Some Shareholders May Object To A Pay Rise For The City Pub Group plc's (LON:CPC) CEO This Year

Performance at The City Pub Group plc (LON:CPC) has not been particularly rosy recently and shareholders will likely be holding CEO Rupert Clark and the board accountable for this. At the upcoming AGM on 28 June 2021, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. The data we gathered below shows that CEO compensation looks acceptable for now.

Check out our latest analysis for City Pub Group

Comparing The City Pub Group plc's CEO Compensation With the industry

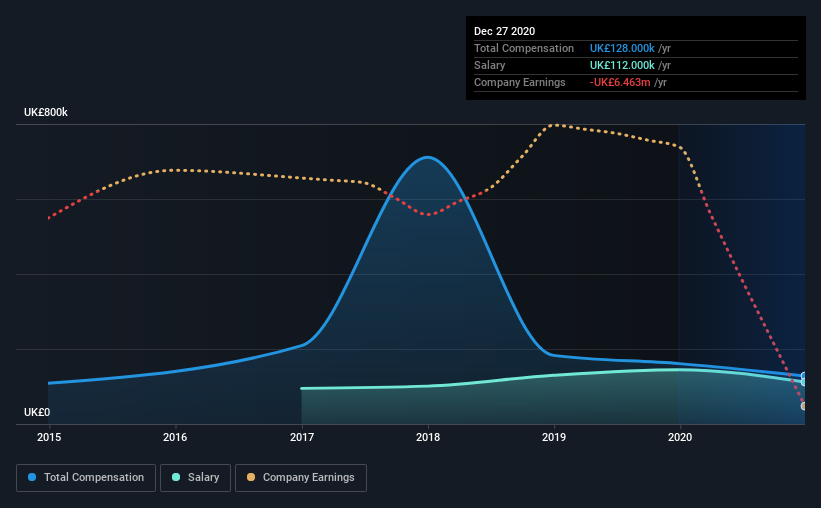

At the time of writing, our data shows that The City Pub Group plc has a market capitalization of UK£130m, and reported total annual CEO compensation of UK£128k for the year to December 2020. Notably, that's a decrease of 20% over the year before. Notably, the salary which is UK£112.0k, represents most of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between UK£72m and UK£287m, we discovered that the median CEO total compensation of that group was UK£272k. In other words, City Pub Group pays its CEO lower than the industry median. Moreover, Rupert Clark also holds UK£760k worth of City Pub Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2020 | 2019 | Proportion (2020) |

Salary | UK£112k | UK£145k | 88% |

Other | UK£16k | UK£16k | 13% |

Total Compensation | UK£128k | UK£161k | 100% |

Talking in terms of the industry, salary represented approximately 81% of total compensation out of all the companies we analyzed, while other remuneration made up 19% of the pie. Although there is a difference in how total compensation is set, City Pub Group more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

The City Pub Group plc's Growth

Over the last three years, The City Pub Group plc has shrunk its earnings per share by 62% per year. In the last year, its revenue is down 57%.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has The City Pub Group plc Been A Good Investment?

With a total shareholder return of -43% over three years, The City Pub Group plc shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling City Pub Group (free visualization of insider trades).

Switching gears from City Pub Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.