Shake Shack Calls Hot as Stock Breaks Out

One of the best stocks on the New York Stock Exchange (NYSE) this morning is Shake Shack Inc (NYSE:SHAK). SHAK is up 9.6% to trade at $70.16, on track for its best day since Aug. 6. Although the catalyst is unclear, Goldman Sachs did weigh in on the company's exclusive partnership with GrubHub (GRUB), predicting an 80% rally from its current levels. What is clear, though, is options traders are getting in on the action today.

Already, more than 58,000 calls have changed hands, 20 times the average intraday amount and already an annual high. The January 2020 70 call is the most popular, followed by the weekly 1/24 75-strike call. Options traders are buying to open both contracts, indicating they expect SHAK to hold onto its gains through the end of the this week and next, when the options expire, respectively.

The call buying trend is nothing new, though. The burger joint's 10-day call/put volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) comes in at 9.54, and ranks in the 94th annual percentile, showing strong demand for call buying in recent weeks.

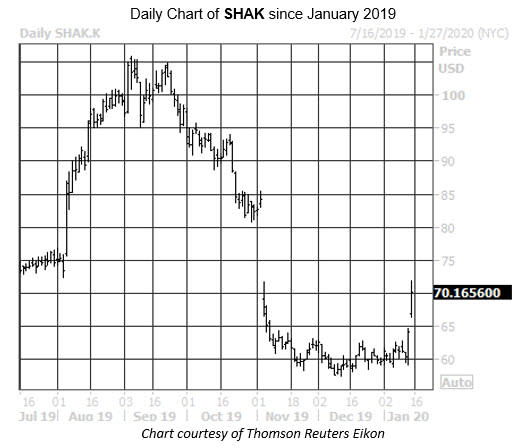

Shake Shack stock is trading at its highest point since an earnings-induced Nov. 5 bear gap. While the shares are up 44.2% year-over-year, they remain a long ways off their Sept. 5 record high of $105.84.

A short squeeze is in play to power additional gains, as bears continue to build their positions -- up 5.4% in the two most reporting periods. Short interest accounts for 16.4% of SHAK's total available float, and accounts for 3.5 times the average trading volume.

Even further, Shake Shack stock has been more volatile than expected during the past 12 months. This is based on its Schaeffer's Volatility Scorecard (SVS) of 87 (out of 100.)