Shake Shack (SHAK) Benefits From Robust Comps, Cost Woes Stay

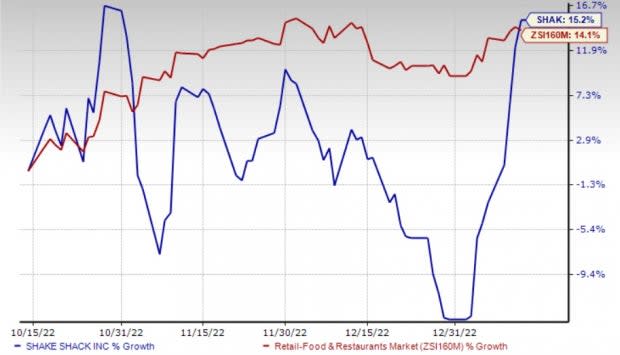

Shake Shack Inc. SHAK is benefiting from robust comps growth, expansion efforts and strong digital sales. Consequently, the company’s shares have gained 15.2% in the past three months, compared with the industry’s increase of 14.1%. However, inflationary pressure remains a concern.

Let’s delve deeper.

Growth Drivers

Recently, the company reported robust preliminary sales for the fourth quarter of fiscal 2022. Total revenues in fourth-quarter fiscal 2022 rose 17.3% year over year to $238.5 million. In third-quarter fiscal 2022, total revenues had increased 17.5% year over year.

Moreover, Shack sales jumped 17.4% year over year to $229.9 million in the quarter under review. In third-quarter fiscal 2022, Shack sales had risen 17.4% year over year.

Same-Shack sales rose 5.1% year over year in the fiscal fourth quarter. In third-quarter fiscal 2022, same-Shack sales had increased 6.3% year over year.

Shake Shack is committed to effectively strategizing its expansion plans. In 2021, the company opened 36 company-operated Shacks. The company anticipates increasing its store count to 35-40 Shacks within fiscal 2022.

The company also expects to open stores in Thailand and Malaysia (in 2023) through a new development agreement. During third-quarter fiscal 2022, the company opened 2 new domestic company-operated Shacks (in New York and Atlanta), 3 new domestic-licensed Shack (Chantilly, Cranbury and Nashville) and 3 new international-licensed Shacks (Chengdu, Shanghai and Seoul).

This Zacks Rank #3 (Hold) company operates more than 150 licensed restaurants. It is targeting to open 7-10 new licensed Shacks in fourth-quarter fiscal 2022, taking the count to 27- 30 licensed openings in fiscal 2022.

Since December, the company has opened 6 company-operated drive-thrus. By the end of 2022, the company is planning to open at least 10 drive-thrus and expects to open 10-15 more in 2023.

For 2023, the company anticipates opening approximately 40 domestic company-operated Shacks, calling for a 16% unit growth on a year-over-year basis.

Shake Shack has been investing in digital transformation which is crucial to the company’s growth. Digital sales continue to impress investors. During the fiscal third quarter, digital sales increased 1.9% year over year to $78.9 million and accounted for nearly 36% of Shack sales.

During the quarter, the company stated to have retained 73% of digital sales, despite solid recovery of in-shack business. The company has been making more investments in digitization in an effort to sustain its digital guest enhancement strategies in near term. The company’s digital retention continues to remain strong.

Image Source: Zacks Investment Research

Concerns

High costs continue to affect the company. During the fiscal third quarter, the company’s business was impacted by a rise expenses. During the quarter, food and paper costs increased 17.0% year over year to $67.8 million, while labor and related expenses increased 11.0% to $64.6 million. Total expenses (as a percentage of company revenues) increased 70 basis points year over year.

During the fiscal third quarter, the company emphasized on a bumpy supply chain and staffing environment. Staffing has been a major concern for the hospitality industry. In July 2021, the company made substantial investments in higher wages, retention bonuses and leadership development initiatives.

The company has been witnessing inflation throughout the supply chain. The company’s premium ingredients have witnessed a significant increase in a very short period. Higher expenses may weigh on margins in the near term.

Key Picks

Some better-ranked stocks in the Zacks Retail-Wholesale sector are Tecnoglass Inc. TGLS, Wingstop Inc. WING and Domino's Pizza, Inc. DPZ.

Tecnoglass currently carries a Zacks Rank #2 (Buy). TGLS has a trailing four-quarter earnings surprise of 26.9%, on average. Shares of the company have gained 35.2% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for TGLS’ 2023 sales and earnings per share (EPS) suggests growth of 11.2% and 9%, respectively, from the year-ago period’s reported levels.

Wingstop currently carries a Zacks Rank #2. WING has a long-term earnings growth rate of 12%. Shares of WING have lost 11.9% in the past year.

The Zacks Consensus Estimate for Wingstop’s 2023 sales and EPS suggests growth of 18.4% and 16.3%, respectively, from the year-ago period’s reported levels.

Domino's currently carries a Zacks Rank #2. DPZ has a long-term earnings growth rate of 12.6%. Shares of DPZ have declined 31.4% in the past year.

The Zacks Consensus Estimate for Domino's 2023 sales and EPS suggests growth of 3.8% and 17.2%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

Shake Shack, Inc. (SHAK) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report