Simulations Plus (SLP) Q2 Earnings Top Estimates, Revenues Up

Simulations Plus SLP reported second-quarter fiscal 2022 earnings of 21 cents per share, up 40% on a year-over-year basis. The figure beat the Zacks Consensus Estimate by 50%.

Revenues of $14.8 million increased 13% year over year, driven by the strong performance of the company’s software business. However, the top line missed the consensus mark by 1.6%.

Since the earnings announcement, shares of Simulations Plus are up 2.5% and closed trading at $49 Apr 8, 2022. The stock has declined 22.9% in the past year against the industry’s growth of 6%.

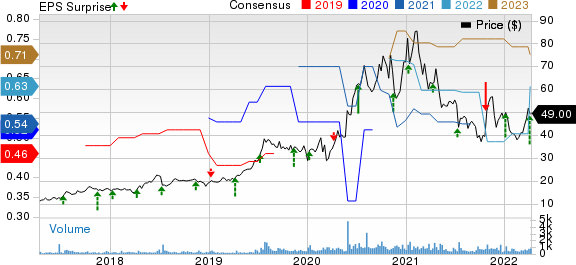

Simulations Plus, Inc. Price, Consensus and EPS Surprise

Simulations Plus, Inc. price-consensus-eps-surprise-chart | Simulations Plus, Inc. Quote

Quarter in Details

Software revenues (66% of the total quarterly revenues) increased 25% year over year to $9.8 million. Breaking up the software revenues, GastroPlus contributed 56%, MonolixSuite contributed 23%, ADMET Predictor contributed 14% and other software generated 7%.

The Lixoft buyout expanded the company’s total addressable market (TAM) and increased the mix of software revenues, which bodes well for profitability. Revenues from MonolixSuite were up 43% year over year in the second quarter.

The renewal rate for commercial customers came in at 96% based upon fees compared with 92% in the prior quarter. The renewal rate for commercial customers came in at 87% based on accounts compared with 88% in the prior quarter.

Services revenues (34% of total quarterly revenues) declined 5% to $5 million. Breaking up the services revenues, PK/PD represented 44%, QSP/QST was 30%, PB/PK was 19% and other services was 7%.

At the end of the reported quarter, services backlog was $17 million, up 51.8% year over year and 10.4% sequentially.

Operating Details

The gross margin in the quarter under review was 81%, up 300 basis points (bps) year over year. Software gross margin came in at 92%, up 300 bps from the prior-year quarter’s levels mainly due to higher revenues. Services gross margin was 59%, down 200 bps from the prior-year quarter’s figure. The downside was caused by higher salaries and an increase in lower-margin services projects.

Total operating expenses, as a percentage of revenues, contracted nearly 600 bps to year over year 44%.

The operating income margin was 37% compared with 27% reported in the year-ago period.

Balance Sheet

As of Feb 28, 2022, cash and short-term investments were 124.6 million compared with $124.3 million as of Nov 30, 2021.

The company declared a cash dividend of 6 cents per share payable on May 2, 2022, to stockholders as of Apr 25, 2022.

Fiscal 2022 Outlook

Management maintained its earlier provided fiscal 2022 guidance. For fiscal 2022, Simulations Plus expects revenues growth of 10-15% year over year.

Zacks Rank & Stocks to Consider

Currently, Simulations Plus carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology sector are Broadcom AVGO, Apple AAPL and Arrow Electronics ARW. All stocks carry a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for Broadcom’s fiscal 2022 earnings is pegged at $35.49 per share, up 7.4% in the past 60 days. AVGO’s long-term earnings growth rate is pegged at 14.5%.

Broadcom’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, with the average being 1.9%. Shares of AVGO have increased 21.3% in the past year.

The Zacks Consensus Estimate for Apple’s fiscal 2022 earnings is pegged at $6.16 per share, up 0.2% in the past 60 days. The long-term earnings growth rate is pegged at 12.5%.

Apple’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the average being 20.3%. Shares of AAPL have rallied 29.6% in the past year.

The Zacks Consensus Estimate for Arrow Electronics 2022 earnings is pegged at $18.48 per share, up 4.5% in the past 60 days. The long-term earnings growth rate is 3.1%.

Arrow Electronics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the average being 19.1%. Shares of ARW have lost 5.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Arrow Electronics, Inc. (ARW) : Free Stock Analysis Report

Simulations Plus, Inc. (SLP) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.