Seth Klarman Dials Down Akebia Therapeutics Stake

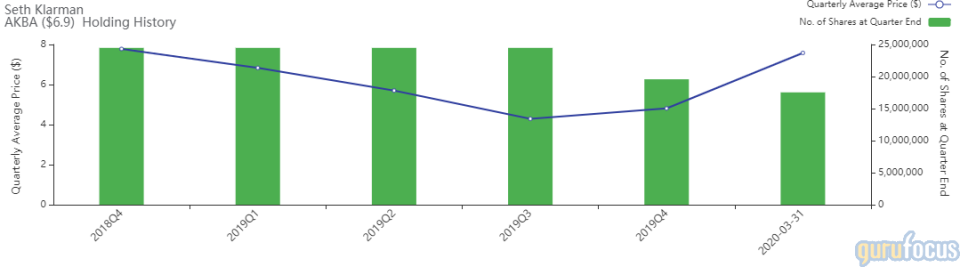

Baupost Group's Seth Klarman (Trades, Portfolio) revealed last week he curbed his stake in Akebia Therapeutics Inc. (NASDAQ:AKBA) by 10.44%.

The guru's Boston-based hedge fund manages about $24.7 billion in assets. It searches for value among a broad range of opportunities, including stocks, distressed debt, liquidations and foreign securities. With a long-term horizon, the renowned investor typically seeks securities trading well below his estimate of intrinsic value and waits for the price to rise.

According to GuruFocus Real-Time Picks, a Premium feature, Klarman sold 2.04 million shares of the Cambridge, Massachusetts-based biopharmaceutical company on March 31. He now holds 17.52 million shares of the company, which account for 1.55% of the equity portfolio. The stock traded for an average price of $7.58 per share.

GuruFocus data indicates Klarman's firm has lost an estimated 15.96% on the investment since the fourth quarter of 2018.

Akebia Therapeutics

Akebia, which focuses on developing therapeutics for people with kidney disease, has a $910.31 million market cap; its shares were trading around $7.17 on Tuesday with a price-book ratio of 2.12 and a price-sales ratio of 2.48.

The median price-sales chart shows the stock is trading above its median price-sales ratio as well as its price-book ratio, suggesting it is overvalued.

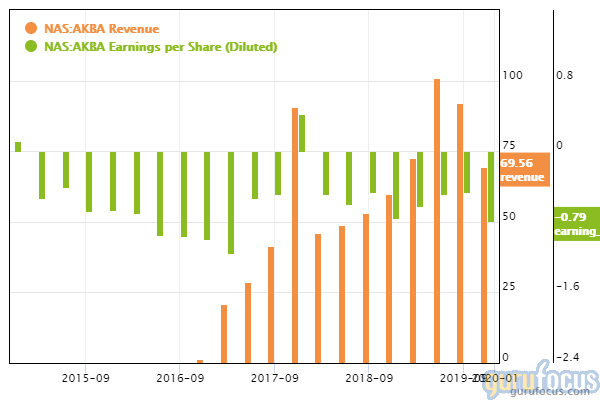

On March 10, the company reported its fourth-quarter and full-year 2019 earnings. For the quarter, it posted a net loss of 79 cents per share on $69.6 million in revenue.

For the full year, Akebia recorded a net loss of $2.36 per share on $335 million in revenue.

In a statement, CEO John P. Butler said 2019 was a year marked by "considerable progress" and that 2020 is "shaping up to be equally, if not more, exciting."

"Our highest priority remains the successful execution of our global Phase 3 program vadadustat, our investigational oral hypoxia-inducible factor prolyl hydroxylase inhibitor (HIF-PHI)," he added. "We have a tremendous amount of confidence in our vadadustat clinical program and believe we've developed an exciting path forward to drive significant value for all our stakeholders."

GuruFocus rated Akebia's financial strength 5 out of 10 on the back of a low Altman Z-Score of -0.64, which warns it could be in danger of going bankrupt, and a Sloan ratio that indicates it has poor earnings quality.

The company's profitability fared even worse, scoring a 1 out of 10 rating. In addition to negative margins and returns, Akebia is being weighed down by a low Piotroski F-Score of 2, which implies poor operating conditions, and revenue per share that has been declining over the past 12 months.

Despite the reduction, Klarman is still the company's largest guru shareholder with a 13.5% stake. David Abrams (Trades, Portfolio), Steven Cohen (Trades, Portfolio) and Jim Simons (Trades, Portfolio)' Renaissance Technologies also have positions in the stock.

Portfolio composition

Klarman's $8.6 billion equity portfolio, which was composed of 29 stocks as of Dec. 31, was most heavily invested in the communication services sector at 40.48%. He also had smaller holdings in the technology (18.27%) and health care (14.17%) spaces.

Other biotechnology companies he held at the end of fourth-quarter 2019 included Theravance Biopharma Inc. (NASDAQ:TBPH), Translate Bio Inc. (NASDAQ:TBIO) and Atara Biotherapeutics Inc. (NASDAQ:ATRA).

Disclosure: No positions.

Read more here:

Parnassus Endeavor Fund Adds 3 Stocks to Portfolio in 1st Quarter

4 Farm Products Companies to Consider Heading Into Easter Weekend

The Top 5 Buys of the Tweedy Browne Global Value Fund

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.