September Insights Into Basic Materials Stocks: Cascades Inc (TSX:CAS)

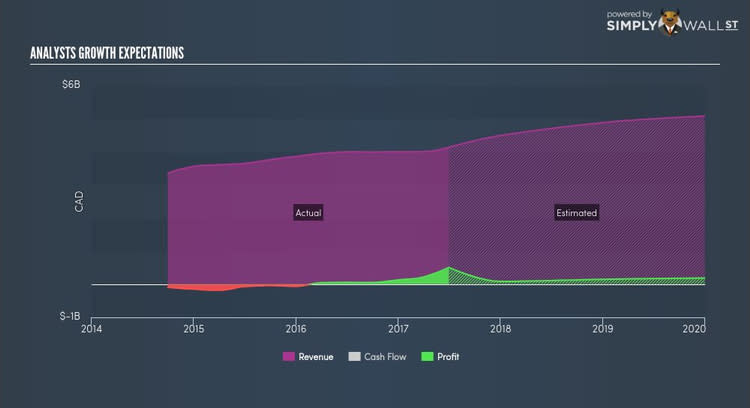

Cascades Inc (TSX:CAS), a CAD$1.56B small-cap, is a packaging company operating in an industry which supplies materials for construction. This means it is highly sensitive to changes in the economic cycle, a key driver of building activities. Moreover, the packaging industry can be affected by shifts in consumer spending and their exposure to fast moving consumer good (FMCG) producers. Basic material analysts are forecasting for the entire industry, a strong double-digit growth of 17 percent in the upcoming year, and a whopping growth of 32 percent over the next couple of years. This rate is larger than the growth rate of the Australian stock market as a whole. Should your portfolio be overweight in the packaging sector at the moment? Today, I will analyse the industry outlook, and also determine whether CAS is a laggard or leader relative to its basic materials sector peers. See our latest analysis for CAS

What’s the catalyst for CAS's sector growth?

Overall, the basic materials sector seems like it has reached maturity in its life cycle. Companies appear to be vastly competitive and consolidation seems to be a natural trend. There are plenty of emerging trends to deal with across the board including the reduction of waste, raw material inflation, and innovation in global supply chain management. Over the past year, the industry saw growth of 2 percent, though still underperforming the wider Australian stock market. CAS leads the pack with its impressive earnings growth of ver 100 percent last year. This proven growth may make CAS a more expensive stock relative to its peers.

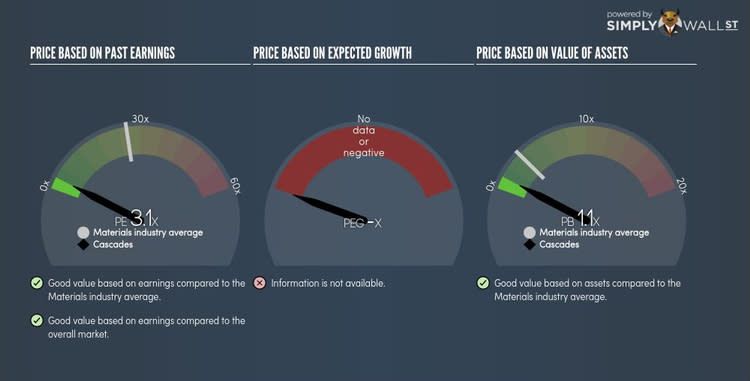

Is CAS and the sector relatively cheap?

The packaging industry is trading at a PE ratio of 21 times, in-line with the Australian stock market PE of 22 times. This illustrates a fairly valued sector relative to the rest of the market, indicating low mispricing opportunities. Furthermore, the industry returned a similar 15 percent on equities compared to the market’s 16 percent. On the stock-level, CAS is trading at a lower PE ratio of 3 times, making it cheaper than the average packaging stock. In terms of returns, CAS generated 39 percent in the past year, which is 24 percent over the packaging sector.

What this means for you:

Are you a shareholder? CAS recently delivered an industry-beating growth rate in earnings, which is a positive for shareholders. In addition to this, its PE is below its packaging peers, suggesting it is also trading at a relatively cheaper price. Perhaps the market isn’t as bullish of the growth going forward. If your investment thesis of the company hasn’t changed, now may be the right time to accumulate more of CAS, if you’re not already highly concentrated in the stock.

Are you a potential investor? If CAS has been on your watchlist for a while, now may be the best time to enter into the stock. Its industry-beating growth delivered have not been fully accounted for in its shares given its lower PE ratio relative to its peers. But before you make the decision to buy, I recommend you also look at other important fundamentals such as the health of the company, and see whether there is a significant reason why the stock may be trading at a discount in the packaging sector.

For a deeper dive into Cascades's stock, take a look at the company's latest free analysis report to find out more on its financial health and other fundamentals. Interested in other basic materials stocks instead? Use our free playform to see my list of over 2000 other basic materials companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.