Shareholders of Imagion Biosystems (ASX:IBX) Must Be Delighted With Their 430% Total Return

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. In the case of Imagion Biosystems Limited (ASX:IBX), the share price is up an incredible 400% in the last year alone. On top of that, the share price is up 128% in about a quarter. It is also impressive that the stock is up 140% over three years, adding to the sense that it is a real winner.

Check out our latest analysis for Imagion Biosystems

Imagion Biosystems isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Imagion Biosystems saw its revenue shrink by 1.3%. This is in stark contrast to the splendorous stock price, which has rocketed 400% since this time a year ago. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. To us, a gain like this looks like speculation, but there might be historical trends to back it up.

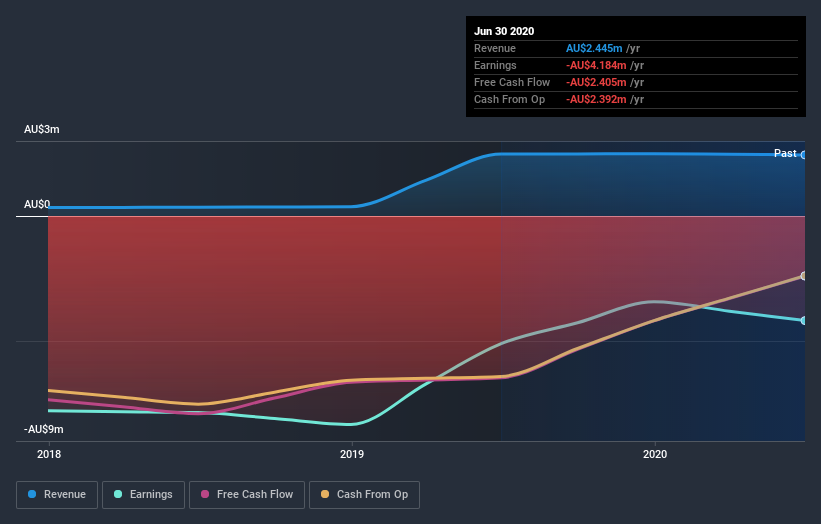

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Imagion Biosystems' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Imagion Biosystems hasn't been paying dividends, but its TSR of 430% exceeds its share price return of 400%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that Imagion Biosystems rewarded shareholders with a total shareholder return of 430% over the last year. So this year's TSR was actually better than the three-year TSR (annualized) of 42%. Given the track record of solid returns over varying time frames, it might be worth putting Imagion Biosystems on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Imagion Biosystems (1 is potentially serious) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.