Shake Shack (SHAK) Shares Surge on Q1 Earnings & Sales Beat

Shake Shack Inc. SHAK reported robust first-quarter 2018 results, wherein both earnings and sales surpassed the Zacks Consensus Estimate. The company’s earnings beat the consensus mark for the fifth straight quarter. Adjusted earnings of 13 cents per share beat the Zacks Consensus Estimate by 7 cents. Also, the bottom line rose 30% year over year, backed by an increase in revenues.

Revenues jumped 29.1% year over year to $99.1 million and outpaced the consensus mark of $96 million. Rise in Shack sales and licensing revenues drove this top-line improvement. The top line beat the estimate for the second consecutive quarter.

However, the big take away from the quarter was rise in comparable sales after witnessing a decline in the year-ago quarter. Following the quarterly numbers, shares of the company surged 10.6% during the after-hours trading session, yesterday. In fact, the stock has witnessed a sharp gain of 18.5% in the past three months, outperforming 0.9% growth recorded by the industry.

Top Line in Detail

Shack sales improved 29.6% year over year to $96.1 million, primarily owing to the opening of 24 new domestic company-operated Shacks and rise in same-Shack sales. Shake Shack’s cult following and successful expansion into various cities around the world boosted Shack sales, as well as traffic.

Licensing revenues for the quarter under review came in at $3 million, up 16.7% year over year, owing to opening of new licensed Shacks stores, and robust performance of Shacks in South Korea and Japan. The company continues to cash in on the diversification of its licensing business and the opportunity to reach places that it could not, domestically.

Same-Shack sales (or comps) rose 1.7% year over year. The figure compared unfavorably with the year-ago quarter’s 2.5% rise. The metric inched up 0.8% from the last reported quarter. For the reported period, comparable SHAK base, that includes restaurants open for 24 full fiscal months or longer, had 44 Shacks compared with 32 in the year-ago quarter.

Operating Performance

Shack-level operating profit (non-GAAP operating income) of $24 million was up 28.5% year over year. The metric margins as a percentage of Shack sales shrunk 20 bps to 25%, primarily due to increased labor and related expenses, certain fixed expenses and cost related with free burger promotion.

Adjusted EBITDA increased 32.8% to $16.2 million. However, as a percentage of total revenues, adjusted EBITDA margins increased roughly 40 bps to 16.3%, on a year-over-year basis.

General and administrative expenses were $11.8 million, up from $8.5 million a year ago. As a percentage of total revenues, general and administrative expenses were 11.9%, up 90 bps from the prior-year quarter. This upside primarily stemmed from increase in employee to support growth initiatives, technology improvement costs and expense related to the company’s new home office.

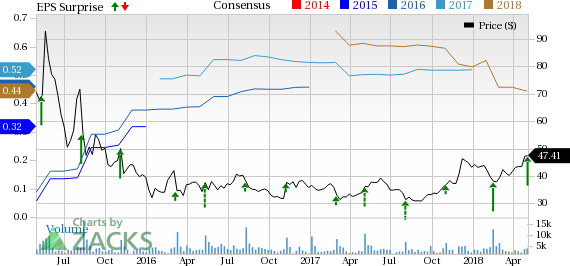

Shake Shack, Inc. Price, Consensus and EPS Surprise

Shake Shack, Inc. Price, Consensus and EPS Surprise | Shake Shack, Inc. Quote

2018 View

Following the better-than-expected results, the company raised its 2018 revenue view. The company now expects total revenues between $446 million and $450 million, up from the prior estimate of $444 million and $448 million. It projects Same-Shack sales to be flat to up 1% and licensing revenues in the band of $12-$ 13 million.

However, the company kept its operating margin and general and administrative expenses view intact. Shack-level operating profit margin is guided between 24.5% and 25.5%, while general and administrative expenses are anticipated between $49 million and $51 million, excluding roughly $4-$6 million of costs associated with Project Concrete.

The company continues to expect to launch 32-35 domestic company-operated Shacks and another 16-18 net licensed Shacks in 2018.

Zacks Rank & Peer Releases

Shake Shack carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Darden DRI reported mixed third-quarter fiscal 2018 results, wherein earnings surpassed the Zacks Consensus Estimate, while revenues lagged the same. Adjusted earnings of $1.71 per share increased 29.5% year over year on the back of higher revenues.

Restaurant Brands’ QSR first-quarter 2018 earnings and revenues surpassed the Zacks Consensus Estimate. Earnings under the previous accounting standard came in at 67 cents, improving 86.1% year over year.

Chipotle’s CMG first-quarter 2018 earnings surpassed analysts’ expectations, while revenues were in line with the same. Adjusted earnings of $2.13 grew 33.1% from the year-ago quarter, driven by higher revenues and lower food costs.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

Restaurant Brands International Inc. (QSR) : Free Stock Analysis Report

Shake Shack, Inc. (SHAK) : Free Stock Analysis Report

To read this article on Zacks.com click here.