Seth Klarman's Top 4th-Quarter Trades

Seth Klarman (Trades, Portfolio) recently released the portfolio updates for The Baupost Group's fourth quarter of 2019.

Klarman is the portfolio manager of The Baupost Group, a hedge fund founded by Harvard Professor William Poorvu in 1982. Based in Boston, the long-only fund invests in a wide range of securities, from common stocks to liquidations and distressed debt. Klarman holds that a solid investing strategy should never ignore risks in the pursuit of absolute returns, which is one of the three pillars of his investing philosophy. The other two are to analyze losses before gains and to forget about macro conditions, focusing only on the investment idea.

As of the end of the quarter, Baupost's equity portfolio is valued at $8.6 billion.

Following the above criteria, Baupost established new positions in HP Inc. (NYSE:HPQ), Eldorado Resorts Inc. (NASDAQ:ERI) and McDermott International Inc. (MDRIQ) and sold out of Takeda Pharmaceutical Co. Ltd. (NYSE:TAK) during the quarter.

HP

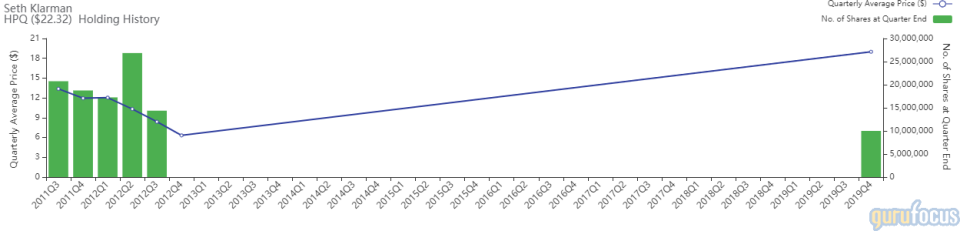

After selling out of Baupost's previous holding in the company in the third quarter of 2012, Klarman established a new position of 10,000,000 shares in HP, impacting the equity portfolio by 2.39%. Shares traded at an average price of $18.99 during the quarter.

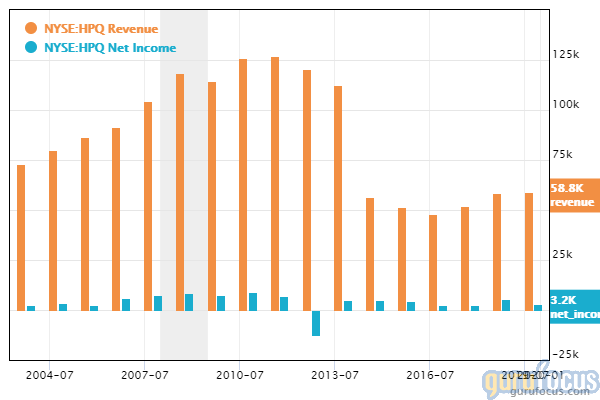

HP, or Hewlett-Packard, is a multinational information technology company based in Palo Alto, California. It mainly develops personal computers and printers (including 3-D printers). PCs account for approximately two-thirds of revenue, while printing accounts for the other third. However, printing is by far the more profitable of the company's two divisions, as it still brings in more net income ($777 million in the fourth quarter of 2019 compared to the PC division's $556 million).

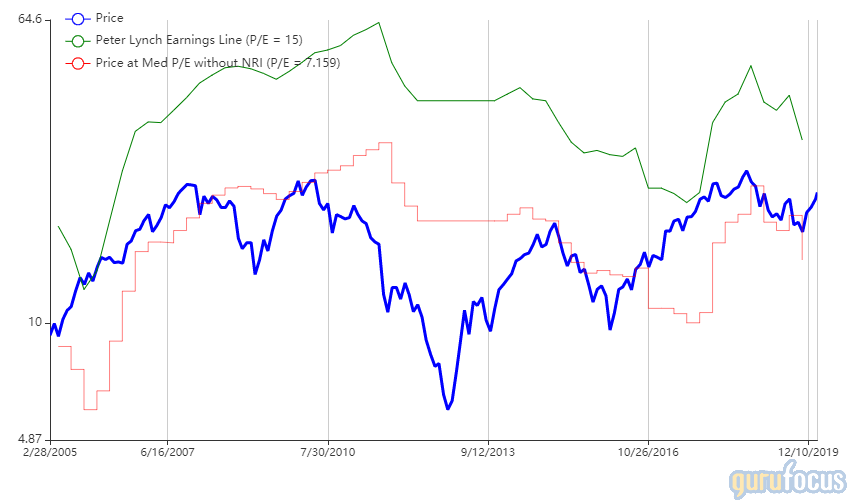

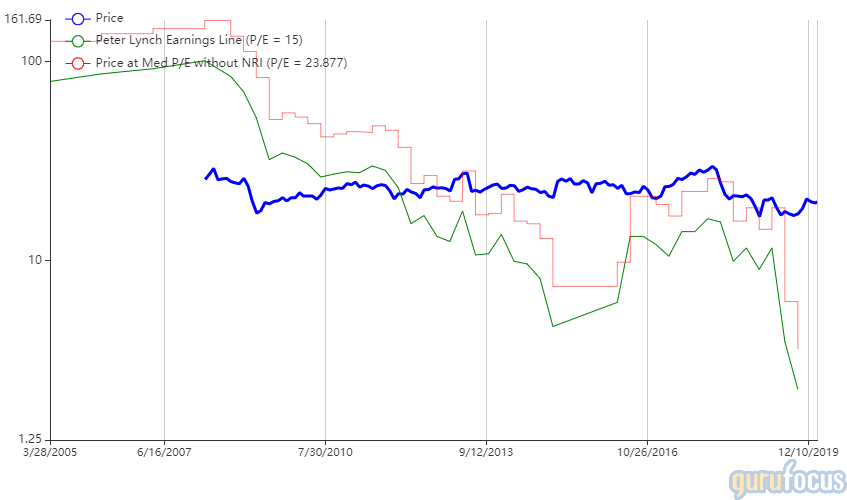

On Feb. 14, shares of HP traded around $22.34 apiece for a market cap of $32.46 billion and a price-earnings ratio of 10.85. According to the Peter Lynch chart, the stock is trading near its intrinsic value.

HP has a GuruFocus financial strength score of 6 out of 10 and a profitability score of 7 out of 10. The cash-to-debt ratio of 0.88 is average for the industry, but the negative shareholders' equity means that the company's liabilities are higher than the value of its total assets.

Sales suffered a two-fold blow when cloud computing made smartphones and tablets into common household items, reducing the demand for PCs and printers. However, Xerox's (XRX) recent bid to acquire HP suggests its rival may have a dominant position in the printing market. Over the past three years, HP has grown its revenue approximately 8.5% per year.

Eldorado Resorts

Klarman invested in 389,026 shares of Eldorado Resorts. The trade had a 0.27% impact on the equity portfolio. During the quarter, shares traded around $49.87 on average.

Eldorado Resorts is a hotel and casino company based in Reno, Nevada. Founded in 1973, the company owns and operates 26 properties in the U.S.

On Feb. 14, Eldorado shares traded around $68.05 for a market cap of $5.26 billion and a price-earnings ratio of 56.81. Over the past year, the stock price has gained 43.20%.

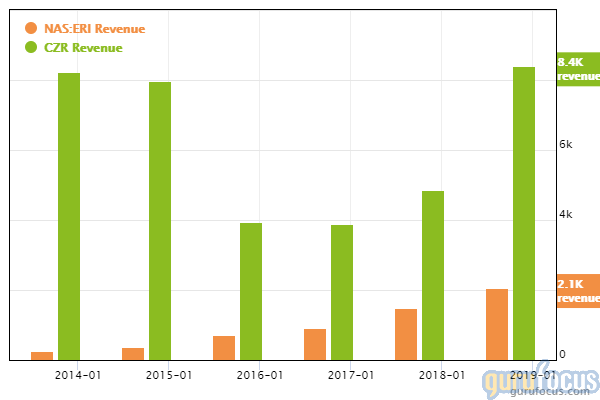

Eldorado has entered into a definitive agreement to acquire Caesars Entertainment Corp. (CZR) in a deal of approximately 77 billion shares and $7.2 billion in cash. The deal is set to close during the first quarter of 2020. The combined company will operate under the Caesars name, but will be headed by Eldorado's current leaders.

Takeda Pharmaceutical

Klarman sold out of the 9,434,803-share stake in Takeda Pharmaceutical, impacting the equity portfolio by -1.91%. Shares traded at an average price of $19.19 during the quarter.

Takeda is a Tokyo-based pharmaceutical and biopharmaceutical company. It is the largest pharmaceutical company in Japan, and its more well-known drugs in the U.S. include Prevacid (which treats heartburn) and Protonix (used to treat ulcers and other gastrointestinal disorders).

On Feb. 14, shares traded around $19.52 for a market cap of $60.78 billion and a price-earnings ratio of 17.06. According to the Peter Lynch chart, shares are trading above their intrinsic value.

GuruFucus has assigned the company a financial strength rating of 3 out of 10 and a profitability rating of 5 out of 10. Its interest coverage of 0.25 and Altman-Z score of 0.95 put it firmly in the danger zone. The operating margin of 1.01% is on the low side, and revenue has grown faster than net income over the past few years.

Takeda's poor financial strength rating comes largely from its $50 billion deal to acquire Shire PLC in January of 2019. In order to offset the financial strain of the acquisition, Takeda has been forced to sell a portfolio of medicines to Swiss drug company Acino (XSWX:ACIN).

Portfolio composition

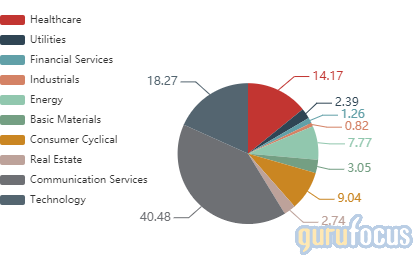

The Baupost Group's top holdings at the end of the quarter are Liberty Global PLC (LBTYK) with 13.27% of the equity portfolio, Fox Corp. (FOXA) with 11.77%, Viasat Inc. (VSAT) with 11.68%, eBay Inc. (EBAY) with 8.39% and ViacomCBS Inc. (VIAC) with 8.29%.

The equity portfolio is composed of 29 stocks (three of which are new buys for the quarter) at a turnover rate of 9%. In terms of sector weighting, the firm is mostly invested in communication services, technology and health care.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Daniel Loeb's Top Trades of the 4th Quarter

Ken Fisher's Top 4th-Quarter Buys

PepsiCo Posts 4th-Quarter Revenue Beat and Earnings Loss

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.