Shareholders Are Thrilled That The Austal (ASX:ASB) Share Price Increased 161%

The most you can lose on any stock (assuming you don’t use leverage) is 100% of your money. But on a lighter note, a good company can see its share price rise well over 100%. Long term Austal Limited (ASX:ASB) shareholders would be well aware of this, since the stock is up 161% in five years. Also pleasing for shareholders was the 26% gain in the last three months. But this could be related to the strong market, which is up 12% in the last three months.

View our latest analysis for Austal

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Austal’s earnings per share are down 0.5% per year, despite strong share price performance over five years. By glancing at these numbers, we’d posit that the decline in earnings per share is not representative of how the business has changed over the years. Therefore, it’s worth taking a look at other metrics to try to understand the share price movements.

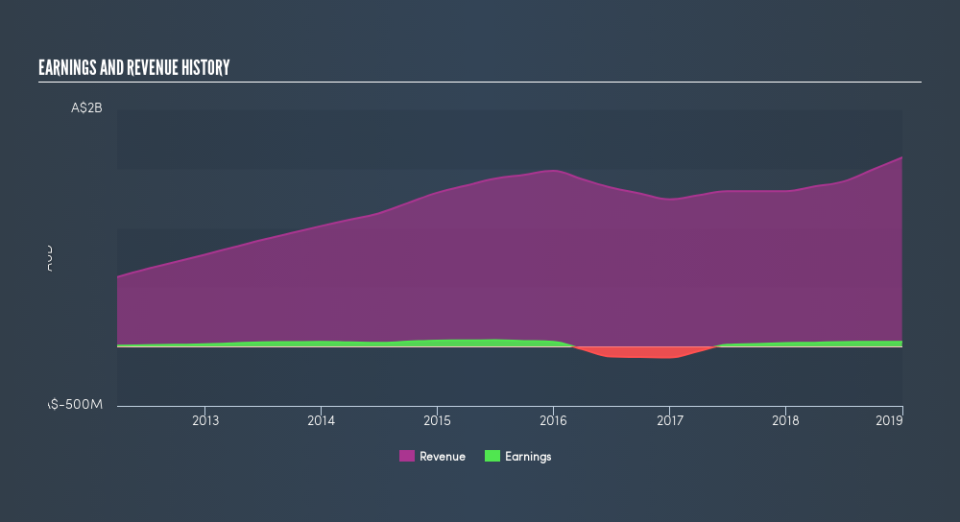

On the other hand, Austal’s revenue is growing nicely, at a compound rate of 4.3% over the last five years. It’s quite possible that management are prioritizing revenue growth over EPS growth at the moment.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We know that Austal has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Austal

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Austal’s TSR for the last 5 years was 188%, which exceeds the share price return mentioned earlier. And there’s no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It’s nice to see that Austal shareholders have received a total shareholder return of 33% over the last year. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 24% per year), it would seem that the stock’s performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research Austal in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.