Simulations Plus (SLP) Q2 Earnings & Revenues Top Estimates

Simulations Plus SLP reported second-quarter fiscal 2021 earnings of 15 cents per share, up 25% on a year-over-year basis. The figure beat the Zacks Consensus Estimate by 7.1%.

Moreover, revenues of $13.1 million surpassed the consensus mark by 1.7% and improved 27% year over year. The upside was driven by strong performance of the company’s software business.

Despite better-than-expected performance, share of Simulations Plus fell 4.1% and closed at $60.95 on Apr 13, 2021. Nevertheless, the stock has soared 62.9% in the past year compared with the industry’s growth of 50.2%.

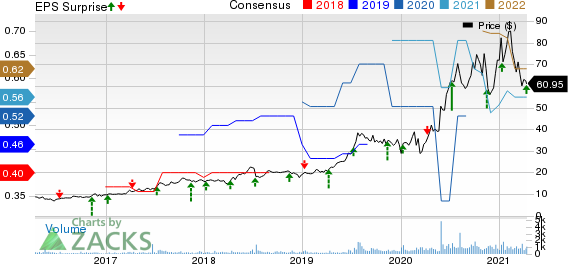

Simulations Plus, Inc. Price, Consensus and EPS Surprise

Simulations Plus, Inc. price-consensus-eps-surprise-chart | Simulations Plus, Inc. Quote

The outperformance can be attributed to investors’ optimism regarding strategic investments in sales and marketing infrastructure, and growing clout of modeling and simulation solutions across the drug development ecosystem that is facilitating strong revenue growth.

Quarter in Details

Software revenues (60% of the total quarterly revenues) jumped 45% year over year, while Services revenues (40% of total quarterly revenues) increased 7%.

Further, Services’ backlog at the end of the reported quarter was $11 million, down 8.3% sequentially.

Notably, renewal rate came in at 93% based upon fees, which compares with renewal rate of 94% in the prior-year period. In the quarter, the company clinched six new multi-year renewals for GastroPlus and ADMET Predictor solutions.

Moreover, Lixoft buyout has expanded the company’s total addressable market (TAM) and increased the mix of software revenues, which bodes well for profitability. For the second quarter, Lixoft reported revenues of $1.6 million for the quarter.

Under the services segment, the company inked deal with a large pharmaceutical client for PK/PD project in support of regulatory interactions in the quarter under review.

Operating Details

Gross margin in the quarter under review was 78%, up 400 basis points (bps) year over year. Total operating expenses, as a percentage of revenues, expanded 400 bps to year over year 51%.

Operating income margin contracted 80 bps to 26.5% on a year-over-year basis.

Balance Sheet

As of Feb 28, 2021, cash and cash equivalents were $42.4 million compared with $27.7 million as of Nov 30, 2020.

The company declared a cash dividend of 6 cents per share payable on May 3, 2021, to stockholders as of Apr 26, 2021.

Fiscal 2021 Outlook

Simulations Plus continues to project organic revenue growth in the range of 15-20% for fiscal 2021. Management believes strong demand for consulting services and optimism surrounding next-generation software products scheduled for release in fiscal 2021 will drive organic growth.

Management continues to anticipate incremental Lixoft to contribute 3-5% to the top line over the organic growth in fiscal 2021.

Software revenue growth is expected in the range of 20-25%, while Services revenue growth is projected to be between 25% and 30% for the fiscal year.

Zacks Rank & Stocks to Consider

Currently, Simulations Plus carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader sector are Ubiquiti UI, Etsy ETSY and Cornerstone OnDemand CSOD. All the stocks flaunt a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Ubiquiti, Etsy and Cornerstone OnDemand is currently pegged at 32.9%, 19.4% and 15.5%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simulations Plus, Inc. (SLP) : Free Stock Analysis Report

Etsy, Inc. (ETSY) : Free Stock Analysis Report

Cornerstone OnDemand, Inc. (CSOD) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research