stock is less volatile than the wider market, given its low beta.

Can we expect growth from Johnson & Johnson?

With profit expected to grow by 51% over the next couple of years, the future seems bright for Johnson & Johnson. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation. The company is continually investing in CapEx and is focused on improving cash flows efficacy in the future.

The company is also producing more free cash flows than profits, which is a leading indicator that profits can increase in the future.

Key Takeaways

The company's product portfolio has mixed performance, and growth is partially driven by cyclical movements because of COVID-19. Management is placing high priority on investing in capital projects in the company and improving cash flows, which is expected to increase the future value of cash flows even in stable growth.

The company's cash flows seem to be undervalued, and investors might be able to take advantage of the recent market pessimism.

So while earnings quality is important, it's equally important to consider the risks facing Johnson & Johnson at this point in time. Case in point: We've spotted 1 warning sign for Johnson & Johnson you should be aware of.

If you are no longer interested in Johnson & Johnson, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com