Siemens Healthineers AG (ETR:SHL) Will Pay A €0.80 Dividend In 3 Days

Siemens Healthineers AG (ETR:SHL) stock is about to trade ex-dividend in 3 days time. You can purchase shares before the 13th of February in order to receive the dividend, which the company will pay on the 17th of February.

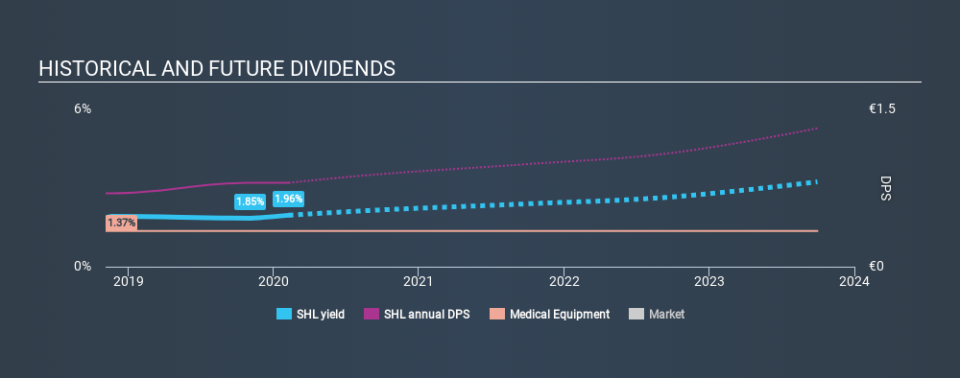

Siemens Healthineers's next dividend payment will be €0.80 per share. Last year, in total, the company distributed €0.80 to shareholders. Based on the last year's worth of payments, Siemens Healthineers has a trailing yield of 2.0% on the current stock price of €40.77. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Siemens Healthineers can afford its dividend, and if the dividend could grow.

See our latest analysis for Siemens Healthineers

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Siemens Healthineers is paying out an acceptable 52% of its profit, a common payout level among most companies. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Dividends consumed 54% of the company's free cash flow last year, which is within a normal range for most dividend-paying organisations.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. This is why it's a relief to see Siemens Healthineers earnings per share are up 3.7% per annum over the last five years. Earnings per share growth has been slim, and the company is already paying out a majority of its earnings. While there is some room to both increase the payout ratio and reinvest in the business, generally the higher a payout ratio goes, the lower a company's prospects for future growth.

Unfortunately Siemens Healthineers has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

The Bottom Line

Should investors buy Siemens Healthineers for the upcoming dividend? Earnings per share have been growing modestly and Siemens Healthineers paid out a bit over half of its earnings and free cash flow last year. To summarise, Siemens Healthineers looks okay on this analysis, although it doesn't appear a stand-out opportunity.

Ever wonder what the future holds for Siemens Healthineers? See what the 17 analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.