Shareholders in Myriad Genetics (NASDAQ:MYGN) have lost 44%, as stock drops 3.8% this past week

The main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in Myriad Genetics, Inc. (NASDAQ:MYGN), since the last five years saw the share price fall 44%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Myriad Genetics

Because Myriad Genetics made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade Myriad Genetics reduced its trailing twelve month revenue by 4.4% for each year. That's not what investors generally want to see. The share price decline at a rate of 8% per year is disappointing. Unfortunately, though, it makes sense given the lack of either profits or revenue growth. It might be worth watching for signs of a turnaround - buyers are probably expecting one.

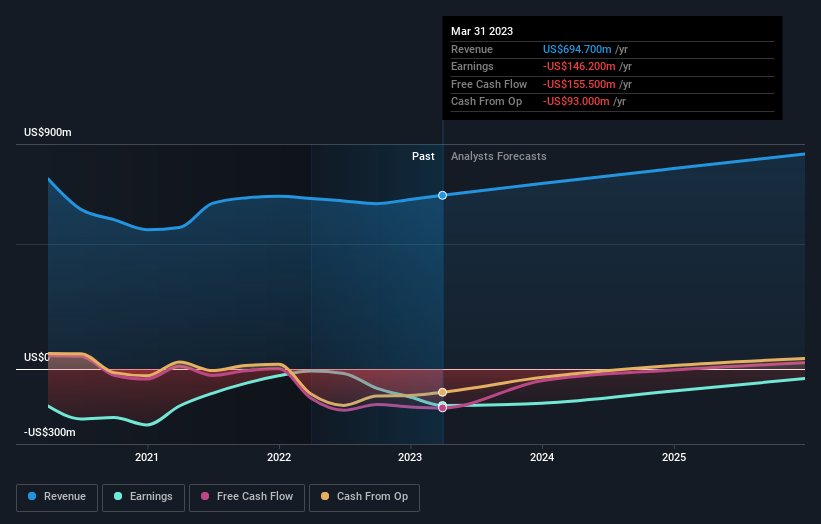

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Myriad Genetics' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Myriad Genetics shareholders have received a total shareholder return of 16% over one year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course Myriad Genetics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here