Shire (SHPG) Q1 Earnings Beat, Rare Disease Franchise Strong

Shire plc SHPG reported first-quarter 2018 earnings of $3.86 per American Depositary Share (“ADS”), which beat the Zacks Consensus Estimate of $3.58 and were up 6% from the year-ago quarter figure of $3.63.

Revenues of $3.77 billion, up 5% year over year, were almost in line with the Zacks Consensus Estimate of $3.78 billion. The year-over-year increase was aided by growth in the rare disease franchise, recently-launched products, and international markets.

Shire’s shares have outperformed the industry so far this year, rising 3.6% against the industry’s 3.9% decline.

Quarter in Detail

Product sales increased 7% year over year to $3.6 billion driven by the rare disease franchise. Royalties and other revenues were down 20% to $129 million.

Beginning 2018, Shire divided its products in two business segments – Rare Disease and Neuroscience. Also, as part of the portfolio restructuring, the company has accepted a $2.4 billion offer for divesting its Oncology franchise to French company, Servier.

The company’s Rare Disease franchise contributed $2.7 billion to total product sales, up 10% year over year driven by growth across Immunology, Hematology, Internal Medicine, and Ophthalmics franchise.

The immunology franchise, which includes sales of hereditary angioedema (“HAE”) drugs, registered sales of $1.13 billion, up 8% year over year. Genetic disease portfolio sales were up 1% to $332.5 million, driven by higher sales of Replagal (up 13% to $124.2 million) and Vpriv (up 13% to $89.9 million), partially offset by lower sales of Elaprase (down 16% to $118.4 million).

Gattex and Natpara showed impressive performance with sales increasing 39% and 52% to $96.2 million and $45 million, respectively.

Sales of Hematology franchise was up 9% year over year to $952.6 million while Oncology segment grew 15% to $66.9 million. Sales at Opthalmics franchise surged 61% to $62.1 million.

Sales from recently launched drugs including Adynovate, Cuvitru, Gattex and Xiidra grew 77% year over year.

Neuroscience franchise sales came in at $918.2 million, down 2%. Vyvanse sales increased 12% to $928.8 million and Adderall XR sales increased 17% to $76 million. Pentasa sales increased 5% to $72.4 million. Mydayis brought in sales of $4.5 million.

However, Lialda sales were down 65% to $62 million due to the entry of generic competition. The company has launched an authorized generic version of its own to counter competition.

Research and development (R&D) costs were up 6.8% to $405.2 million while selling, general & administrative (SG&A) expenses decreased 9.5% to $804.8.

2018 Outlook Maintained

Shire reiterated its earnings per ADS guidance in the range of $14.90–$15.50. Total revenues are expected in the range of $15.4 billion to $15.9 billion. Gross margin is estimated between 73.5% and 75.5%. However, the guidance excludes the impact of divestment of the oncology franchise.

Other Activities

Subsequent to the quarter in April, Takeda offered to acquire Shire for approximately $63 billion in a cash-stock deal, which was turned down by the company.

In March, the EMA accepted the marketing authorization application (“MAA”) for lanadelumab seeking approval for treatment of HAE. The MAA will be reviewed under accelerated assessment. The FDA has also accepted and granted priority review to the Biologics License Application (“BLA”) for Lanadelumab in a similar indication.

During the quarter, the FDA accepted regulatory applications seeking approval of Prucalopride and Calaspargase Pegol for the treatment of chronic idiopathic constipation and acute lymphoblastic leukemia, respectively.

Cinryze’s supplemental BLA seeking label expansion in pediatric patients with HAE was accepted by the FDA in February.

During the quarter, Xiidra received approval in Canada and Adynovi was approved for Hemophilia A in Europe.

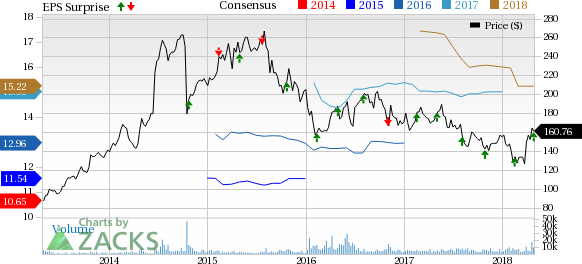

Shire plc Price, Consensus and EPS Surprise

Shire plc Price, Consensus and EPS Surprise | Shire plc Quote

Zacks Rank & Stocks to Consider

Shire carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the same space are Ligand Pharmaceuticals LGND, Protagonist Therapeutics PTGX and Catabasis Pharmaceuticals CATB. Whlle Ligand and Protagonist Therapeutics sport a Zacks Rank #1 (Strong Buy), Catabasis carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

Ligand’s earnings per share estimates moved up from $4.15 to $4.43 for 2018 over the last 60 days. The company delivered a positive earnings surprise in three of the trailing four quarters, with an average beat of 24.88%. The company’s shares have rallied 13% year to date.

Protagonist Therapeutics’ loss estimates narrowed from $1.68 to 66 cents for 2018 and from $2.43 to $1.26 for 2019, over the last 60 days. The company delivered a positive earnings surprise in three of the trailing four quarters, with an average beat of 24.95%.

Catabasis’ loss estimates narrowed from 92 cents to 90 cents for 2018 and from $1.48 to $1.43 for 2019, in the last 30 days. The company came up with positive earnings surprise in all the preceding four quarters, with an average beat of 14.56%. The stock has rallied 8.1% year to date.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Catabasis Pharmaceuticals, Inc. (CATB) : Free Stock Analysis Report

Shire plc (SHPG) : Free Stock Analysis Report

Protagonist Therapeutics, Inc. (PTGX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research