Shorting Early Week Strength in Yen Crosses

Daily Technicals (all USD crosses, gold, crude)

FOREX Trading and Technical Analysis Observations

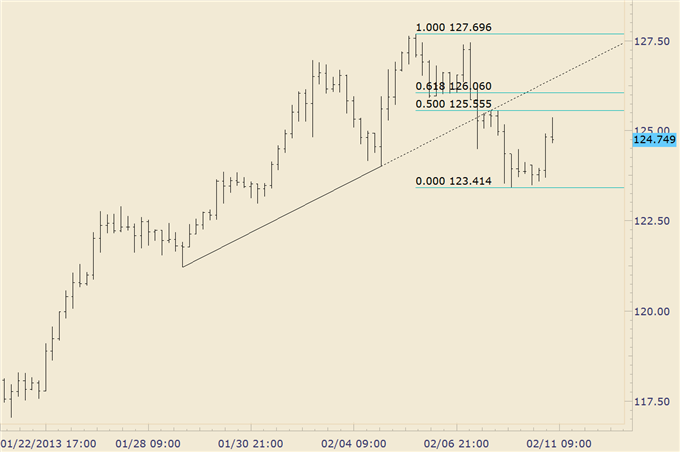

The EURJPY, CHFJPY, AUDJPY, CADJPY, and NZDJPY carved out Weekly J Spike Reversals. As such, I’d like to short early week strength in Yen crosses. Levels of interest as resistance are 12556-12606 EURJPY, 10208/45 CHFJPY, 9628/55 AUDJPY, 9325/54 CADJPY, and 7819/48 NZDJPY.

My trading will focus on EURJPY and AUDJPY but AUDJPY is probably the best play as per EURAUD structure (bullish) and AUDUSD structure (bearish). On that front, I’ll be looking to return to a long EURAUD position this week – I’d like to see an up day above trendline support before going back in.

EURJPY –240 Minute

Prepared by Jamie Saettele, CMT

AUDJPY –240 Minute

Prepared by Jamie Saettele, CMT

EURAUD –Daily

Prepared by Jamie Saettele, CMT

--- Written by Jamie Saettele, CMT, Senior Technical Strategist for DailyFX.com

To contact Jamie e-mail jsaettele@dailyfx.com. Follow me on Twitter for real time updates @JamieSaettele

Subscribe to Jamie Saettele's distributionlist in order to receive actionable FX trading strategy delivered to your inbox.

Jamie is the author of Sentiment in the ForexMarket.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.