Signature Bank (SBNY) Up 9.1% as Q1 Earnings Beat Estimates

Shares of Signature Bank SBNY gained 9.1% in response to first-quarter 2021 results. Earnings of $3.24 per share easily beat the Zacks Consensus Estimate of $2.83. Also, the bottom line grew 72.3% year over year.

Higher loan and deposit balances supported net interest income (NII) growth. This, along with increase in non-interest income and lower provisions, were the tailwinds. However, rise in operating expenses and lower interest rates were the undermining factors.

Net income was $190.5 million, jumping 91.3% from the prior-year quarter. Also, pre-tax pre-provision earnings came in at $272.8 million, up 24.9%.

Revenues, Loans & Deposits Rise; Expenses Up

Total revenues jumped 21.2% from the prior-year quarter to $439.2 million. The top line, also, surpassed the Zacks Consensus Estimate of $427.1 million.

NII climbed 16.7% to $406.5 million on increase in average interest earning assets. However, net interest margin (on tax-equivalent basis) contracted 69 basis points (bps) to 2.10%.

Non-interest income was $32.7 million, up substantially from $14.2 million in the year-ago quarter. Growth in all the components led to the jump.

Non-interest expenses of $166.4 million rose 15.6%. This upsurge chiefly stemmed from rise in salaries and benefits due to massive hiring of private client banking teams.

Efficiency ratio was 37.88%, down from 39.72% reported as of Mar 31, 2020. A lower ratio indicates a rise in profitability.

Net loans and leases, as of Mar 31, 2021, were $50.4 billion, up 4.4% sequentially. Also, total deposits rose 16.8% to $74 billion.

Credit Quality: Mixed Bag

Net charge-offs were $17.9 million during the March quarter, up substantially from $1.7 million recorded in the prior-year quarter. Further, the ratio of non-accrual loans to total loans was 0.26%, up 11 bps.

Also, allowance for credit losses for loans and leases was $521.8 million, up 46.4%. However, provision for loan and lease losses plunged 53.8% to $30.9 million, mainly driven by improved macroeconomic conditions.

Capital & Profitability Ratios Improve

As of Mar 31, 2021, Tier 1 risk-based capital ratio was 12.18%, up from 11.05% on Mar 31, 2020. Furthermore, total risk-based capital ratio was 14.41% compared with the prior-year quarter’s 12.77%.

Return on average assets was 0.97% in the reported quarter compared with the year-earlier quarter’s 0.78%. As of Mar 31, 2021, return on average common stockholders' equity was 13.02%, up from 8.42%.

Our Take

Signature Bank’s first-quarter results reflect escalating expenses. It is focused on investing in technology by enhancing its payments platform and credit-approval system, which might further inflate costs. Nevertheless, the company has a robust balance sheet. Also, top-line strength on rising fee income and NII are expected to continue supporting profitability.

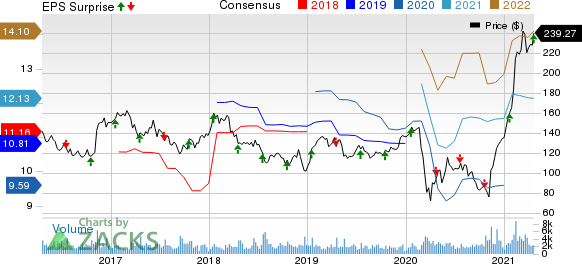

Signature Bank Price, Consensus and EPS Surprise

Signature Bank price-consensus-eps-surprise-chart | Signature Bank Quote

Currently, Signature Bank carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Washington Federal’s WAFD second-quarter fiscal 2021 (ended Mar 31) earnings of 56 cents per share surpassed the Zacks Consensus Estimate of 49 cents. Further, the figure reflects a year-over-year rise of 19.1%.

Commerce Bancshares Inc.’s CBSH first-quarter 2021 earnings per share of $1.11 surpassed the Zacks Consensus Estimate of 96 cents. Also, the bottom line surged significantly from the 42 cents earned in the prior-year quarter.

Synovus Financial SNV reported first-quarter 2021 adjusted earnings of $1.21 per share, which handily beat the Zacks Consensus Estimate of 93 cents, aided by solid mortgage banking income. Also, the bottom line increased 17.4% from the prior-year quarter figure.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Commerce Bancshares, Inc. (CBSH) : Free Stock Analysis Report

Synovus Financial Corp. (SNV) : Free Stock Analysis Report

Washington Federal, Inc. (WAFD) : Free Stock Analysis Report

Signature Bank (SBNY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research