Sherwin-Williams (SHW) Closes Sika Coatings Business Buyout

The Sherwin-Williams Company SHW recently completed the acquisition of the European industrial coatings business of Sika AG. The acquired business will bea part of the company's Performance Coatings Group segment.

It is expected that roughly 115 Sika employees will join Sherwin-Williams. Sika is a Germany-based business, which makes and markets corrosion protection coating systems. It generated sales of roughly $82 million for the year ended Dec 31, 2020.

Sherwin-Williams noted that the acquisition is in sync with its strategy of taking over premium, complementary and differentiated businesses that have the potential to contribute to its growth momentum. It expects the newly-acquired business to provide unique technology, an efficient sales and marketing team, strategic manufacturing locations and add to scale. It hopes to leverage these factors across Europe and other regions globally to maintain its strong position. SHW is expecting synergies from the transaction, which will expedite its already robust financial performance.

Shares of Sherwin-Williams have remained flat in the past year compared with a 3.4% decline of the industry.

Image Source: Zacks Investment Research

The company, in its last earnings call, stated that it expects consolidated net sales to increase in low-to-mid single-digit percentage in first-quarter 2022. For 2022, net sales are expected to increase high-single digits to low double digits. The company also expects adjusted earnings per share for 2022 to be between $9.25 and $9.65.

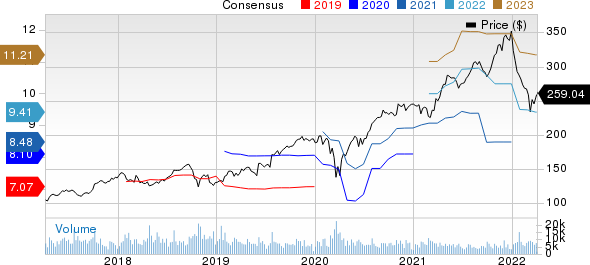

The SherwinWilliams Company Price and Consensus

The SherwinWilliams Company price-consensus-chart | The SherwinWilliams Company Quote

Zacks Rank & Key Picks

Sherwin-Williams currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are The Mosaic Company MOS, AdvanSix Inc. ASIX and Allegheny Technologies Incorporated ATI.

Mosaic has a projected earnings growth rate of 125% for the current year. The Zacks Consensus Estimate for MOS' current-year earnings has been revised 33.3% upward in the past 60 days.

Mosaic’s earnings beat the Zacks Consensus Estimate in three of the last four quarters while missing once. It delivered a trailing four-quarter earnings surprise of roughly 3.7%, on average. MOS has rallied around 116.4% in a year and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AdvanSix has a projected earnings growth rate of 64.8% for the current year. The Zacks Consensus Estimate for ASIX’s current-year earnings has been revised 58% upward in the past 60 days.

AdvanSix’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average being 23.6%. ASIX has surged 89.8% in a year. The company sports a Zacks Rank #1.

Allegheny, currently sporting a Zacks Rank #1, has an expected earnings growth rate of 661.5% for the current year. The Zacks Consensus Estimate for ATI's earnings for the current year has been revised 45.6% upward in the past 60 days.

Allegheny’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 127.2%. ATI has rallied around 24.6% over a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The SherwinWilliams Company (SHW) : Free Stock Analysis Report

Allegheny Technologies Incorporated (ATI) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

To read this article on Zacks.com click here.