The Simple Reason Why I Won't Buy Kratos Defense & Security Solutions, Inc. Stock

Military drone specialist Kratos Defense & Security Solutions, Inc. (NASDAQ: KTOS) appears to have an exciting opportunity ahead of it as unmanned aircraft grow in importance. However, I'm not a fan of the stock -- I think the risks outweigh the potential rewards here. But the word "risk" is pretty vague, and there's a number of factors that back up my decision. So here's why I won't buy Kratos Defense & Security Solutions today.

Failing the first test

My investment approach tends toward the conservative side. I'm generally what Benjamin Graham, the author of The Intelligent Investor and the man who helped shape Warren Buffett's investment approach, would call a defensive investor. That takes Kratos off my radar pretty quickly, since I'm looking for large, relatively stable companies that pay dividends.

Image source: Getty Images

Kratos fails on all three of those points. At a roughly $1 billion market cap, it's tiny relative to military contractor peers like Raytheon (NYSE: RTN) and Lockheed Martin (NYSE: LMT). And unlike those two companies, Kratos has, at best, a spotty earnings record, with red ink in eight of the last ten years. (Raytheon and Lockheed were both profitable throughout that period.) And Kratos doesn't pay a dividend -- both Raytheon and Lockheed Martin pay dividends that have, generally speaking, been heading higher lately.

So I find it pretty easy to strike Kratos off my list because it's just too risky for my taste. But what about an investor that's a little more enterprising?

An interesting story

Some bolder investors would look at Kratos' focus on military drones as a huge growth opportunity. And it is no doubt an exciting focus, since the technology allows the U.S. military and its allies to reduce the risk to human life in very dangerous situations. Further, Kratos is working on some very material programs, with a notable string of contract wins over the last few months. In fact, the company's book to bill ratio was an impressive 1.4 to 1 in the third quarter, which means it brought in more new orders than it completed in the time span. The CEO, meanwhile, is projecting enormous growth for the drone business.

There are still some problems here, though. For one thing, management has a history of overpromising. Case in point: investors were expecting a profit in the second quarter because CEO Eric DeMarco said the company would be in the black. When earnings came out, however, the bottom line was in negative territory. Not surprisingly, investors punished the stock. The company lost money in the third quarter, too, though it avoided promising black ink this time around. Still, even enterprising investors should be a little leery of a company that misses its own projections.

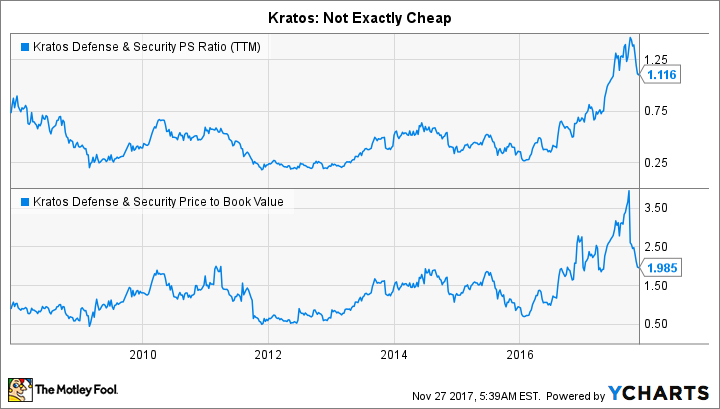

Another big problem is price. Since Kratos is losing money, you can't use price to earnings as a valuation tool. But you can use price to sales and price to book. The company's PS ratio is around 1.1 today, which is above its five year average of 0.4. It's also near the highest point of the past decade. Sure, Kratos' PS ratio is well below Raytheon's 2.2 and Lockheed Martins' 1.9, but that doesn't inherently mean it's cheap, especially when you consider its own history.

KTOS PS Ratio (TTM) data by YCharts

Kratos looks equally expensive when you examine price to book. The drone specialist's P/B ratio is around 2, compared to a five year average of 1.2. And, again, the PB ratio is toward the high end of the company's range over the past decade. Kratos looks relatively cheap when you compare it to the P/B ratios of Raytheon and Lockheed, but it's still hard to call Kratos cheap today when you compare it to its recent past.

I'm taking a pass

When you boil it down, my big issue with Kratos is risk. There are too many other options in the investing world for me to own a small company taking on giant peers in a competitive business. My concerns are only exacerbated by the fact that it has a spotty earnings history and looks expensive relative to its own historical valuation range. (The lack of a dividend is another big negative for me.) I'm certain that drones are a huge opportunity, but I'm not certain enough that Kratos will be the one to take advantage of it to put my investment dollars at risk here.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.